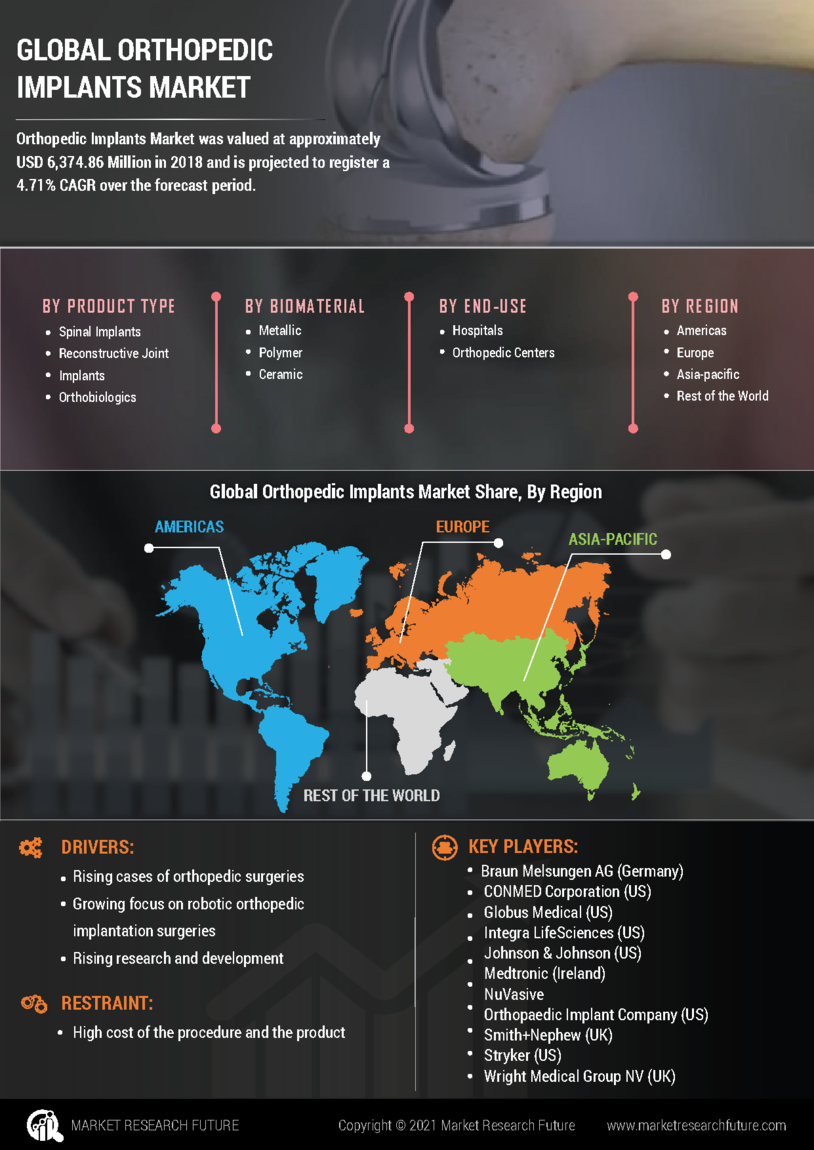

Orthopedic Implants Market Overview

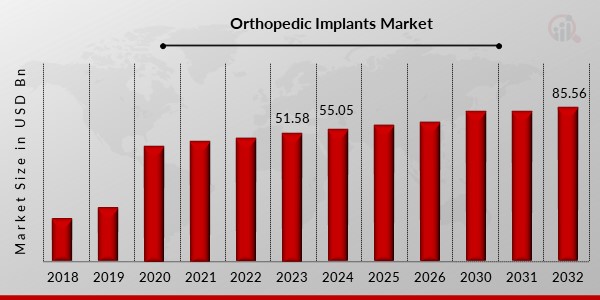

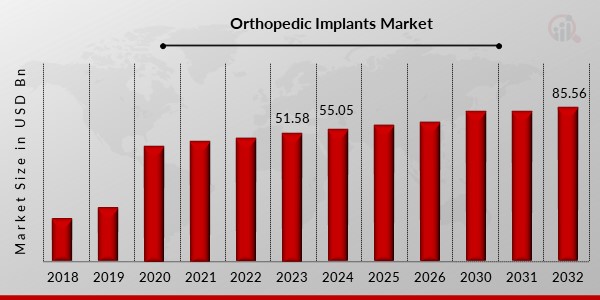

Orthopedic Implants Market Size was valued at USD 51.58 Billion in 2023. The Global Orthopedic Implants industry is projected to grow from USD 55.05 Billion in 2024 to USD 85.56 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.02% during the forecast period (2024 - 2032). Because of the constantly growing geriatric population, persons over 65 have a higher risk of acquiring osteoarthritis, low bone density, and degenerative disc disease are the key market drivers propelling the market growth.

As the number of patients requiring orthopedic care rises, so does the market for bone implants. The growing popularity of implantable medical devices has allowed doctors to personalize implants to suit the needs of their patients, who all present their own unique problems to the operating room. In addition, customization provides the orthopedic surgeon with more options for how to surgically place an implant.

The market for AI-powered guidance software, handheld navigation to assist the surgeon throughout the implantation process, and fully remote robotic orthopedic surgery is expected to expand. Because of the growing number of health-conscious customers, the pharmaceutical industry is in a prime position to develop and introduce new orthopedic implants, which bodes well for the orthopedic implants market. The market is expected to expand as a result of rising launch rates for new types of orthopedic implants and rising investments in the production of innovative orthopedic implants by key players around the globe.

The development of sophisticated implants and other technical advances in the field of orthopedics are also anticipated to contribute to the expansion of the orthopedic implants market. In addition, some major businesses are using effective techniques, like innovation and collaboration, to further develop and supply cutting-edge implant technologies for orthopedic surgery.

The use of 3D printing in the fabrication of speciality implants to create a multi-layered composite implant is also a major development in the orthopedic implant market. This is because numerous significant parties have invested, and the technology permits individualized approaches. Additionally, the increasing prevalence of arthritic conditions among the elderly is anticipated to fuel the market expansion. Additionally, the increasing prevalence of musculoskeletal ailments is expected to fuel market expansion.

Acelus, a medical technology company in the field of expandable spinal implant technologies, launched a linesider modular-cortical system for spinal implant surgeries among patients in January 2024.

For instance, Stryker launched the Ortho Q Guidance System with ortho guidance software by May 2023, which offers advanced surgical planning to doctors and gives guidance on hip and knee procedures. The surgeon easily controls this software from the sterile field.In March 2023, Invibio Biomaterial Solutions unveiled Peek-Optima Am filament, which is an implantable polyetheretherketone polymer designed for the manufacture of 3D-printed medical devices. Consequently, these filaments will help increase the production of such products in the market.Curiteva Inc., for instance, obtained FDA 510(k) approval in March 2023 on its Inspire 3D Porous PEEK HAFUSE Cervical Interbody System in March of that year; it is a 3D printed PEEK-implant produced by their Fused Filament Fabrication (FFF) printer.Enovis Corporation is an innovation-driven medical technology company that announced the introduction of DynaClip DeltaTM and DynaClip QuattroTM bone staples into the Company’s growing foot and ankle portfolio as well as the DynaClip® family of bone fixation systems in January 2023.

A seed investment and research fund worth around USD 1.4 million was announced by Trabtech – a medtech firm - in January 2023. This funding was meant to facilitate the development of new implants within the orthopedic and pediatric fields.Stryker, one of the world’s leading global medical technology companies, recently, in October 2022, introduced the Monterey AL Interbody System, which is a stand-alone interbody fusion device specifically designed for anterior lumbar interbody fusion (ALIF).In March 2022, Johnson & Johnson MedTech revealed two other innovations from DePuy Synthes Johnson & Johnson’s orthopedic company: ATTUNE™ Knee portfolio, consisting of ATTUNE™ Cementless Fixed Bearing Knee with AFFIXIUM™ 3DP Technology and the ATTUNE™ Medial Stabilized Knee System. Alongside the government, various organizations have been advising patients and physicians about orthopedic implants.

Orthopedic Implants Market Trends

-

Growing orthopedic implant innovation to boost market growth

The rise in orthopedic surgeries has led to an increase in the demand for bone implants. Implants can now be tailored because of the rising need for implantable medical devices, as each patient confronts the surgeon with a different set of challenges. Additionally, personalization enables the orthopedic specialist to insert an implant using a variety of techniques. Artificial intelligence (AI)-driven guidance software, portable navigation to guide the surgeon during the implant, and robotic orthopedic surgery performed fully remotely will all find growing commercial use. Additionally, 3D printing to manufacture specialty implants to make a multi-layered composite implant is one of the primary orthopedic implant market trends in the production of these devices. This is because different important players have invested, and the technology enables for customization.

In addition, Health Canada approved the first 3D-printed implant-specific mandibular plate produced domestically in December 2021. The (LARA 3D), a division of Investissement Québec (CREEK) with headquarters in Quebec City, created the implant. The market is expected to be expand by the worldwide support governments give to domestic manufacturing and the development of cutting-edge medical products like implants.

Geriatrics are considered a viable patient population for orthopedic implants because of the increased risk of bone diseases, fractures, and bone porosity as people age. According to a report by MDPI medicine 2021, the elderly have a higher risk of fractures, with a chance of 40–50% for women and 13–22% for males as they age. Additionally, according to a World Health Organization (WHO) article from 2021, the number of older adults worldwide is expected to rise from 1 billion to 1.4 billion by 2030. Furthermore, throughout this time, 1 in 6 people is anticipated to reach 60. Therefore, this condition has recently enhanced the market of Orthopedic Implants CAGR.

However, a sharp increase in road accidents and sports-related injuries are projected to spur market expansion, another factor driving the growth of the Orthopedic Implants market revenue.

Orthopedic Implants Market Segment Insights

Orthopedic Implants Product type Insights

Based on product type, the market of Orthopedic Implants segmentation includes spinal implants, reconstructive joint implants, orthobiologics, and others. The Reconstructive Joint Implants segment held the majority share in 2022, contributing to around ~40% of the Orthopedic Implants market revenue. This category is expected to maintain its dominance during the market's growth phase due to the sharp rise in osteoarthritis and osteoporosis cases. The market has been supported by the leading market players' quick research and development to create the best implants for these situations.

Orthopedic Implants Biomaterial Insights

The Orthopedic Implants market segmentation, based on Biomaterial, includes metallic, ceramic, and others. The Metallic segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Compared to other materials, metallic biomaterials are more affordable and promote better bone repair. They primarily produce several orthopedic implants, including plates, screws, and VCF devices. Hence, rising applications of Metallic material implants for Orthopedic Implants positively impact the market growth.

Orthopedic Implants End User Insights

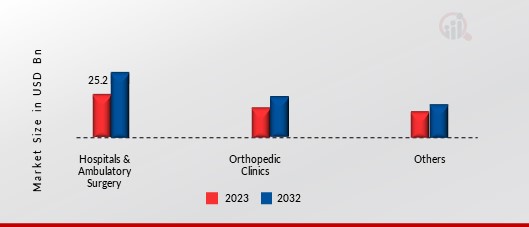

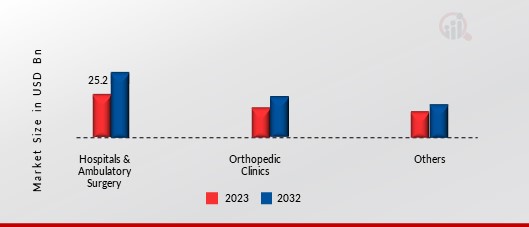

Based on End Users, the market of Orthopedic Implants data has been segmented into hospitals & ambulatory surgery, orthopedic clinics, and others. Hospitals & ambulatory surgery held the most significant segment share in 2022; the large hospitals that offer implantations are to blame for the segment's domination with their broad reimbursement practices. The industry is also expected to grow due to manufacturer initiatives to introduce cutting-edge goods through partnerships with critical hospitals and higher usage of innovative implantation techniques such as robot-assisted orthopedic surgery.

The fastest-growing segment in the Orthopedic Implants industry is orthopedic clinics. The possibility for different experts to interact through private practice is predicted to promote the growth of orthopedic clinics & other segments due to the rising number of orthopedic professionals opening private practices and novel implant procedures like remote surgical implantations.

Figure 2: Orthopedic Implants Market, by End User, 2023 & 2032 (USD billion)

Materialise, a market leader in medical 3D planning and printing solutions, announced a partnership with Exactech to offer cutting-edge treatment options for patients with severe shoulder defects. Exactech is a developer and producer of innovative implants, instrumentation, and smart technologies for joint replacement surgery. In order to better serve customers in Europe and Australia, Exactech has decided to add the Materialise Glenius solution to its product lineup.

In May 2023, With the intention of further strengthening their relationship and adding Ossis' specialized implants to Zimmer Biomet's own orthopedics offering, Zimmer Biomet announced Monday that it will purchase the New Zealand-based devicemaker. The combination of Ossis's more than 16 years of clinical experience and engineering knowledge with Zimmer Biomet's wide network across Asia Pacific, Europe, the Middle East, and Africa shows dedication to bringing game-changing medtech innovations to patients in need.

Orthopedic Implants Regional Insights

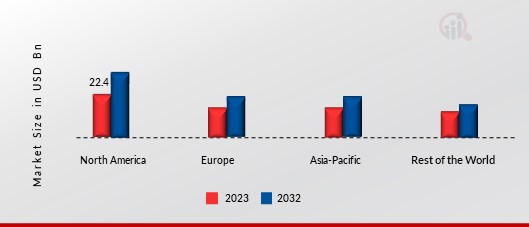

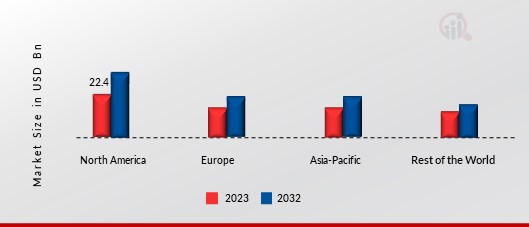

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. In North America, the market for Orthopedic Implants is expected to exhibit a significant CAGR growth during the study period. It is anticipated that the demand for orthopedic operations would rise due to the rising incidence of orthopedic disorders among people such as osteoporosis and other related bone disorders, and the growing senior population at a substantially higher risk of bone fractures.

Further, the significant countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: ORTHOPEDIC IMPLANTS MARKET SHARE BY REGION 2023 (%)

Europe's Orthopedic Implants market accounts for the second-largest market share. The market is expanding due to an increase in patients with osteoarthritis and other bone issues as well as strategic initiatives taken by major industry players. Further, the Germany market of Orthopedic Implants held the largest market share, and the UK market of Orthopedic Implants was the major growing market in the European region.

The Asia-Pacific market of Orthopedic Implants is expected to grow at the fastest CAGR from 2022 to 2030. Improvements in bone scan diagnostics for detecting bone density among diagnostic laboratories, greater reimbursements by commercial and governmental organizations, and the growth of healthcare infrastructure have all contributed to an increase in the number of patients receiving orthopedic treatments. This is projected to boost the market growth in Asian nations with governments' favorable regulations to support orthopedic surgeries. Moreover, the China market of Orthopedic Implants held the largest share, and the India market of Orthopedic Implants was the fastest-growing market in the Asia-Pacific region.

Orthopedic Implants Key Market Players & Competitive Insights

Major market companies are investing a lot of money in R&D to expand their product portfolios, which will spur further growth in the orthopedic implants market. With significant key development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their presence. Orthopedic Implants industry competitors must provide affordable products to grow and compete in a more cutthroat and competitive market climate.

Manufacturing locally to cut operating costs is one of the leading business tactics manufacturers use in the Orthopedic Implants industry to benefit customers and increase the market sector. In recent years, the Orthopedic Implants industry has provided medicine with some of the most significant benefits. Major companies in the orthopedic implants industry, including DePuy Synthes (Johnson & Johnson Services, Inc.), Zimmer Biomet,Smith & Nephew, and others, are attempting to increase market demand by funding R&D initiatives..

Smith & Nephew plc, usually called Smith+Nephew, is a British multinational medical equipment manufacturer with its headquarters in Watford, England. In November 2021, Smith and Nephew unveiled a total knee system without cement. Conceloc Advanced Porous Titanium, a proprietary material patented for 3D printing, is used to make the implant. The porous nature of the implant encourages bone ingrowth.

Also, LimaCorporate manufactures medical equipment. Large Joint Primary and Revision Implants, Extremities and Fixation Solutions, and a patient-specific prosthesis division are all part of their product line.

In March 2022, the successful insertion of ProVide, a patient-specific 3D printed implant, by Ortho Carolina Center in New York City, United States, was the catalyst for a partnership between LimaCorporate S.p.A. and Ortho. The development highlights the advantages of on-site implant development in conjunction with surgeons' knowledge, including shorter surgery times and patient-specific implant personalization.

Key Companies in the Orthopedic Implants market includes

- CONMED Corporation, among others

Orthopedic Implants Industry Developments

March 2022:Zimmer Biomet announced the debut of WalkAI. The Artificial Intelligence (AI) algorithm identifies patients whose post-hip replacement walking pace is expected to be slower. The company's ZBEdge Connected Intelligence Suite, which incorporates the WalkAI further, gives it a competitive edge in the bone implants market.

January 2022:Announcing the purchase of Engage Surgical, Smith & Nephew The investment is purchasing the cementless partial knee system from Engage. The latest implant can be used with the exclusive CORI robotic surgical system from Smith & Nephew.

Orthopedic Implants Market Segmentation

Orthopedic Implants Biomaterial Outlook

- Reconstructive Joint Implants

Orthopedic Implants Biomaterial Outlook

Orthopedic Implants End User Outlook

- Hospitals & Ambulatory Surgery

Orthopedic Implants Regional Outlook

North America

Europe

Asia-Pacific

Middle East

| Attribute/Metric |

Details |

| Market Size 2023 |

USD 51.58 billion |

| Market Size 2024 |

USD 55.05 billion |

| Market Size 2032 |

USD 85.56 billion |

| Compound Annual Growth Rate (CAGR) |

5.02% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product Biomaterial, Operating Platforms, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Braun Melsungen AG (Germany), CONMED Corporation (US), Globus Medical (US), Integra LifeSciences (US), Johnson & Johnson (US), Medtronic (Ireland), NuVasive, Inc. (US), Orthopaedic Implant Company (US), Smith+Nephew (UK), Stryker (US), Wright Medical Group NV (UK), and Zimmer Biomet (US) |

| Key Market Opportunities |

Governments are also investing much in research and developments that are helping the market gain momentum. |

| Key Market Dynamics |

Growing focus on robotic orthopedic implantation surgeries, and rising research and development. |

Orthopedic Implant Market Highlights:

Frequently Asked Questions (FAQ) :

The Orthopedic Implants market size was valued at USD 51.58 Billion in 2023.

The market for Orthopedic Implants is projected to grow at a CAGR of 5.02 % during the forecast period, 2024-2032.

North America had the largest share in the market for Orthopedic Implants.

The key players in the market for Orthopedic Implants are Braun Melsungen AG (Germany), CONMED Corporation (US), Globus Medical (US), Integra LifeSciences (US), Johnson & Johnson (US).

The Reconstructive Joint Implants category dominated the Orthopedic Implants market in 2022.

The metallic had the largest share in the Orthopedic Implants market.