Rising Fuel Costs

In recent years, the electric truck market in Mexico has been significantly influenced by the rising costs of traditional fuels. As fuel prices continue to escalate, companies are increasingly seeking alternatives to reduce operational expenses. Electric trucks, which offer lower energy costs compared to diesel or gasoline vehicles, present a viable solution. Reports indicate that electric trucks can reduce fuel costs by up to 70%, making them an economically attractive option for fleet operators. This shift towards electric trucks is likely to accelerate as businesses aim to mitigate the impact of fluctuating fuel prices on their bottom line.

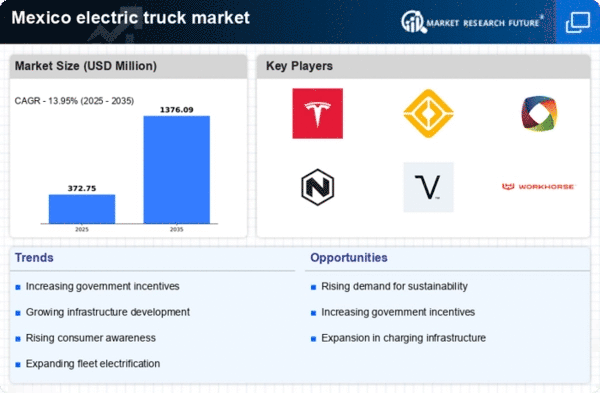

Regulatory Support for Electric Vehicles

The electric truck market in Mexico is experiencing a surge in regulatory support aimed at promoting sustainable transportation. The Mexican government has implemented various policies that encourage the adoption of electric vehicles, including electric trucks. These regulations often include tax incentives, rebates, and grants for companies investing in electric truck technology. As of 2025, it is estimated that the government has allocated approximately $500 million to support the transition to electric vehicles. This regulatory framework not only fosters innovation but also enhances the competitiveness of the electric truck market, making it an attractive option for logistics and transportation companies.

Technological Innovations in Battery Technology

Advancements in battery technology are playing a crucial role in shaping the electric truck market in Mexico. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing the performance and range of electric trucks. These developments are expected to reduce charging times and increase the overall efficiency of electric vehicles. As of November 2025, the average range of electric trucks has improved to approximately 500 km on a single charge, making them more viable for long-haul transportation. This technological progress is likely to attract more companies to invest in electric trucks, thereby expanding the market.

Urbanization and Demand for Efficient Logistics

The rapid urbanization in Mexico is creating a pressing need for efficient logistics solutions, which is positively impacting the electric truck market. As cities grow, the demand for sustainable and efficient transportation options increases. Electric trucks are well-suited for urban environments due to their lower noise levels and zero emissions, making them ideal for last-mile delivery services. In 2025, it is estimated that urban logistics will account for over 30% of the total logistics market in Mexico, further driving the adoption of electric trucks. This trend suggests that urbanization will continue to be a key driver for the electric truck market.

Environmental Awareness and Sustainability Goals

The electric truck market in Mexico is benefiting from a growing awareness of environmental issues and sustainability goals among consumers and businesses alike. As climate change becomes a pressing concern, many companies are committing to reducing their carbon footprints. The adoption of electric trucks aligns with these sustainability initiatives, as they produce zero tailpipe emissions. In 2025, it is projected that over 60% of logistics companies in Mexico will have set targets for reducing greenhouse gas emissions, further driving the demand for electric trucks. This trend indicates a shift in corporate responsibility, where businesses are prioritizing eco-friendly practices.