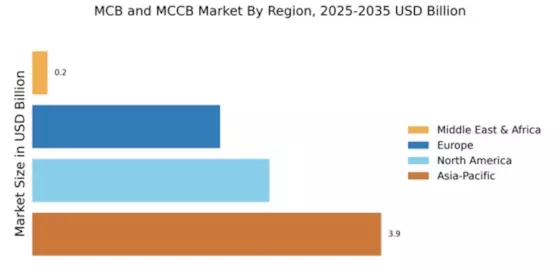

Market Growth Projections

The Global MCB and MCCB Market Industry is projected to experience substantial growth over the coming years. In 2024, the market is anticipated to reach 8.82 USD Billion, with expectations to expand to 19.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 7.5% from 2025 to 2035. Such projections indicate a robust demand for circuit protection devices driven by various factors, including technological advancements, infrastructure development, and increased awareness of electrical safety. The market's expansion reflects the critical role that MCBs and MCCBs play in modern electrical systems.

Rising Demand for Energy Efficiency

The Global MCB and MCCB Market Industry experiences a notable surge in demand for energy-efficient solutions. As industries and households increasingly prioritize sustainability, the adoption of Miniature Circuit Breakers (MCBs) and Molded Case Circuit Breakers (MCCBs) that minimize energy wastage becomes essential. This trend is further supported by government regulations promoting energy efficiency, which are likely to drive market growth. In 2024, the market is projected to reach 8.82 USD Billion, reflecting a growing awareness of energy conservation. By 2035, the market could expand to 19.5 USD Billion, indicating a compound annual growth rate (CAGR) of 7.5% from 2025 to 2035.

Expansion of Renewable Energy Sources

The Global MCB and MCCB Market Industry is positively impacted by the expansion of renewable energy sources. As countries strive to reduce their carbon footprints, investments in solar, wind, and other renewable energy projects are increasing. These projects require robust electrical systems equipped with reliable circuit protection devices to ensure operational efficiency and safety. MCBs and MCCBs are essential components in these systems, as they protect against overloads and short circuits. The growing adoption of renewable energy technologies is likely to drive the demand for these circuit protection devices, contributing to the overall growth of the market.

Increasing Infrastructure Development

The Global MCB and MCCB Market Industry is significantly influenced by the ongoing infrastructure development across various regions. Governments worldwide are investing heavily in upgrading and expanding their electrical infrastructure to support urbanization and industrialization. This investment is likely to create a robust demand for MCBs and MCCBs, as these devices are essential for ensuring electrical safety and reliability in new constructions. The expansion of smart cities and renewable energy projects further amplifies this demand, as modern electrical systems require advanced circuit protection solutions. Consequently, the market is poised for substantial growth in response to these infrastructural advancements.

Growing Awareness of Electrical Safety

The Global MCB and MCCB Market Industry is witnessing a heightened awareness of electrical safety among consumers and businesses. This trend is driven by increasing incidents of electrical fires and accidents, prompting stakeholders to prioritize safety measures. Regulatory bodies are also enforcing stricter safety standards, which necessitate the installation of reliable circuit protection devices. As a result, the demand for MCBs and MCCBs is likely to rise, as these devices are critical in preventing electrical hazards. The emphasis on safety not only influences consumer purchasing decisions but also encourages manufacturers to innovate and improve their product offerings.

Technological Advancements in Circuit Protection

Technological innovations play a crucial role in shaping the Global MCB and MCCB Market Industry. The introduction of smart circuit breakers, which offer enhanced monitoring and control capabilities, appears to be a game changer. These advanced devices not only provide real-time data on energy consumption but also facilitate remote management, thus appealing to both residential and commercial sectors. The integration of IoT technology into circuit protection devices is likely to enhance safety and reliability, further driving market growth. As consumers and businesses increasingly seek smarter solutions, the demand for technologically advanced MCBs and MCCBs is expected to rise significantly.