- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

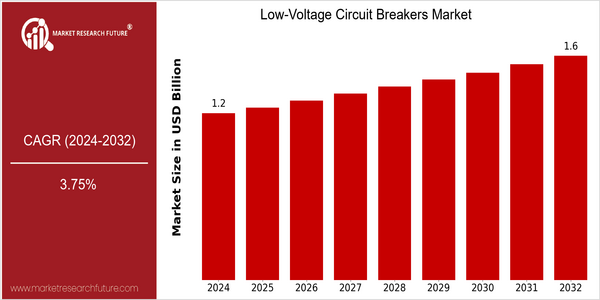

| Year | Value |

|---|---|

| 2024 | USD 1.19 Billion |

| 2032 | USD 1.6 Billion |

| CAGR (2024-2032) | 3.75 % |

Note – Market size depicts the revenue generated over the financial year

The low-voltage circuit-breaker market is set to grow steadily. It is currently valued at $1.19 billion, and it is expected to reach $1.6 billion by 2032. This translates into a compound annual growth rate (CAGR) of 3.7% during the forecast period. The growing need for reliable and efficient electrical systems, combined with the rising emphasis on safety and energy management, is driving this market’s expansion. As both the industrial and residential sectors adopt advanced electrical solutions, the need for low-voltage circuit breakers to protect against overloads and short circuits increases. Furthermore, technological advancements, such as the integration of smart grids and the increasing automation of various industries, are driving this market’s growth. In response, the leading companies, such as Schneider Electric, Siemens, and ABB, are constantly working to improve their product offerings. Strategic moves such as mergers and acquisitions, collaborations, and alliances are also notable. Product launches, for instance, have been aimed at meeting the rising demand for energy-efficient circuit breakers.

Regional Market Size

Regional Deep Dive

LOW-VOLTAGE CIRCULATOR BREAKERS MARKET is experiencing significant growth across various regions, owing to increasing demand for electrical safety and reliability in residential, commercial, and industrial applications. The market is also driven by technological advancements, regulatory framework, and growing trend of automation in electrical systems. Each region has its own unique characteristics in terms of the development of the power sector, energy consumption, and regulatory framework.

Europe

- In Europe, the drive for energy efficiency and the integration of renewable energies, such as wind and solar, is bringing a growing number of low-voltage circuit breakers into use. Consequently, major players such as ABB and Siemens are developing solutions to meet the needs of this growing market.

- The European Union's Green Deal and various national initiatives are promoting the use of energy-efficient technologies, which is expected to drive the demand for advanced circuit breakers that can handle fluctuating loads from renewable sources.

Asia Pacific

- The Asia-Pacific region is experiencing rapid urbanization and industrialization, especially in China and India. This has led to a significant increase in the demand for low-voltage circuit breakers in the construction and manufacturing industries. The demand has prompted companies such as Mitsubishi Electric and Schneider Electric to expand their operations in the region.

- Government initiatives aimed at improving electrical infrastructure and safety standards are also playing a crucial role in market growth, with programs focused on upgrading outdated electrical systems in urban areas.

Latin America

- The interest in generating electricity from the sun and the wind is growing in Latin America, especially in Brazil and Chile. This is creating a demand for low-voltage circuit breakers to support these projects. Schneider Electric has invested in local production to meet this demand.

- Economic factors, including fluctuating currency values and investment in infrastructure, are influencing market dynamics, with governments looking to modernize electrical systems to improve efficiency and safety.

North America

- The demand for smart breakers is growing in North America, driven by the increasing popularity of home automation and energy management systems. Schneider Electric and Eaton are innovating in this market with products that include IoT technology for better remote control and monitoring.

- Regulatory changes, particularly in the U.S. with the National Electrical Code (NEC) updates, are mandating the use of more advanced circuit protection solutions, thereby pushing manufacturers to innovate and comply with stricter safety standards.

Middle East And Africa

- In the Middle East and Africa, the market is being driven by an increase in investments in the development of the country's infrastructure and in energy projects, particularly in the countries of the Gulf Cooperation Council (GCC). Actively participating in such large-scale projects are companies like Siemens and GE.

- Regulatory frameworks are evolving, with many countries implementing stricter electrical safety standards, which is pushing manufacturers to innovate and provide compliant products that enhance safety and reliability.

Did You Know?

“Did you know that low-voltage circuit breakers can interrupt electrical currents in less than a millisecond, providing critical protection against electrical faults?” — International Electrotechnical Commission (IEC)

Segmental Market Size

The Low Voltage Circuit Breakers (LVB) sector plays a crucial role in electrical distribution systems, ensuring safety and reliability in various applications. The current growth in this sector is being driven by the increasing demand for energy-saving solutions and the development of renewable energy sources. Also driving the demand is the growing need for reliable power distribution in the residential and commercial sectors. LVBs are currently being widely adopted. Leading LVB manufacturers, such as Schneider Electric and Siemens, are bringing out new products with a variety of features. The North American and European markets are leading the way in LVB adoption, implementing the most advanced LVBs in smart grid projects. LVBs are mainly used in residential buildings, industrial plants and renewable energy plants. The LVB market is being driven by the rising trend for energy-saving solutions and government policies that encourage energy efficiency. However, digital advancements such as the IoT and smart monitoring are also contributing to the growth of this market.

Future Outlook

The Low Voltage Circuit Breakers Market is expected to increase steadily from 2024 to 2032. The market is estimated to rise from $1.19 billion to $1.62 billion, at a compound annual growth rate (CAGR) of 3.7 percent. This growth is attributed to the growing demand for energy-efficient solutions and the increasing adoption of smart grid technology. As industries and residential buildings are focusing on the safety and reliability of their electrical systems, the penetration of low-voltage circuit breakers is expected to increase significantly. It is expected to reach approximately 60 percent of new equipment installed by 2032, compared to 45 percent in 2024. The main technological developments, such as the integration of the Internet of Things (IoT) into circuit breakers, are expected to drive the market. This development not only improves monitoring and control, but also allows for the prediction of maintenance, thereby reducing downtime and operational costs. In addition, government initiatives to promote energy efficiency and the use of alternative energy sources are expected to increase the market. The trend towards compact and modular designs will meet the changing needs of modern electrical systems and will ensure the dynamic development of the low-voltage circuit breaker market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.14 Billion |

| Growth Rate | 4.54% (2023-2032) |

Low Voltage Circuit Breakers Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.