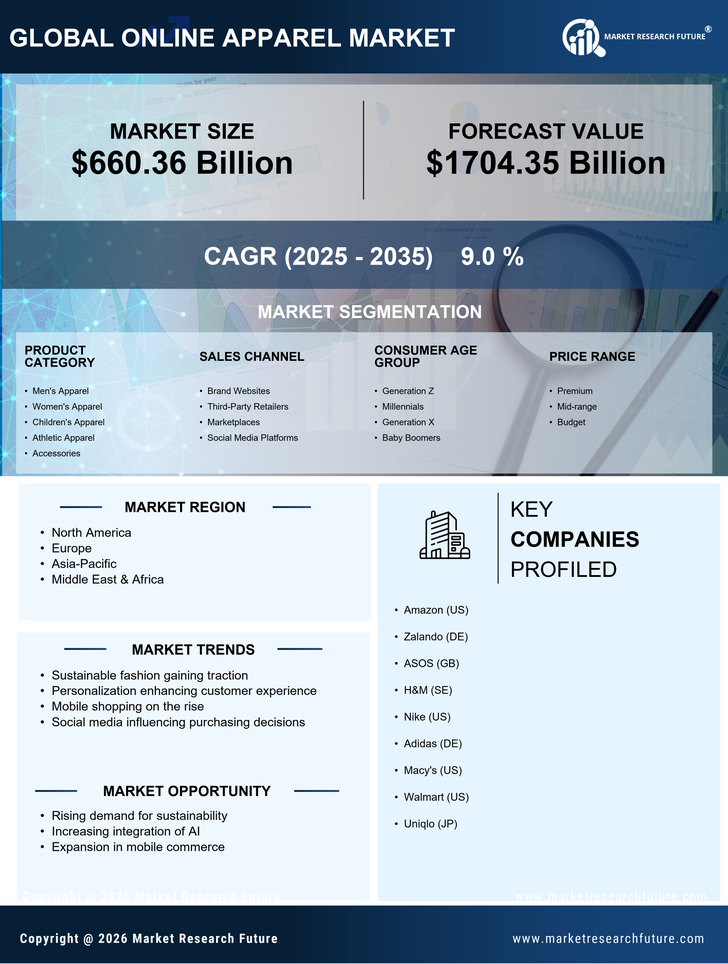

The Online Apparel Market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and shifting consumer preferences. Major players such as Amazon (US), Zalando (DE), and Nike (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Amazon (US) continues to leverage its vast logistics network and data analytics capabilities to personalize shopping experiences, while Zalando (DE) focuses on expanding its marketplace model, allowing third-party sellers to reach a broader audience. Nike (US), on the other hand, emphasizes innovation in product development and sustainability, aligning its offerings with the growing consumer demand for eco-friendly apparel. Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological integration and consumer-centric approaches.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The Online Apparel Market appears moderately fragmented, with a mix of established brands and emerging players. The influence of key players is substantial, as they set trends and standards that smaller competitors often follow. This competitive structure fosters an environment where innovation and agility are paramount, compelling companies to continuously adapt to maintain relevance.

In August Nike (US) announced a partnership with a leading tech firm to develop a new line of smart apparel that integrates wearable technology. This strategic move not only positions Nike at the cutting edge of the intersection between fashion and technology but also caters to the growing consumer interest in health and fitness tracking. By embedding technology into their products, Nike (US) aims to enhance customer engagement and loyalty, potentially setting a new standard in the athletic apparel segment.

In September Zalando (DE) launched a new sustainability initiative aimed at reducing its carbon footprint by 50% by 2030. This initiative underscores Zalando's commitment to environmental responsibility and aligns with the increasing consumer preference for sustainable fashion. By prioritizing sustainability, Zalando (DE) not only enhances its brand image but also positions itself favorably among eco-conscious consumers, which could lead to increased market share in the long term.

In October Amazon (US) unveiled a new feature on its platform that utilizes artificial intelligence to provide personalized shopping recommendations based on user behavior and preferences. This innovation reflects Amazon's ongoing commitment to enhancing the customer experience through technology. By leveraging AI, Amazon (US) aims to increase conversion rates and customer satisfaction, thereby solidifying its dominance in the online apparel sector.

As of October the Online Apparel Market is witnessing significant trends such as digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, as companies collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex market.