Medium Density Fiberboards Market Summary

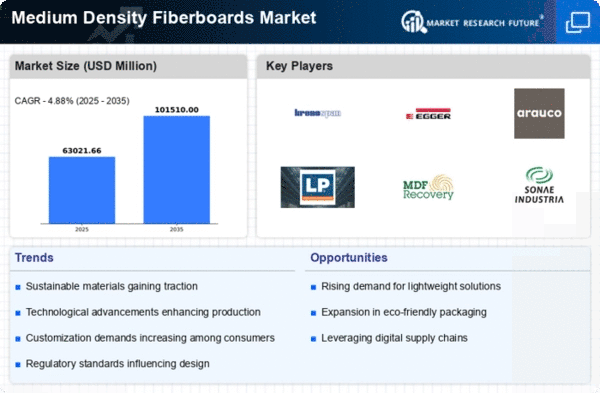

As per MRFR analysis, the Medium Density Fiberboards Market Size was estimated at 43.2 USD Billion in 2024. The Medium Density Fiberboards industry is projected to grow from 46.7 USD Billion in 2025 to 102.7 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.2% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Medium Density Fiberboards Market is experiencing a dynamic shift driven by sustainability and customization demands.

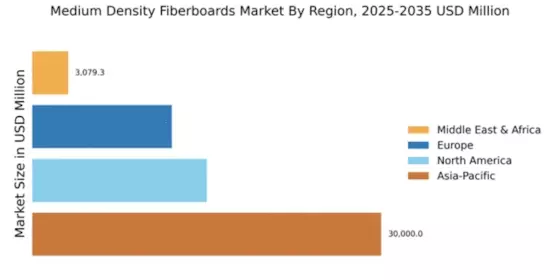

- North America remains the largest market for medium density fiberboards, driven by robust furniture and construction industries.

- Asia-Pacific is recognized as the fastest-growing region, fueled by rapid urbanization and increasing infrastructure projects.

- The furniture segment continues to dominate the market, while the flooring segment is witnessing the highest growth rates.

- Key market drivers include a strong focus on sustainability and customization, which are shaping product offerings and consumer preferences.

Market Size & Forecast

| 2024 Market Size | 43.2 (USD Billion) |

| 2035 Market Size | 102.7 (USD Billion) |

| CAGR (2025 - 2035) | 8.2% |

Major Players

Kronospan (AT), Egger (AT), Arauco (CL), Louisiana-Pacific Corporation (US), MDF Recovery (US), Sonae Industria (PT), Masisa (CL), Finsa (ES), Greenply Industries (IN), Duratex (BR)