Growing Geriatric Population

The demographic shift towards an aging population is a significant driver for the Onychomycosis Market. Older adults are more susceptible to onychomycosis due to factors such as reduced immune function and comorbidities. As the global population ages, the prevalence of nail fungal infections is likely to rise, leading to increased demand for effective treatment options. According to recent estimates, the incidence of onychomycosis in the elderly population can reach up to 50%. This trend suggests that the Onychomycosis Market will need to adapt to cater to the specific needs of this demographic, potentially leading to the development of targeted therapies.

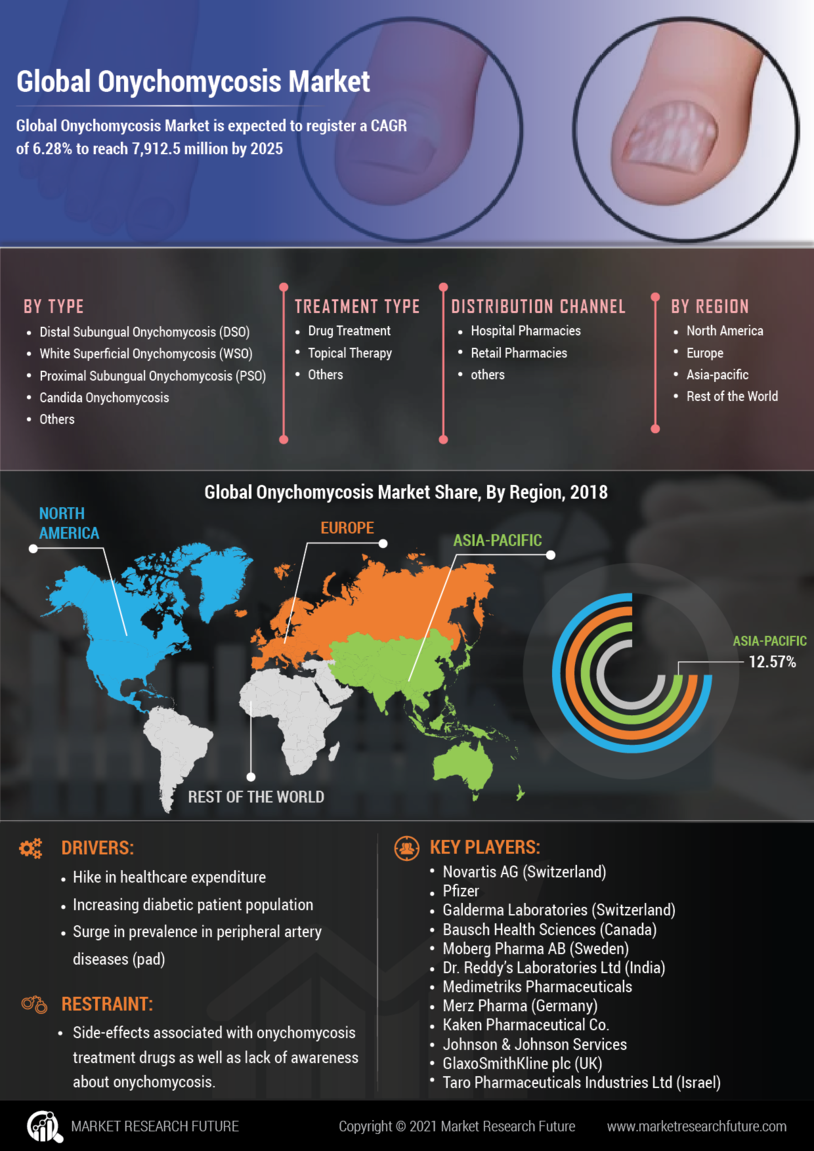

Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is contributing to the growth of the Onychomycosis Market. As individuals allocate more resources towards health and wellness, there is a corresponding rise in spending on dermatological treatments, including those for onychomycosis. This trend is particularly evident in developed economies, where healthcare systems are increasingly prioritizing the treatment of fungal infections. Enhanced access to healthcare services and insurance coverage for antifungal treatments may further stimulate market growth. Consequently, the Onychomycosis Market is poised to benefit from this upward trajectory in healthcare spending, as more patients seek effective solutions for their nail fungal infections.

Emergence of E-commerce Platforms

The emergence of e-commerce platforms is reshaping the distribution landscape of the Onychomycosis Market. With the increasing penetration of the internet and mobile devices, consumers are now able to access a wide range of antifungal products online. This shift towards digital purchasing is likely to enhance product availability and convenience for patients seeking treatment for onychomycosis. Furthermore, e-commerce platforms often provide detailed product information and customer reviews, which can aid consumers in making informed decisions. As a result, the Onychomycosis Market may experience growth as more individuals opt for online purchases, thereby expanding the reach of antifungal treatments.

Advancements in Antifungal Treatments

The Onychomycosis Market is witnessing a surge in advancements in antifungal treatments, which is likely to enhance treatment efficacy and patient compliance. Recent developments in drug formulations, including novel topical and systemic antifungal agents, have shown promising results in clinical trials. For instance, the introduction of new oral antifungal medications has been associated with higher cure rates and reduced treatment durations. This innovation not only addresses the limitations of traditional therapies but also expands the treatment landscape for onychomycosis. As a result, the Onychomycosis Market is expected to benefit from increased adoption of these advanced treatments, ultimately improving patient outcomes.

Increasing Awareness of Onychomycosis

The rising awareness regarding onychomycosis is a pivotal driver for the Onychomycosis Market. Educational campaigns and health initiatives have been instrumental in informing the public about the symptoms and risks associated with nail fungal infections. This heightened awareness is likely to lead to increased consultations with healthcare professionals, thereby driving demand for effective treatment options. As individuals become more informed, they are more inclined to seek medical advice, which could potentially result in a surge in diagnosed cases. Consequently, the Onychomycosis Market may experience growth as pharmaceutical companies respond to this demand with innovative therapies and products tailored to treat onychomycosis.