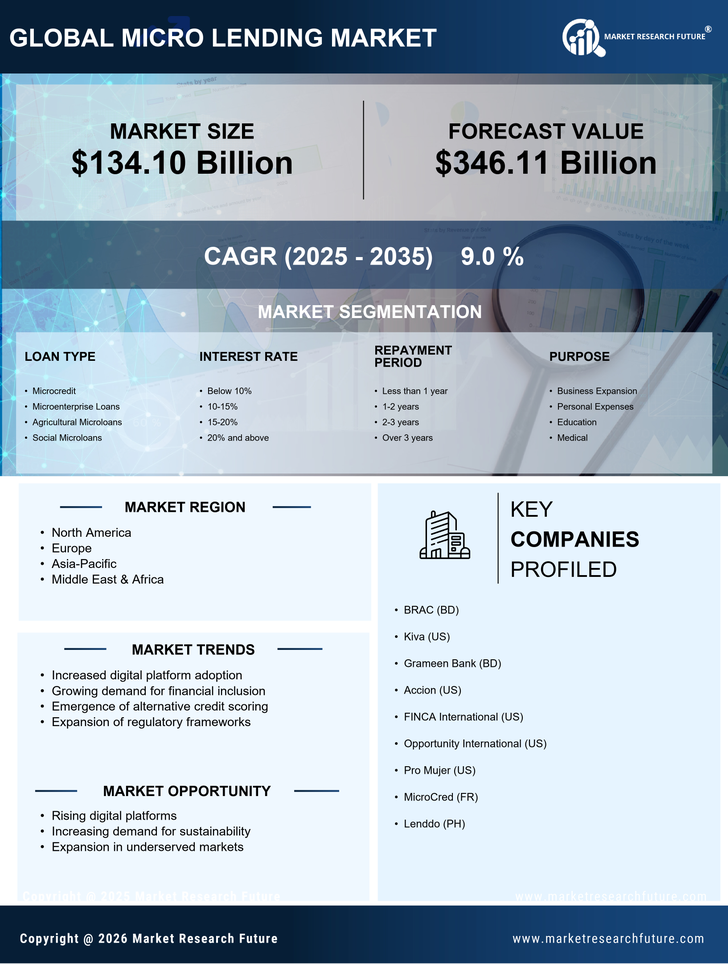

The Micro Lending Market is characterized by intense competition among micro lending institutions, micro lending companies, and micro financing companies. Strategic partnerships, technology investments, and expansion of micro lending business capabilities continue to shape the competitive landscape within the microfinance market. Key players such as BRAC (BD), Kiva (US), and Grameen Bank (BD) are at the forefront, each adopting distinct strategies to enhance their operational effectiveness. BRAC (BD) continues to leverage its extensive grassroots network to provide tailored financial solutions, while Kiva (US) focuses on digital platforms to facilitate

peer-to-peer lending, thereby broadening its reach. Grameen Bank (BD), renowned for its microcredit model, emphasizes community engagement and social impact, which collectively shapes a competitive environment that prioritizes accessibility and innovation.

The business tactics employed by these organizations reflect a moderately fragmented market structure, where localized strategies and supply chain optimization play pivotal roles. For instance, BRAC (BD) has localized its services to cater to the unique needs of various communities, enhancing customer loyalty and operational efficiency. This fragmentation allows for diverse approaches to micro lending, with each player contributing to a collective influence that fosters competition based on service quality and customer engagement rather than solely on pricing.

In August Kiva (US) announced a partnership with a leading fintech company to enhance its digital lending platform. This strategic move is significant as it aims to streamline the lending process, making it more user-friendly and accessible to borrowers in underserved regions. By integrating advanced technology, Kiva (US) positions itself to capture a larger market share while improving the overall user experience, which is crucial in a rapidly evolving digital landscape.

In September Grameen Bank (BD) launched a new initiative aimed at expanding its services to rural areas, focusing on women entrepreneurs. This initiative underscores the bank's commitment to social impact and financial inclusion, as it seeks to empower women through access to capital. The strategic importance of this move lies in its potential to not only enhance the bank's customer base but also to contribute to broader economic development in rural communities, thereby reinforcing its brand as a socially responsible lender.

In October Accion (US) unveiled a new program designed to support small businesses affected by economic fluctuations. This program is particularly relevant as it addresses the immediate needs of entrepreneurs seeking stability in uncertain times. By providing tailored financial products and advisory services, Accion (US) demonstrates its adaptability and responsiveness to market demands, which is essential for maintaining competitive advantage in the micro lending sector.

As of October the Micro Lending Market is witnessing trends that emphasize digitalization, sustainability, and the integration of

artificial intelligence. These trends are reshaping the competitive landscape, as organizations increasingly form strategic alliances to enhance their service offerings and operational capabilities. The shift from price-based competition to a focus on innovation and technology is evident, suggesting that future differentiation will hinge on the ability to leverage advanced technologies and maintain reliable supply chains. This evolution indicates a promising trajectory for the micro lending sector, where the emphasis on customer-centric solutions will likely define competitive success.