Integration with Smart Devices

The integration of optical fingerprint sensors into smart devices is a pivotal driver for the Optical Fingerprint Sensor Market. As consumers increasingly adopt smartphones, tablets, and wearables, the demand for secure biometric authentication has surged. In 2025, it is estimated that over 80% of smartphones will feature biometric capabilities, with optical fingerprint sensors being a preferred choice due to their efficiency and reliability. This trend is further fueled by the growing need for enhanced security measures in personal and financial transactions. The Optical Fingerprint Sensor Market is likely to benefit from this integration, as manufacturers strive to meet consumer expectations for seamless and secure user experiences. Additionally, the proliferation of Internet of Things (IoT) devices is expected to create new opportunities for optical fingerprint sensors, as these devices increasingly require secure access controls.

Advancements in Sensor Technology

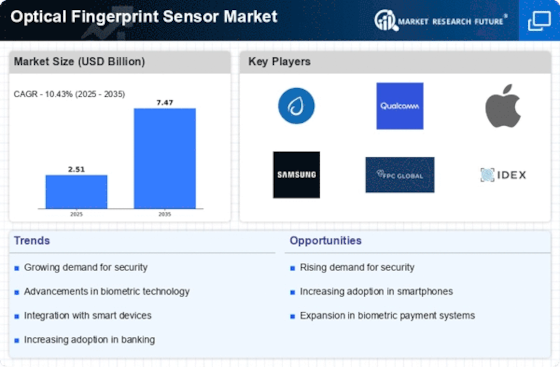

Technological advancements in optical fingerprint sensors are significantly influencing the Optical Fingerprint Sensor Market. Innovations such as improved image capture techniques and enhanced algorithms for fingerprint recognition are making these sensors more accurate and faster. In 2025, the market is projected to witness a compound annual growth rate of approximately 12%, driven by these technological improvements. Enhanced sensor capabilities, including the ability to function in various lighting conditions and on different skin types, are expanding the applicability of optical fingerprint sensors across diverse sectors. This includes not only consumer electronics but also security systems in banking and healthcare. As manufacturers continue to invest in research and development, the Optical Fingerprint Sensor Market is poised for substantial growth, with new applications emerging that leverage these advancements.

Rising Demand for Biometric Security

The increasing demand for biometric security solutions is a crucial driver for the Optical Fingerprint Sensor Market. As security breaches and identity theft incidents rise, organizations and consumers are seeking more reliable authentication methods. The biometric security market is expected to reach a valuation of over 30 billion dollars by 2026, with optical fingerprint sensors playing a significant role in this growth. These sensors offer a balance of convenience and security, making them an attractive option for various applications, including mobile payments, access control, and identity verification. The Optical Fingerprint Sensor Market is likely to see heightened interest from sectors such as finance, government, and healthcare, where secure access to sensitive information is paramount. This trend suggests a robust future for optical fingerprint sensors as they become integral to comprehensive security strategies.

Growing Adoption in Automotive Applications

The growing adoption of optical fingerprint sensors in automotive applications is emerging as a notable driver for the Optical Fingerprint Sensor Market. As vehicles become more technologically advanced, the integration of biometric systems for keyless entry and ignition is gaining traction. In 2025, it is anticipated that the automotive sector will account for a significant share of the optical fingerprint sensor market, driven by consumer preferences for enhanced security and convenience. Manufacturers are increasingly incorporating these sensors into vehicle designs, allowing for personalized settings and improved safety features. This trend not only enhances user experience but also aligns with the broader movement towards smart and connected vehicles. The Optical Fingerprint Sensor Market is likely to benefit from this shift, as automotive companies seek innovative solutions to differentiate their offerings in a competitive market.

Regulatory Support for Biometric Technologies

Regulatory support for biometric technologies is becoming an influential driver for the Optical Fingerprint Sensor Market. Governments and regulatory bodies are increasingly recognizing the importance of secure identification methods in various sectors, including finance, healthcare, and public safety. In 2025, several countries are expected to implement stricter regulations that mandate the use of biometric authentication for sensitive transactions and access controls. This regulatory landscape is likely to propel the adoption of optical fingerprint sensors, as organizations seek to comply with these requirements. Furthermore, initiatives aimed at promoting digital identity solutions are expected to create additional opportunities for the Optical Fingerprint Sensor Market. As regulatory frameworks evolve, the demand for reliable and secure biometric solutions, including optical fingerprint sensors, is anticipated to grow, fostering innovation and investment in this sector.