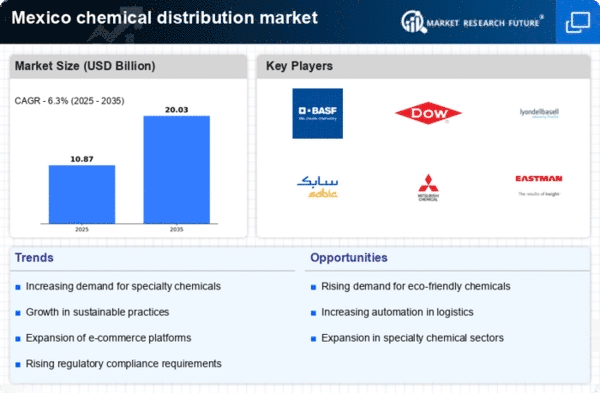

The chemical distribution market in Mexico is characterized by a dynamic competitive landscape, driven by increasing demand for specialty chemicals and a growing emphasis on sustainability. Major players such as BASF (DE), Dow (US), and SABIC (SA) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. BASF (DE) has been particularly aggressive in enhancing its product portfolio, while Dow (US) emphasizes digital transformation to optimize its supply chain. SABIC (SA) is leveraging partnerships to strengthen its market presence, indicating a collective shift towards more integrated and sustainable operations among these key players.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance responsiveness to market demands. The market structure appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. This fragmentation allows for a diverse range of offerings, yet the influence of major companies remains significant, as they set benchmarks for innovation and operational efficiency.

In October BASF (DE) announced a new investment in a state-of-the-art production facility in Mexico aimed at increasing its capacity for specialty chemicals. This strategic move is expected to enhance BASF's ability to meet local demand while reducing transportation costs, thereby improving overall supply chain efficiency. Such investments not only bolster production capabilities but also signal a commitment to long-term growth in the region.

In September Dow (US) launched a digital platform designed to streamline its distribution processes, enhancing customer engagement and operational transparency. This initiative reflects Dow's focus on digital transformation, which is likely to improve its competitive edge by enabling faster response times and more efficient inventory management. The integration of technology into distribution processes is becoming increasingly vital in maintaining market relevance.

In August SABIC (SA) entered into a strategic partnership with a local logistics firm to enhance its distribution network across Mexico. This collaboration aims to optimize supply chain logistics and improve service delivery to customers. By aligning with local expertise, SABIC is positioning itself to better navigate the complexities of the Mexican market, which may lead to improved customer satisfaction and loyalty.

As of November current trends in the chemical distribution market are heavily influenced by digitalization, sustainability initiatives, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need for collaboration to enhance their competitive positioning. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future differentiation will hinge on these factors. Companies that can effectively leverage these trends are likely to emerge as leaders in the evolving landscape.