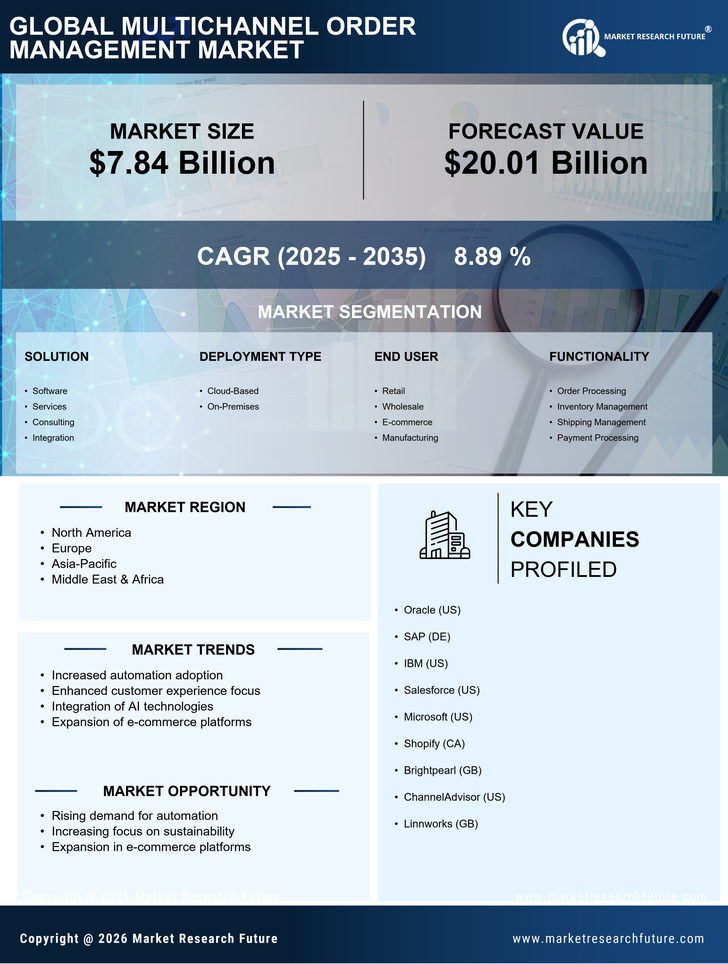

Rising E-commerce Demand

The surge in e-commerce activities has been a pivotal driver for the Multichannel Order Management Market. As consumers increasingly prefer online shopping, businesses are compelled to adopt multichannel strategies to meet customer expectations. According to recent data, e-commerce sales have shown a consistent upward trajectory, with projections indicating a potential growth rate of over 15% annually. This trend necessitates robust order management systems that can seamlessly integrate various sales channels, ensuring efficient order processing and fulfillment. Companies that leverage multichannel order management solutions are likely to enhance their operational efficiency, reduce order errors, and improve customer satisfaction, thereby gaining a competitive edge in the marketplace.

Technological Advancements

Technological innovations play a crucial role in shaping the Multichannel Order Management Market. The advent of cloud computing, artificial intelligence, and machine learning has transformed how businesses manage orders across multiple channels. These technologies enable real-time data analytics, which can optimize inventory management and streamline order fulfillment processes. For instance, the integration of AI-driven tools can predict customer demand patterns, allowing businesses to adjust their inventory levels accordingly. As a result, companies that adopt these advanced technologies are likely to experience improved operational efficiency and reduced costs, positioning themselves favorably in a competitive landscape.

Global Supply Chain Optimization

The need for supply chain optimization is becoming increasingly critical in the Multichannel Order Management Market. As businesses expand their operations across various channels, the complexity of managing inventory and logistics grows. Effective order management systems can provide visibility into the entire supply chain, enabling companies to make informed decisions regarding inventory allocation and fulfillment strategies. Recent studies indicate that organizations that optimize their supply chains can reduce operational costs by up to 20%. By leveraging multichannel order management solutions, businesses can enhance their responsiveness to market demands, minimize stockouts, and improve overall supply chain efficiency.

Regulatory Compliance and Standards

The evolving landscape of regulatory compliance is a notable driver in the Multichannel Order Management Market. As businesses operate across different regions, they must adhere to various regulations concerning data protection, consumer rights, and product safety. Compliance with these regulations is essential to avoid legal repercussions and maintain customer trust. Companies are increasingly turning to multichannel order management solutions that incorporate compliance features, ensuring that their operations align with local and international standards. This proactive approach not only mitigates risks but also enhances brand reputation, making it a vital consideration for businesses aiming to thrive in a competitive environment.

Increased Focus on Customer Experience

The emphasis on enhancing customer experience is a significant driver within the Multichannel Order Management Market. Businesses are increasingly recognizing that a seamless and personalized shopping experience can lead to higher customer retention rates and increased sales. As a result, companies are investing in multichannel order management solutions that facilitate smooth transitions between online and offline channels. Data suggests that organizations prioritizing customer experience can achieve up to 60% higher profitability compared to their competitors. By implementing effective order management systems, businesses can ensure timely deliveries, accurate order tracking, and responsive customer service, all of which contribute to a superior customer experience.