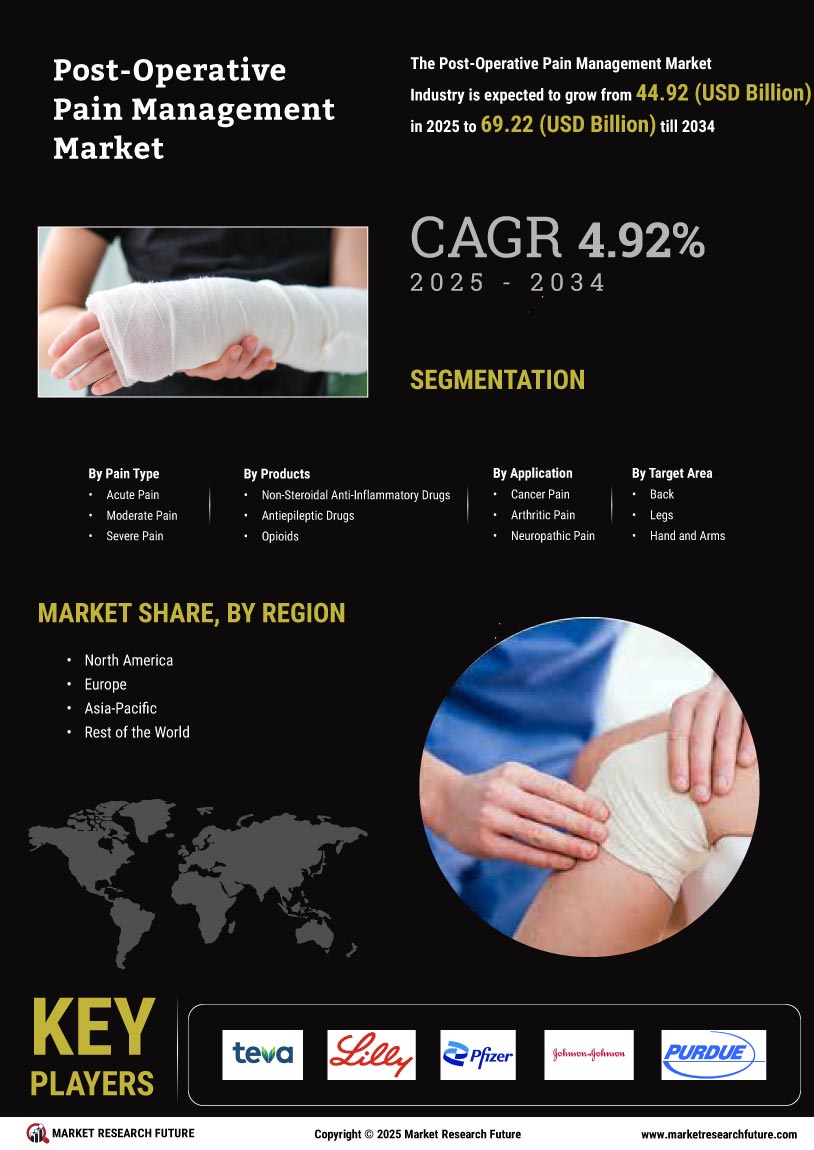

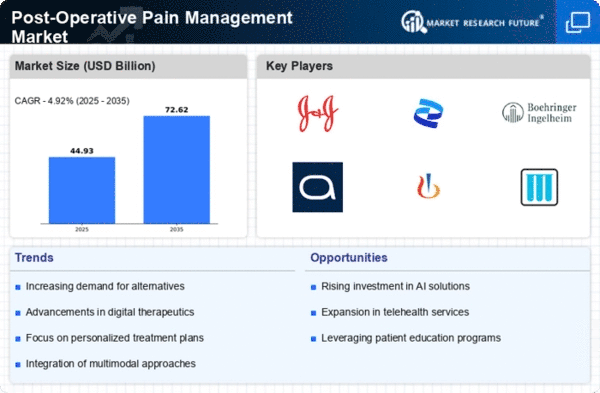

Market Growth Projections

The Global Postoperative Pain Management Market Industry is projected to experience substantial growth over the coming years. The market is expected to reach 35.9 USD Billion in 2024 and is forecasted to grow to 52.7 USD Billion by 2035, reflecting a compound annual growth rate of 3.54% from 2025 to 2035. This growth is driven by various factors, including the increasing number of surgical procedures, advancements in pain management technologies, and heightened awareness of the importance of effective pain control. As the market evolves, stakeholders are likely to explore new opportunities to enhance patient care and optimize pain management strategies.

Rising Surgical Procedures

The increasing number of surgical procedures globally drives the Global Postoperative Pain Management Market Industry. As healthcare systems evolve and improve, more patients undergo surgeries, leading to a heightened demand for effective pain management solutions. For instance, the World Health Organization indicates that surgical procedures are expected to rise significantly, with millions of surgeries performed annually. This trend necessitates advanced pain management strategies to enhance patient recovery and satisfaction. Consequently, the market is projected to grow from 35.9 USD Billion in 2024 to 52.7 USD Billion by 2035, reflecting a compound annual growth rate of 3.54% from 2025 to 2035.

Increase in Chronic Pain Conditions

The rising prevalence of chronic pain conditions globally is a significant driver of the Global Postoperative Pain Management Market Industry. Patients with chronic pain often require surgical interventions, leading to an increased demand for effective postoperative pain management solutions. According to the National Institutes of Health, millions of individuals suffer from chronic pain, necessitating comprehensive pain management strategies. This growing patient population underscores the need for innovative pain management solutions, contributing to the market's expansion as healthcare providers seek to address the unique challenges associated with managing pain in these patients.

Growing Awareness of Pain Management

There is a notable increase in awareness regarding the importance of effective pain management in postoperative care, which significantly influences the Global Postoperative Pain Management Market Industry. Healthcare providers, patients, and policymakers are increasingly recognizing that adequate pain control is essential for recovery and overall patient satisfaction. Educational initiatives and guidelines from health organizations emphasize the need for comprehensive pain management strategies. This growing awareness is likely to drive demand for various pain management solutions, contributing to the market's expansion as healthcare systems prioritize patient-centered care.

Advancements in Pain Management Technologies

Technological advancements in pain management are reshaping the Global Postoperative Pain Management Market Industry. Innovations such as patient-controlled analgesia devices, regional anesthesia techniques, and non-opioid analgesics provide healthcare professionals with more effective tools to manage postoperative pain. These advancements not only improve patient outcomes but also reduce the reliance on opioids, addressing the growing concerns regarding opioid misuse. As hospitals and clinics adopt these technologies, the market is likely to experience substantial growth, aligning with the increasing emphasis on personalized medicine and enhanced recovery protocols.

Regulatory Support for Pain Management Practices

Regulatory bodies worldwide are increasingly supporting the development and implementation of effective pain management practices, which positively impacts the Global Postoperative Pain Management Market Industry. Initiatives aimed at improving pain management protocols and reducing opioid prescriptions are being introduced. For example, guidelines from the Centers for Disease Control and Prevention encourage the use of multimodal analgesia approaches. This regulatory support fosters innovation and encourages healthcare providers to adopt evidence-based practices, ultimately enhancing patient care and satisfaction while driving market growth.