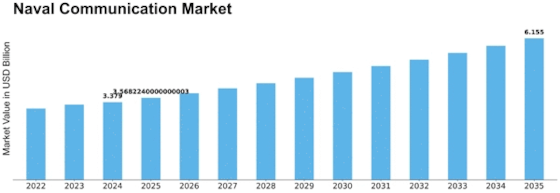

Naval Communication Size

Naval Communication Market Growth Projections and Opportunities

The market for naval communication is highly influenced by a number of variables that together determine its structure and future directions. The growing requirement for reliable communications equipment in naval operations across the globe is a major driver of this market. Naval forces are stressing the significance of safe, dependable, and cutting-edge communication technologies in order to guarantee efficient control and command, monitoring, and collaboration capabilities at sea as maritime activities grow. Innovations in technology are essential to the development within the naval communication industry. More complex naval communication solutions are developed as a result of ongoing innovation in communication technology, including as communications via satellite, secure information transmission, and sophisticated radio frequency systems. These innovations in technology not only increase the effectiveness of communication but also allow naval forces to adjust to changing threats. The market for naval communication is greatly impacted by defense budget allocations. Developing and acquiring cutting-edge communication technologies for their navy vessels is more likely to be funded by nations with sizable defense budgets. On the other hand, financial limitations could force certain countries to prioritize their expenditures, which would affect the choices made about investments in naval communication. In order to shape the entire dynamics of the market, it is necessary that economic concerns be balanced with the need for upgraded naval communication capabilities. International cooperation and the geopolitical environment both have a significant impact on the naval communication sector. Communication systems are among the naval technology that are frequently exchanged in strategic alliances and cooperation between nations. Global collaboration inside the naval communication industry is fostered by collaborative research and development activities that result in compatible and standardized solutions for communication. Moreover, the naval communication industry summary is impacted by compliance requirements and regulatory frameworks. The creation of secure systems for communication is driven by strict laws pertaining to the safety and confidentiality of naval communications. To guarantee the integrity and dependability of communication systems in marine operations, producers and naval forces must adhere to worldwide standards and certifications. Another factor influencing the naval communication industry is the increase in cyber threats in the marine sector. The susceptibility of naval communications equipment to cyberattacks increases with their increasing digitization. Because of this, cybersecurity measures are given more attention in an effort to shield naval networks of communication from potential interruptions and unwanted access. Robust cybersecurity measures are becoming an essential component of contemporary naval communication systems. In summary, a wide range of factors, such as the need for sophisticated communication capabilities, technological developments, financial constraints, geopolitical dynamics, international cooperation, legal frameworks, and cybersecurity issues, all have an impact on the naval communication market. The naval communication industry will probably see ongoing growth and innovation in the coming years as naval forces work to modernize its communication network to meet the needs of maritime operations. In order to maintain the efficacy and robustness of naval communication systems, stakeholders will need to be able to navigate and adjust to these varied market forces.

Leave a Comment