Pipeline Monitoring System Size

Pipeline Monitoring System Market Growth Projections and Opportunities

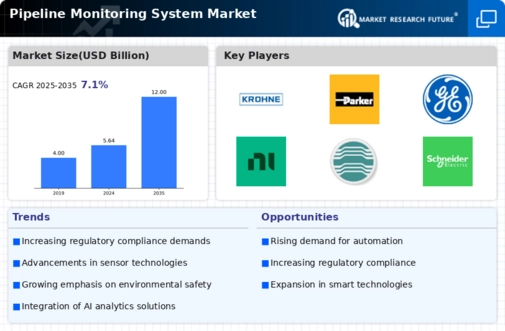

The Pipeline Monitoring System (PMS) market is influenced by a variety of factors that collectively shape its dynamics and growth trajectory. One crucial factor is the increasing demand for energy resources, which drives the expansion of pipeline infrastructure globally. As countries strive to meet their growing energy needs, the need for efficient and secure transportation of oil, gas, and other hazardous materials becomes paramount. This surge in pipeline construction and expansion directly contributes to the market growth of Pipeline Monitoring Systems.

Moreover, stringent regulations and safety standards imposed by governments and environmental agencies play a pivotal role in shaping the PMS market. The need to prevent and mitigate environmental disasters, such as oil spills and gas leaks, has led to the implementation of strict monitoring and control measures. Pipeline operators are compelled to invest in advanced monitoring technologies to comply with these regulations, fostering the growth of the Pipeline Monitoring System market.

Technological advancements also exert a significant impact on the market. The integration of cutting-edge technologies, such as Internet of Things (IoT), artificial intelligence, and machine learning, enhances the capabilities of Pipeline Monitoring Systems. These innovations enable real-time monitoring, predictive analytics, and remote control, contributing to improved operational efficiency and risk management. As the industry embraces these technological advancements, the demand for sophisticated Pipeline Monitoring Systems continues to rise.

The ever-present threat of cybersecurity breaches is another critical market factor. As Pipeline Monitoring Systems become more interconnected and data-driven, the vulnerability to cyber threats increases. Ensuring the security of critical infrastructure and sensitive data is a top priority for pipeline operators, leading to a growing demand for robust cybersecurity solutions within the PMS market.

Economic factors also play a role in shaping the Pipeline Monitoring System market landscape. Investment in pipeline infrastructure is often influenced by economic conditions, including factors such as GDP growth, government spending, and overall industry investment trends. Economic downturns can lead to a slowdown in pipeline projects, affecting the demand for monitoring systems. Conversely, economic recovery and increased investment in infrastructure projects can spur market growth.

Environmental awareness and the growing emphasis on sustainable practices are influencing the PMS market as well. Stakeholders in the energy sector are increasingly adopting eco-friendly technologies and practices to reduce the environmental impact of pipeline operations. This includes monitoring systems that not only ensure safety but also contribute to environmentally conscious practices, such as early detection of leaks to minimize ecological damage.

Lastly, geopolitical factors can have a significant impact on the Pipeline Monitoring System market. Political instability, international conflicts, and regulatory changes in key regions can disrupt the flow of resources through pipelines. These uncertainties may influence investment decisions and the implementation of monitoring systems to safeguard against potential risks associated with geopolitical instability.

The Pipeline Monitoring System market is shaped by a complex interplay of factors, including the demand for energy resources, regulatory frameworks, technological advancements, cybersecurity concerns, economic conditions, environmental considerations, and geopolitical dynamics. Understanding and navigating these market factors are crucial for stakeholders in the PMS industry to adapt, innovate, and capitalize on emerging opportunities in the evolving landscape of pipeline monitoring.

Leave a Comment