Regulatory Compliance

Regulatory compliance is a significant driver in the Low-Temperature Coating Market. As governments worldwide implement stricter environmental regulations, manufacturers are compelled to adopt coatings that comply with these standards. Low-temperature coatings often meet or exceed regulatory requirements due to their reduced volatile organic compound (VOC) emissions and lower energy consumption during application. This compliance not only helps companies avoid penalties but also enhances their marketability as environmentally responsible entities. Recent statistics indicate that the market for low-VOC coatings is expected to grow by approximately 8% annually, driven by the increasing emphasis on regulatory adherence and sustainable practices.

Technological Innovations

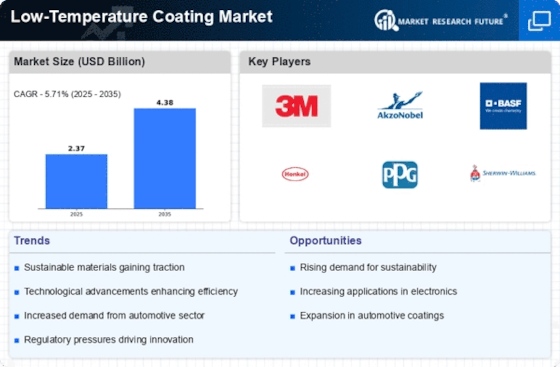

Technological innovations play a pivotal role in shaping the Low-Temperature Coating Market. Advances in coating formulations and application techniques have led to the development of more efficient low-temperature coatings. These innovations not only improve the performance characteristics of coatings but also expand their applicability across various sectors, including automotive, aerospace, and electronics. For instance, the introduction of advanced polymer technologies has enhanced adhesion and durability, making low-temperature coatings more appealing to manufacturers. Market data suggests that the segment of low-temperature coatings is expected to witness a growth rate of around 5% annually, driven by these technological advancements that cater to evolving industry needs.

Sustainability Initiatives

The Low-Temperature Coating Market is increasingly influenced by sustainability initiatives. As industries strive to reduce their carbon footprint, low-temperature coatings offer an eco-friendly alternative to traditional coatings. These coatings typically require less energy during application, which aligns with global efforts to minimize energy consumption. Furthermore, many low-temperature coatings are formulated with non-toxic materials, reducing harmful emissions. According to recent data, the demand for sustainable coatings is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This trend indicates a shift towards environmentally responsible practices, making low-temperature coatings a preferred choice for manufacturers aiming to enhance their sustainability profiles.

Growing End-User Industries

The growth of end-user industries is a crucial driver for the Low-Temperature Coating Market. Sectors such as automotive, aerospace, and electronics are experiencing robust expansion, leading to increased demand for innovative coating solutions. Low-temperature coatings are particularly advantageous in these industries due to their ability to provide high-performance finishes without the need for high-temperature curing processes. This characteristic not only saves energy but also allows for the coating of heat-sensitive substrates. Market analysis indicates that the automotive sector alone is projected to contribute significantly to the low-temperature coating market, with an expected growth rate of around 6% over the next few years, reflecting the industry's ongoing evolution.

Customization and Versatility

Customization and versatility are emerging as key drivers in the Low-Temperature Coating Market. As industries demand coatings that meet specific performance criteria, manufacturers are increasingly offering tailored solutions. Low-temperature coatings can be formulated to achieve various finishes, colors, and properties, making them suitable for a wide range of applications. This adaptability is particularly beneficial in sectors such as consumer electronics and automotive, where aesthetic appeal and functionality are paramount. The market for customized coatings is anticipated to grow, with estimates suggesting a potential increase of 7% in demand for specialized low-temperature coatings over the next few years, reflecting the industry's shift towards personalized solutions.