Increased Investment in IT Infrastructure

Investment in IT infrastructure is a critical driver for the private cloud-services market in Mexico. As organizations strive to modernize their IT capabilities, they are allocating substantial budgets towards cloud technologies. Recent statistics indicate that IT spending in Mexico is projected to reach $30 billion by 2026, with a significant portion directed towards cloud services. This investment is likely to facilitate the adoption of private cloud solutions, as businesses seek to enhance operational efficiency and reduce costs. The growing emphasis on digital transformation further propels this trend, making it a vital driver for the private cloud-services market.

Rising Adoption of Hybrid Cloud Solutions

There is a notable shift towards hybrid cloud solutions in Mexico.. Many organizations are recognizing the benefits of combining private and public cloud environments to optimize their IT infrastructure. This trend is driven by the need for flexibility, scalability, and cost-effectiveness. According to recent data, approximately 60% of enterprises in Mexico are expected to adopt hybrid cloud strategies by 2026. This adoption is likely to enhance the demand for private cloud services, as businesses seek to maintain control over sensitive data while leveraging the scalability of public clouds. Consequently, this trend is a significant driver for the private cloud-services market.

Growing Regulatory Compliance Requirements

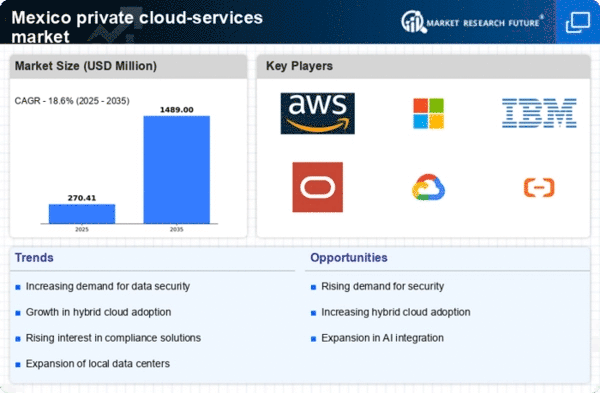

There is a surge in demand for private cloud-services in Mexico. due to increasing regulatory compliance requirements. Organizations are compelled to adhere to various data protection laws, such as the Federal Law on Protection of Personal Data Held by Private Parties. This law mandates stringent measures for data security and privacy, which private cloud services can effectively address. As businesses seek to comply with these regulations, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth indicates a strong inclination towards private cloud solutions that offer enhanced security features and compliance capabilities, thereby driving the private cloud-services market in Mexico.

Demand for Enhanced Performance and Reliability

The private cloud-services market in Mexico is increasingly driven by the demand for enhanced performance and reliability. Organizations are seeking solutions that can provide high availability, low latency, and robust performance to support their critical applications. As businesses become more reliant on digital services, the need for reliable cloud infrastructure becomes paramount. Recent surveys suggest that approximately 70% of IT decision-makers in Mexico prioritize performance when selecting cloud services. This focus on performance is likely to propel the growth of the private cloud-services market, as providers enhance their offerings to meet these expectations.

Shift Towards Digital Transformation Initiatives

There is a significant influence of ongoing digital transformation initiatives in Mexico.. Organizations are increasingly adopting cloud technologies to streamline operations, improve customer experiences, and drive innovation. This trend is evident as companies invest in digital tools and platforms to remain competitive in a rapidly evolving market. Data indicates that around 80% of Mexican enterprises are prioritizing digital transformation strategies, which often include the adoption of private cloud solutions. This shift not only enhances operational efficiency but also positions businesses to leverage advanced technologies, thereby driving the private cloud-services market.