- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

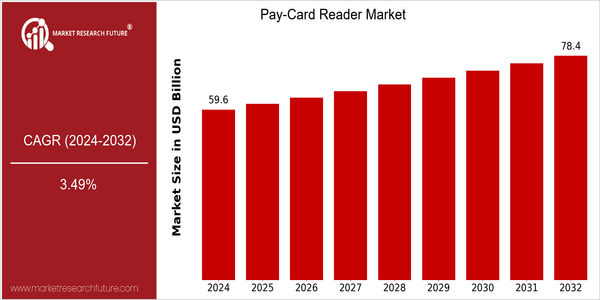

Pay Card Reader Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 59.59 Billion |

| 2032 | USD 78.42 Billion |

| CAGR (2024-2032) | 3.49 % |

Note – Market size depicts the revenue generated over the financial year

The monetary card reader market is growing steadily. In 2024, the market size is estimated to be $59,597,517,687, and it will rise to $79,425,895 by 2032. This growth rate is a CAGR of 3.49%. It is mainly because of the increasing popularity of cashless payment solutions. The consumers who want to be convenient and safe have a great influence on this market. The rise of e-commerce and mobile payment has also accelerated the demand for advanced payment systems, including card readers. In addition, the integration of near-field communication and contactless payment capabilities further enhances the functionality and appeal of the card reader. The major players in this market, such as Square, Inc., PayPal Holdings, and Ingenico Group, have been investing in product innovation and strategic cooperation to enhance their market positions. For example, Square has launched new features that are more suited to small and medium-sized businesses, and PayPal has been expanding its payment solutions to include more types of payments. These strategies not only reflect the fierce competition in the market, but also demonstrate the continuous development of payment technology and the future trend of the monetary card reader market.

Regional Deep Dive

The card reader market is expected to grow significantly across various regions. This is attributed to the growing adoption of cashless payment solutions and technological advancements. North America is characterized by a high penetration of digital payment systems and a strong focus on security and convenience. Europe is a highly diverse region with varying regulations and preferences. The Asia-Pacific region is rapidly evolving due to the growing penetration of mobile payment solutions and the growing middle class. The Middle East and Africa is slowly adopting digital payment systems, owing to government initiatives and the large youth population. Latin America is also embracing card readers, driven by the need for financial inclusion and a need to improve efficiency.

North America

- The COVID-19 pandemic has accelerated the development of contactless payment methods, with companies such as Square and PayPal launching new card readers to meet the demand.

- In the United Kingdom, for example, the introduction of the EMV standard, which imposes the use of the EMV chip, has made retailers update their payment systems, and so the sales of card readers have risen.

- The biggest retail chains, such as Walmart and Target, are also investing in advanced payment systems, and integrating payment card readers with customer loyalty cards, to enhance customer experience.

Europe

- The European Union's new PSD2 directive is promoting competition and innovation in the payments sector, thereby encouraging the use of card readers by SMEs.

- Sweden and Denmark are ahead in the field of cashless payment. In these countries, companies such as iZettle and SumUp offer a tailored card reader solution to local businesses.

- Increasingly, a growing emphasis on the environment is changing the way people think and behave, and encouraging companies to develop more eco-friendly card readers that fit in with the environment.

Asia-Pacific

- In China, the rapid development of mobile payment platforms such as Alipay and WeChat Pay has changed the market for payment card readers. The traditional card reader has been integrated into the phone.

- The government’s “digital India” initiative has led to a surge in digital payments, and the government is backing companies like Paytm and PhonePe, which have launched contactless card readers.

- Hence the growth of the mPOS system, which allows the small merchants to accept credit cards easily.

MEA

- The United Arab Emirates is promoting the use of cashless transactions through its Smart City project, which involves the use of card readers in the retail and hospitality sectors.

- The fintechs, with the support of the financial institutions, are making it possible for small businesses to acquire card readers at a low price.

- The regulatory framework is evolving, with countries like Kenya establishing policies to promote digital payment systems, which is expected to boost the card reader market.

Latin America

- The Central Bank of Brazil is promoting a system of cashless payments, and local companies are investing in card readers.

- Latin America’s growing e-commerce is driving the demand for credit card readers, and companies like Mercado Pago are expanding their service to include payment solutions.

- Among younger consumers, there is a tendency towards digital payment, which is a reason for some retailers to install card readers.

Did You Know?

“In 2022 it was estimated that more than half of all Swedish transactions were done with digital means, making Sweden one of the most cashless societies in the world.” — Swedish Central Bank

Segmental Market Size

The Pay-card reader market is a vital part of the payment processing industry. This market is currently growing at a steady pace due to the growing demand for contactless payment solutions. This is driven by the growing preference for digital payments, which was further accelerated by the COVID-N°19 epidemic and government policies encouraging cashless payment solutions. Also, technological advancements in mobile payment systems and NFC (Near Field Communication) technology are enhancing the functionality and availability of pay-card readers.

The current stage of the development of credit card readers is a period of rapid growth, with leaders such as Square and PayPal expanding their business in many countries, especially in North America and Europe. The main application fields are in the retail industry, the food and beverage industry, and the e-commerce platform, where the convenience of payment is the most important. The push for green development and the trend of the government to ban cash transactions are also the main growth points. The related technologies in this field include mobile wallets, fingerprint recognition, and cloud payment solutions. The combination of these three things has greatly improved the security and convenience of users.

Future Outlook

The Credit Card Readers Market is expected to show a positive growth trend from 2024 to 2032, with a CAGR of 3.49% from 2024 to 2032. The main growth driver is the increasing adoption of cashless payment solutions in various industries, such as retail, hospitality and transport. The increasing convenience and speed of transactions are expected to drive the growth of the market. It is expected that by 2032, more than 70% of POS transactions will be completed with the help of an e-payment method, compared to 55% in 2024. The shift in this direction is largely driven by the changing preferences of consumers and the ongoing digital transformation of companies.

Contactless payment options and mobile wallets are expected to enhance the functionality and appeal of card readers. Also, government support for digital payment systems, including initiatives aimed at financial inclusion and the reduction of cash use, will act as a further stimulant to growth. Biometric verification and other security features will also play a key role in enhancing trust and accelerating uptake. In the face of these developments, all parties need to be agile and respond quickly to technological innovations and changing customer behaviour in order to capitalise on the growth opportunities that will emerge in the card reader market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 55.1 Billion |

| Market Size Value In 2023 | USD 57.3 Billion |

| Growth Rate | 4.00% (2023-2032) |

Pay Card Reader Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.