Rising Demand for Personalized Medicine

The Microfluidic Devices Market is experiencing a notable surge in demand for personalized medicine. This trend is driven by the increasing recognition of the need for tailored therapeutic approaches that cater to individual patient profiles. Microfluidic devices facilitate the development of personalized diagnostics and treatment options, enabling healthcare providers to deliver more effective care. According to recent estimates, the market for personalized medicine is projected to reach USD 2 trillion by 2025, indicating a robust growth trajectory. This growth is likely to propel the microfluidic devices sector, as these technologies are integral to the development of customized drug delivery systems and diagnostic tools. As healthcare systems increasingly adopt personalized approaches, the Microfluidic Devices Market is poised to benefit significantly from this paradigm shift.

Advancements in Lab-on-a-Chip Technology

Advancements in lab-on-a-chip technology are significantly influencing the Microfluidic Devices Market. These innovations allow for the integration of multiple laboratory functions onto a single chip, thereby enhancing the efficiency and speed of various analytical processes. The lab-on-a-chip devices are increasingly utilized in clinical diagnostics, drug discovery, and environmental monitoring. Recent data suggests that the lab-on-a-chip market is expected to grow at a compound annual growth rate of approximately 20% over the next few years. This growth is indicative of the rising adoption of microfluidic technologies in diverse applications, which is likely to drive the demand for microfluidic devices. As these technologies continue to evolve, the Microfluidic Devices Market is expected to witness substantial advancements, leading to improved healthcare outcomes and operational efficiencies.

Emergence of Wearable Microfluidic Devices

The emergence of wearable microfluidic devices is poised to transform the Microfluidic Devices Market. These innovative devices enable continuous monitoring of physiological parameters, providing real-time health data to users. The integration of microfluidics into wearable technology is facilitating advancements in health monitoring, chronic disease management, and fitness tracking. Recent projections indicate that the wearable medical device market could exceed USD 30 billion by 2025, highlighting the potential for microfluidic applications in this sector. As consumers increasingly seek convenient and efficient health monitoring solutions, the demand for wearable microfluidic devices is likely to rise. This trend suggests that the Microfluidic Devices Market will continue to evolve, driven by the need for innovative health solutions that enhance user engagement and health outcomes.

Growing Focus on Point-of-Care Diagnostics

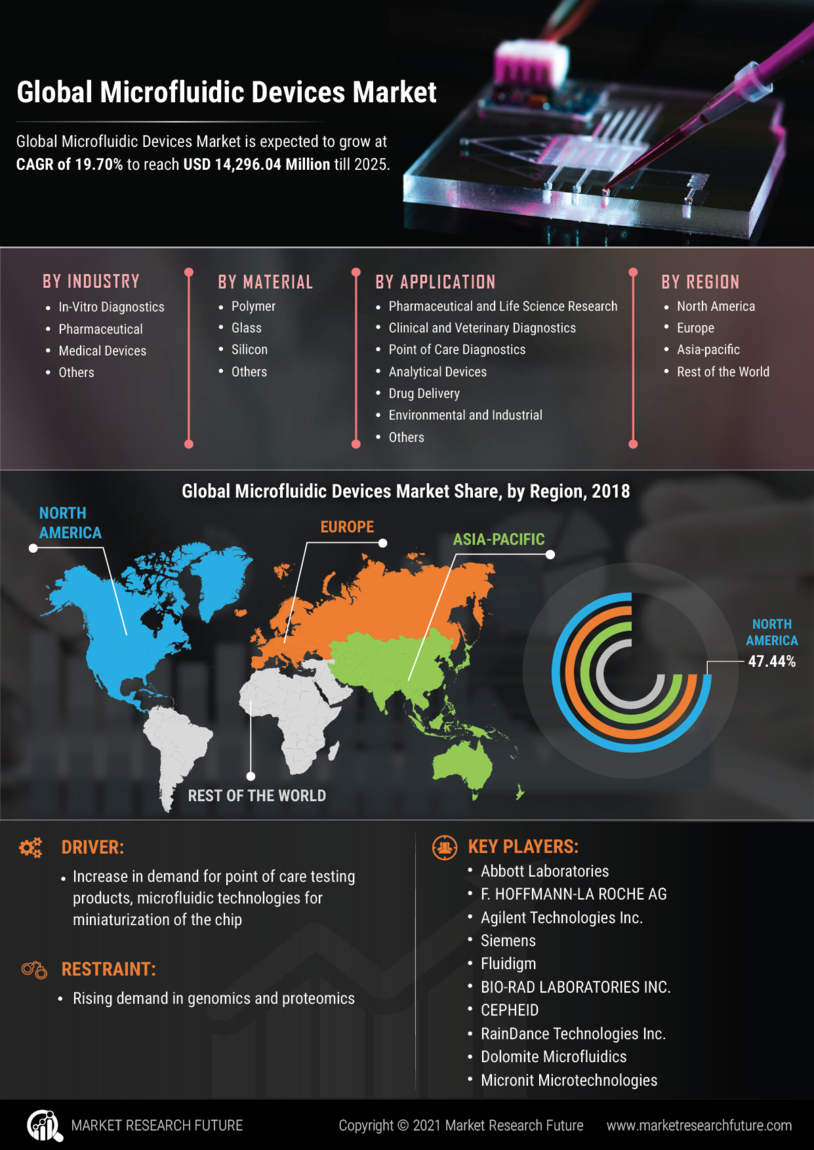

The Microfluidic Devices Market is witnessing a growing focus on point-of-care diagnostics, which is reshaping the landscape of medical testing. Point-of-care testing allows for rapid diagnosis and treatment at the site of patient care, significantly improving patient outcomes. Microfluidic devices play a pivotal role in this trend by enabling the development of portable and efficient diagnostic tools. The market for point-of-care diagnostics is projected to reach USD 50 billion by 2026, reflecting a substantial increase in demand for rapid testing solutions. This growth is likely to drive the adoption of microfluidic technologies, as they offer the necessary precision and speed required for effective point-of-care applications. As healthcare systems increasingly prioritize immediate diagnostic capabilities, the Microfluidic Devices Market is expected to thrive.

Increasing Investment in Research and Development

The Microfluidic Devices Market is benefiting from increasing investment in research and development across various sectors, including healthcare, pharmaceuticals, and biotechnology. This investment is crucial for the innovation and enhancement of microfluidic technologies, which are essential for developing new diagnostic tools and therapeutic solutions. Governments and private entities are allocating significant resources to advance microfluidic research, with funding levels reaching billions of dollars annually. This influx of capital is likely to accelerate the development of novel microfluidic applications, thereby expanding the market. Furthermore, as research institutions and companies collaborate to explore new frontiers in microfluidics, the Microfluidic Devices Market is expected to experience robust growth, driven by the introduction of cutting-edge technologies and solutions.