- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

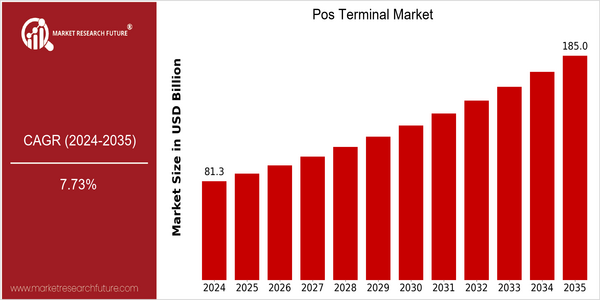

Point Of Sale Terminal Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 81.28 Billion |

| 2035 | USD 184.97 Billion |

| CAGR (2025-2035) | 7.73 % |

Note – Market size depicts the revenue generated over the financial year

The point-of-sale (POS) terminal market is expected to reach $181,970,659,036 by 2035. The CAGR for this market is 7.73% from 2025 to 2035. This growth is driven by the increasing adoption of digital payment solutions and the rising demand for contactless transactions. Customers are looking for fast and convenient payment methods. With this in mind, businesses are investing in advanced POS systems that increase their efficiency and customer satisfaction. Moreover, the integration of artificial intelligence and cloud-based solutions is driving the POS terminal market. These innovations are helping retailers to analyze their customers’ behavior, manage their inventory, and ensure the security of their transactions. The key players in the POS terminal market, such as Square, Inc., Ingenico Group, and Verifone, are launching new products and establishing strategic alliances to strengthen their position in the market. For instance, Square has diversified its offerings by introducing mobile payment solutions, while Ingenico has focused on developing secure, multi-channel payment systems.

Regional Deep Dive

The POS (point of sale) terminal market is experiencing a major transformation across various regions, driven by technological advancements, changing customer preferences, and the rising demand for contactless payment solutions. In North America, the market is characterized by a high adoption rate of advanced POS systems, especially in the retail and hospitality industries, where customer experience is paramount. The European market is diverse, with a variety of regulatory and customer preferences. The Asia-Pacific region is growing rapidly, driven by the growth of e-commerce and mobile payments. Middle East and Africa (MEA) are gradually adopting digital payment solutions, but at a slower pace, mainly due to lack of infrastructure. Latin America is undergoing a major transformation, focusing on the security of payment methods and access to digital payment solutions.

North America

- With the appearance of mobile point-of-sale systems, which are becoming increasingly popular, small merchants have become more flexible in their business methods.

- The EMV (European Mastercard and Visa) mandate has accelerated the installation of EMV-compliant terminals, enhancing security and reducing fraud.

- Artificial intelligence and machine learning are enabling businesses to analyze their customer data more efficiently, which leads to more personal marketing strategies and better customer engagement.

Europe

- The PSD2 directive has been a major driver of innovation in the payment services market. It promotes open banking and enhanced consumer protection, which in turn has increased competition between payment service providers.

- In the United Kingdom and Sweden, where contactless payments have been a great success, the point-of-sale system has been further developed.

- In the field of payment, the omnipresence of Verifone and Ingenico is increasing, with the aim of satisfying the growing demand for a responsible business.

Asia-Pacific

- The rapid growth of e-business in China and India is driving the demand for more advanced POS systems, which can be used to handle both online and offline transactions.

- Alipay and WeChat Pay have changed the face of the POS, and more and more businesses have begun to adopt them.

- The digital economy, supported by the government’s efforts to promote digital payments, such as India’s Digital India campaign, is also influencing the adoption of POS terminals in the region.

MEA

- A new era of digital payments is beginning to take shape in the UAE. The Dubai Smart City project is pushing the use of smart POS systems in the retail and hospitality sectors.

- In certain African countries, the lack of access to the Internet and other infrastructural problems have hampered the use of POS terminals, but efforts are being made to change this situation.

- There are several local companies, such as PayFast and YAP, that are addressing the unique needs of businesses in the region by providing POS solutions that are both affordable and accessible.

Latin America

- In Brazil and Mexico, the growth of fintechs is driving innovation in the POS market, with solutions for small and medium-sized businesses gaining traction.

- In Asia, changes in legislation aimed at improving payment security, such as the implementation of the PCI DSS (Payment Card Industry Data Security Standard), are influencing the take-up of point-of-sale terminals.

- Culture, which still prefers cash, is slowly changing. As consumers are becoming more and more familiar with the new way of paying, it is becoming easier for businesses to invest in modern point-of-sale terminals.

Did You Know?

“By 2022 it was estimated that more than a third of all retail transactions in the United States were being handled by mobile POS terminals, which marked a significant shift towards digital payment solutions.” — Statista

Segmental Market Size

The Point of Sales (POS) terminal market is growing rapidly at the moment, driven by the growing need for fast and easy transactions and improved customer experiences. The rise in e-commerce, which requires a smooth payment solution, and the increased use of contactless payment, which was increased by the Covid 19 pandemic, are driving the market. Also, the promotion of digital payment is stimulating demand.

The market is now in the process of mass implementation. Companies such as Square and Clover are at the forefront of the industry, introducing new and creative POS solutions. The main users are retail stores and restaurants, which use POS to manage inventory, track sales, and engage customers. POS is also the platform for targeted marketing and customer engagement. Its development is influenced by two major trends: the integration of artificial intelligence and the adoption of mobile POS. Also, with the onset of the green economy, the POS industry is undergoing a shift to more energy-efficient hardware and software, reflecting a broader concern for the environment.

Future Outlook

The POS terminal market is expected to grow from $81 billion in 2024 to $184 billion in 2035, at a CAGR of 7.73%. The growth is mainly due to the increasing use of digital payment solutions, the spread of e-commerce, and the continuing shift to contactless transactions. The demand for advanced POS systems that can be seamlessly integrated with multiple payment methods will also increase, resulting in higher penetration in the retail, hospitality, and service industries. In 2035, more than 70% of retail establishments will have advanced POS systems, up from about 50% in 2024. This reflects a clear trend toward the modernization of payment systems.

AI and ML are the two most important technological trends in POS systems, which are expected to further improve the security of transactions and offer valuable insights into customer behavior. Moreover, the growing importance of omni-channel retailing will lead to an increased need for POS solutions that can be used across all platforms. Policy drivers, such as the drive for a cashless society and the introduction of stricter security regulations, will also play a key role in shaping the market. As companies adapt to these changes, the POS terminal market will not only grow in value but also in functionality, becoming an increasingly important component of the retail system in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 72.6432 Billion |

| Growth Rate | 8.10% (2022-2030) |

Point Of Sale Terminal Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.