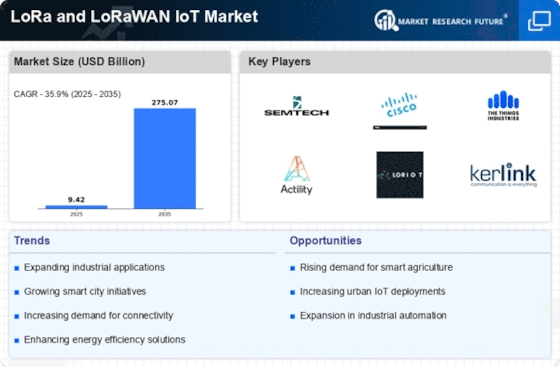

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the LoRa and LoRaWAN IoT market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, LoRa and LoRaWAN IoT industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global LoRa and LoRaWAN IoT industry to benefit clients and increase the market sector. In recent years, the LoRa and LoRaWAN IoT industry has offered some of the most significant advantages to medicine. Major players in the LoRa and LoRaWAN IoT market, including Cisco (US), NEC Corporation (Japan), Tata Communications (India), Semtech (US), Orange SA (France), Advantech (Taiwan), Comcast (US), AWS (US), Bosch (Germany), Murata (Japan), Laird Connectivity (US), Kerlink (France), Senet (US), Actility (France), Sensoterra (Netherlands), DIGI International (US), Nwave Technologies (UK), RAKwireless (China), thethings.io (Spain), Datacake (Germany), MultiTech (US), Milesight (China), LORAIOT (Switzerland), Exosite (US), OrbiWise (Switzerland) and others, are attempting to increase market demand by investing in research and development operations. An important tech company with its headquarters in San Jose, Cisco Systems is known for producing a sizable chunk of the hardware that powers the operation of the Internet. Since its founding in 1984, Cisco has greatly increased the scope of its business by purchasing a number of profitable companies, including but not limited to Jabber, Webex, and Jasper. The business is divided into three main segments: Europe, the Middle East, and Africa (EMEA); the Americas; and Asia Pacific, Japan, and China (APJC). The corporation operates on a global scale and controls its activities by geographical regions. In addition to Internet for the Future, Secure, Agile Networks, Collaboration, Optimized Application Experiences, End-to-End Security, and Other Products, Cisco's range of products and technologies can be divided into other groups. Cisco provides a wide range of services in addition to its product line, such as technical assistance and cutting-edge solutions. The headquarters of NEC Corporation are located in Tokyo, Japan, and it was founded in 1899. The company offers a wide range of products in its product portfolio, including servers, network systems, telecommunications equipment, storage devices, automated teller machines, video broadcasting systems, personal computers, supercomputers, aerospace systems, tablet terminals, fire and disaster prevention systems, and different software solutions. NEC further sells electrical parts and goods such LCD screens, lithium-ion batteries, and lighting fixtures. NEC offers a wide range of services, including support, system integration, and outsourcing, in addition to its products. The firm serves a variety of markets, including those in the aerospace, aviation, healthcare, retail, agriculture, broadcasting, finance, logistics, government, manufacturing, hospitality, transportation, and telecommunications. With locations across the globe, including Europe, the Americas, the Middle East, Africa, and the Asia-Pacific area, NEC conducts business.