- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

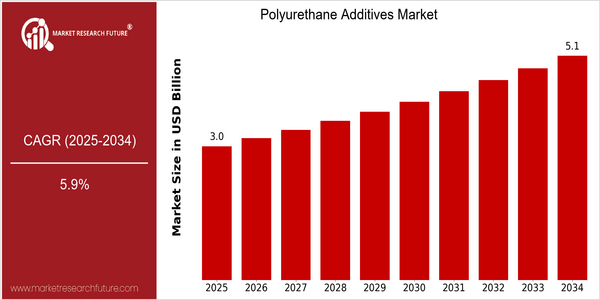

Polyurethane Additive Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 3.02 Billion |

| 2034 | USD 5.06 Billion |

| CAGR (2025-2034) | 5.9 % |

Note – Market size depicts the revenue generated over the financial year

Polyurethane Additives Market is estimated to reach USD 5.06 billion by 2034. The growth rate is 5.9% CAGR from 2017 to 2034. The main driving force for the growth of this market is the increasing demand for polyurethane additives in various industries such as automobiles, construction and furniture. The polyurethane industry has always been a significant industry. Now, in order to improve the performance and sustainability of products, the use of advanced polyurethane formulations is becoming more common. The development of bio-based polyurethane additives and the improvement of application methods will also drive market growth. The main companies in the industry, such as BASF SE, Covestro AG and Huntsman, have invested a lot in research and development, and have launched new products to meet the needs of consumers. Strategic initiatives such as collaborations and agreements are also contributing to the competition in the polyurethane additives market.

Regional Deep Dive

The Polyurethane Additives Market is experiencing dynamic growth across the globe, owing to the rising demand from the industries like automobile, construction, and furniture. The North American market is characterized by a strong focus on innovation and sustainability, with companies investing in the development of eco-friendly polyurethane additives. In Europe, the trend is towards high-performance materials, while the Asia-Pacific market is expanding rapidly due to the rapid industrialization and urbanization. Middle East and Africa are growing fast, driven by the increasing investment in construction and other development projects, while Latin America is slowly adopting polyurethane technology, influenced by the recovery of the economy and the rising investment in manufacturing.

North America

- Consequently, the American authorities have imposed restrictions on the use of VOCs. As a result, manufacturers have developed low-VOC polyurethane systems.

- The development of bio-based polyurethanes, mainly by BASF and Dow, is a reaction to the growing demand for sustainable products.

- The automobile industry has been the main market for polyurethanes in recent years, owing to the fact that they lighten the material and improve performance and fuel economy.

Europe

- The European Green Deal is encouraging the development of the circular economy, which has increased the investment in polyurethanes’ recycling technology.

- Huntsman and Covestro are leading the way in smart coatings and adhesives. These developments are enhancing the performance of polyurethanes in many applications.

- Product reformulation, in response to regulatory changes on chemical safety and environmental impact, is expected to lead to a more competitive market.

Asia-Pacific

- In recent years, China's rapid industrialization and urbanization have driven the demand for polyurethane auxiliaries in the building and automobile industries, and the construction and automobile industries have been investing heavily in this industry.

- The demand for eco-friendly polyurethane chemicals is rising in India.

- The exploitation of this wealth of natural resources has increased the activity of local companies in research and development.

MEA

- The UAE's Vision 2021, with its emphasis on developing its public and private sector, is expected to increase the demand for polyurethanes in the construction industry.

- It is a fact that companies like the Aramco are investing in petrochemical projects that will provide the raw materials for polyurethane production in the region.

- The rules are evolving to promote the green economy, encouraging the industry to adopt cleaner production processes.

Latin America

- Brazil’s economic recovery is driving the manufacturing sector to invest more, which is expected to boost demand for polyurethane (PUR) in several applications.

- The companies are beginning to adopt advanced formulations and technology, influenced by the worldwide trend towards improved performance and sustainability.

- The government's measures to support the building industry will open new opportunities for polyurethanes as an additive to construction materials.

Did You Know?

“Polyurethane additives improve the properties and the resistance of products. In certain cases, the life of the product is increased by up to 50%.” — Polyurethane Manufacturers Association

Segmental Market Size

The polyurethanes market is characterised by a steady growth, primarily owing to the rising demand for high-performance materials across several industries. The increasing consumer preference for durable and versatile products, as well as the stringent government regulations towards the use of environment-friendly materials, are also driving the market. In addition, technological advancements, such as the development of bio-based additives, are enhancing the product performance and the sustainability of the market.

The polyurethanes market is already in a mature phase of development, with the likes of BASF and Covestro deploying their innovations in regions such as North America and Europe. The main applications of these polymers are in the fields of car parts, construction materials and furniture, where they impart greater elasticity, hardness and resistance to external factors. In addition, trends such as the growing importance of eco-friendly products and government initiatives to make products more sustainable are boosting growth. Nanotechnology and the formulation of new polymers are shaping the development of the market, ensuring that polyurethanes will remain an essential part of modern manufacturing processes.

Future Outlook

The Polyurethane Additives Market is projected to grow at a CAGR of 5.9 per cent from 2025 to 2034. The growth of the market is supported by the growing demand for polyurethane products in various industries, including construction, automobiles, and consumer goods. In addition, the growing demand for lightweight and energy-efficient materials will increase the use of polyurethane in these industries.

The market is driven by technological developments and government regulations. In the field of polyurethanes, the development of bio-based polyurethanes and the formulation of bio-based polyurethanes will be particularly favored by the emergence of global sustainability goals and the increasing demand for greener products. The increasingly stringent regulations on volatile organic compounds in industrial applications will also stimulate the demand for advanced polyurethane additives that meet the requirements of these standards. Also, the integration of smart materials and the emergence of e-commerce in the distribution of chemical products will also lead to changes in the market structure and the emergence of new opportunities for market players.

It is important for all parties to understand the evolution of the market. The increased focus on the principles of the circular economy and the possibility of recycling polyurethane materials will probably have an impact on the product development strategies. The range of polyurethane additives is expected to be more diversified by 2034, with more solutions for specific applications and customer needs. This market will continue to grow and will be characterized by innovation, regulatory changes and a greater focus on sustainability.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 2.669 Billion |

| Growth Rate | 6.77% (2023-2032) |

Polyurethane Additive Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.