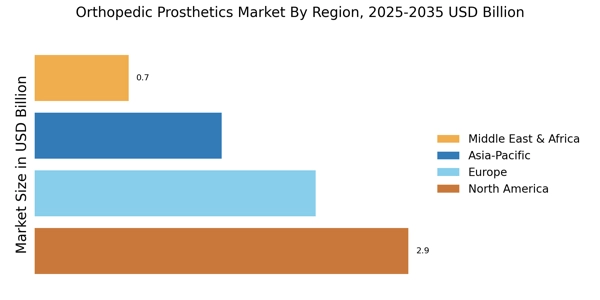

Increasing Healthcare Expenditure

The rise in healthcare expenditure across various regions is significantly influencing the Orthopedic Prosthetics Market. Governments and private sectors are investing more in healthcare infrastructure, which includes the provision of advanced orthopedic solutions. Data suggests that healthcare spending is expected to grow, driven by the need for better medical services and technologies. This increase in funding allows for the development and distribution of high-quality prosthetic devices, making them more accessible to patients. Furthermore, as healthcare systems prioritize rehabilitation and recovery, the demand for orthopedic prosthetics is likely to surge. This trend indicates a positive outlook for the Orthopedic Prosthetics Market as it aligns with broader healthcare initiatives.

Rising Incidence of Orthopedic Disorders

The increasing prevalence of orthopedic disorders, such as arthritis and osteoporosis, is a primary driver of the Orthopedic Prosthetics Market. As populations age, the demand for orthopedic prosthetics is likely to rise significantly. According to recent data, the number of individuals suffering from musculoskeletal disorders is projected to increase, leading to a greater need for prosthetic solutions. This trend is further exacerbated by lifestyle factors, including obesity and sedentary behavior, which contribute to joint and bone issues. Consequently, healthcare providers are focusing on innovative prosthetic solutions to enhance mobility and quality of life for affected individuals. The Orthopedic Prosthetics Market is thus positioned for growth as it responds to these rising demands.

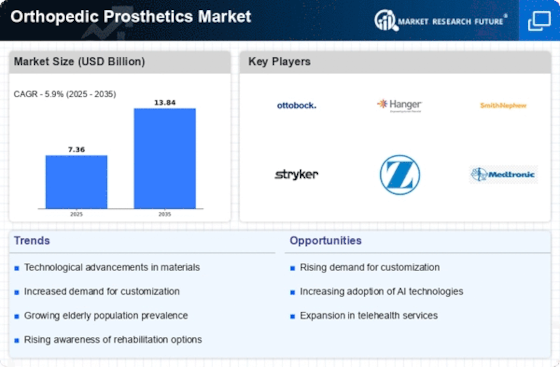

Technological Innovations in Prosthetics

Technological advancements play a crucial role in shaping the Orthopedic Prosthetics Market. Innovations such as 3D printing, smart prosthetics, and advanced materials are revolutionizing the design and functionality of orthopedic devices. For instance, the integration of sensors and artificial intelligence in prosthetics allows for improved user experience and adaptability. Market data indicates that the adoption of these technologies is increasing, with a notable rise in the production of customized prosthetic solutions. This trend not only enhances the performance of orthopedic devices but also addresses the specific needs of patients, thereby driving market growth. As technology continues to evolve, the Orthopedic Prosthetics Market is expected to witness further advancements that will enhance patient outcomes.

Aging Population and Increased Life Expectancy

The aging population and increased life expectancy are significant factors driving the Orthopedic Prosthetics Market. As individuals live longer, the incidence of age-related orthopedic conditions rises, necessitating the use of prosthetic devices. Data indicates that the global population aged 65 and older is expected to double in the coming decades, leading to a higher demand for orthopedic solutions. This demographic shift compels healthcare systems to adapt and provide adequate support for older adults, including access to advanced prosthetics. Consequently, the Orthopedic Prosthetics Market is poised for growth as it addresses the needs of an aging population, ensuring that individuals maintain mobility and independence.

Growing Awareness and Acceptance of Prosthetics

There is a notable increase in awareness and acceptance of prosthetic devices among patients and healthcare providers, which is positively impacting the Orthopedic Prosthetics Market. Educational campaigns and advocacy efforts have contributed to a better understanding of the benefits of prosthetics, leading to higher adoption rates. Market data reveals that more individuals are seeking prosthetic solutions as they become aware of the advancements in technology and the potential for improved quality of life. This shift in perception is crucial, as it encourages patients to pursue rehabilitation options that include orthopedic prosthetics. As awareness continues to grow, the Orthopedic Prosthetics Market is likely to expand, driven by a more informed patient base.