Growth in Therapeutic Applications

The therapeutic applications of oligonucleotides are becoming a major driver for the Oligonucleotide Synthesis Market. With advancements in gene therapy and RNA interference technologies, oligonucleotides are being utilized to develop innovative treatments for various conditions, including cancer and genetic disorders. The market for oligonucleotide therapeutics is expected to reach several billion dollars, reflecting a robust growth trajectory. This trend is further supported by increasing investments in research and development by pharmaceutical companies, which are exploring the potential of oligonucleotides in novel therapeutic modalities. As these applications continue to evolve, the Oligonucleotide Synthesis Market is poised for substantial expansion.

Rising Investment in Genomic Research

The rising investment in genomic research is a critical driver for the Oligonucleotide Synthesis Market. Governments and private entities are increasingly funding genomic studies aimed at understanding genetic diseases and developing targeted therapies. This influx of capital is fostering an environment conducive to innovation in oligonucleotide synthesis, as researchers require high-quality oligonucleotides for their studies. The market for genomic research is projected to grow substantially, with estimates indicating a potential doubling of investment in the next five years. This trend underscores the importance of oligonucleotides in advancing genomic research, thereby propelling the Oligonucleotide Synthesis Market to new heights.

Expanding Applications in Synthetic Biology

The expanding applications of oligonucleotides in synthetic biology are emerging as a significant driver for the Oligonucleotide Synthesis Market. Synthetic biology encompasses a range of applications, including the engineering of microorganisms for bioproduction and the development of novel biomaterials. Oligonucleotides play a crucial role in these applications, serving as essential building blocks for constructing synthetic genetic circuits. The synthetic biology market is anticipated to grow rapidly, with projections suggesting a market size reaching tens of billions of dollars in the coming years. This growth is likely to stimulate demand for oligonucleotide synthesis, further enhancing the Oligonucleotide Synthesis Market.

Technological Advancements in Synthesis Methods

Technological advancements in oligonucleotide synthesis methods are significantly influencing the Oligonucleotide Synthesis Market. Innovations such as improved solid-phase synthesis techniques and the development of high-throughput synthesis platforms are enhancing the efficiency and scalability of oligonucleotide production. These advancements not only reduce costs but also increase the quality and purity of synthesized oligonucleotides. As a result, researchers and manufacturers are more inclined to utilize these advanced synthesis methods, which are expected to drive market growth. The ongoing evolution of synthesis technologies is likely to create new opportunities within the Oligonucleotide Synthesis Market, facilitating the development of more complex and diverse oligonucleotide products.

Increasing Applications in Molecular Diagnostics

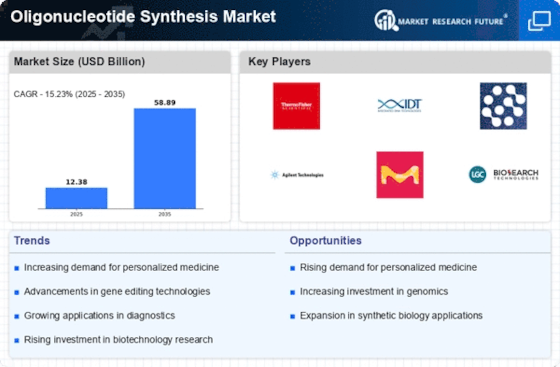

The Oligonucleotide Synthesis Market is experiencing a surge in demand due to the increasing applications of oligonucleotides in molecular diagnostics. These synthetic sequences are pivotal in the detection of various diseases, including genetic disorders and infectious diseases. The market for molecular diagnostics is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the rising prevalence of chronic diseases and the need for early detection methods. As healthcare systems increasingly adopt personalized medicine approaches, the reliance on oligonucleotide-based diagnostics is likely to expand, thereby propelling the Oligonucleotide Synthesis Market forward.