Expansion of IoT Ecosystem

The expansion of the Internet of Things (IoT) ecosystem in Mexico is significantly influencing the 5G System Integration Market. As industries such as manufacturing, agriculture, and healthcare increasingly adopt IoT solutions, the need for advanced connectivity becomes paramount. The Mexican government has recognized the potential of IoT to drive economic growth and has initiated programs to support its development. By 2026, it is projected that the number of connected IoT devices in Mexico will exceed 1 billion, necessitating the integration of 5G technology to support these devices. This trend indicates a growing market for 5G system integration services, as businesses seek to leverage the benefits of IoT while ensuring seamless connectivity.

Rising Demand for High-Speed Connectivity

The demand for high-speed connectivity in Mexico is a primary driver of the 5G System Integration Market. As businesses and consumers increasingly rely on digital services, the need for faster and more reliable internet connections has surged. According to recent data, approximately 70% of Mexican households are expected to have access to high-speed internet by 2026, creating a substantial market for 5G integration. This demand is further fueled by the proliferation of smart devices and applications that require low latency and high bandwidth. Consequently, telecommunications companies are investing heavily in 5G infrastructure to meet this growing demand, which is likely to enhance the overall competitiveness of the Mexico 5G System Integration Market.

Government Support and Regulatory Framework

The Mexico 5G System Integration Market benefits from robust government support and a favorable regulatory framework. The Mexican government has actively promoted the deployment of 5G technology through various initiatives, including the National Digital Strategy. This strategy aims to enhance connectivity and digital infrastructure across the country. In 2025, the government allocated significant funding to improve telecommunications infrastructure, which is expected to bolster the 5G ecosystem. Furthermore, regulatory bodies are streamlining processes for spectrum allocation, which is crucial for the efficient rollout of 5G services. This supportive environment is likely to attract investments from both domestic and international players, thereby accelerating the growth of the Mexico 5G System Integration Market.

Industry-Specific Applications and Solutions

The Mexico 5G System Integration Market is witnessing a surge in demand for industry-specific applications and solutions. Various sectors, including healthcare, transportation, and smart cities, are increasingly recognizing the advantages of 5G technology. For instance, in healthcare, 5G enables telemedicine and remote patient monitoring, which are becoming essential services. The transportation sector is also exploring 5G for smart traffic management and autonomous vehicles. As these industries continue to innovate and adopt 5G solutions, the demand for specialized system integration services is likely to grow. This trend suggests that the Mexico 5G System Integration Market will evolve to cater to the unique needs of different sectors, fostering a more dynamic and competitive landscape.

Investment in Telecommunications Infrastructure

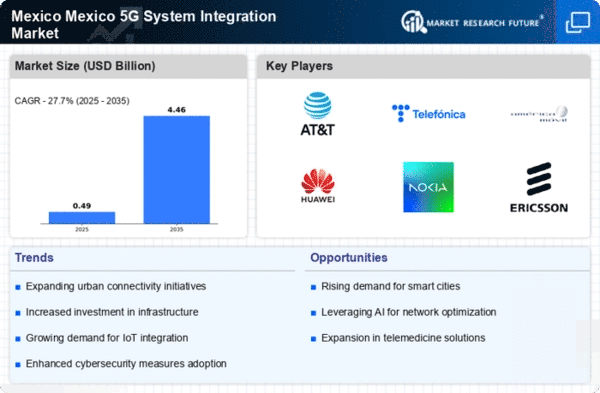

Investment in telecommunications infrastructure is a critical driver of the Mexico 5G System Integration Market. Major telecommunications companies are committing substantial resources to enhance their networks and facilitate the rollout of 5G technology. In 2025, it was reported that investments in telecommunications infrastructure in Mexico reached over $10 billion, with a significant portion allocated to 5G development. This influx of capital is expected to accelerate the deployment of 5G networks, thereby creating opportunities for system integrators to offer their services. As infrastructure improves, the Mexico 5G System Integration Market is likely to experience increased competition and innovation, ultimately benefiting consumers and businesses alike.