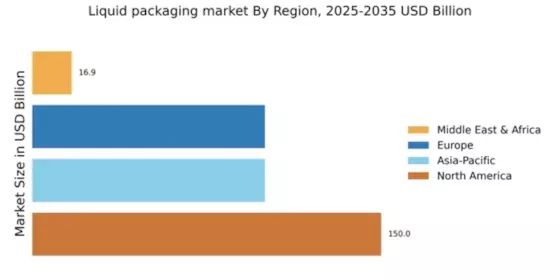

North America : Market Leader in Liquid Packaging

North America continues to lead the liquid packaging market, holding a significant share of 150.0 in 2024. The region's growth is driven by increasing consumer demand for sustainable packaging solutions and stringent regulations promoting eco-friendly materials. The rise in e-commerce and food delivery services further fuels the need for efficient liquid packaging, enhancing market dynamics. The United States is the primary contributor to this market, with key players like Tetra Pak, Ball Corporation, and Crown Holdings dominating the landscape. The competitive environment is characterized by innovation in packaging technologies and a focus on sustainability. As companies invest in R&D, the market is expected to evolve, meeting the growing consumer expectations for quality and environmental responsibility.

Europe : Sustainable Packaging Initiatives

Europe's liquid packaging market, valued at 100.0, is experiencing robust growth, primarily driven by increasing consumer awareness regarding sustainability and regulatory frameworks promoting eco-friendly practices. The European Union's directives on packaging waste and recycling are significant catalysts, pushing companies to innovate and adopt sustainable materials in their packaging solutions. Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with major players like Amcor and Mondi Group actively participating in the market. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings and sustainability. As the market evolves, companies are focusing on reducing their carbon footprint while meeting consumer demands for high-quality packaging solutions.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 100.0, is witnessing rapid growth in the liquid packaging sector, driven by urbanization, rising disposable incomes, and changing consumer lifestyles. The demand for packaged beverages and food products is increasing, leading to a surge in liquid packaging solutions. Regulatory support for sustainable packaging practices is also contributing to market expansion, as governments encourage eco-friendly initiatives. Countries like China, India, and Japan are leading the charge, with key players such as Sealed Air and Smurfit Kappa establishing a strong presence. The competitive landscape is characterized by a mix of local and international companies, all vying for market share. As the region continues to develop, innovation in packaging technology will play a crucial role in meeting the diverse needs of consumers and businesses alike.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 16.95, presents untapped opportunities in the liquid packaging market. The growth is driven by increasing urbanization, a burgeoning middle class, and rising demand for packaged food and beverages. Regulatory frameworks are gradually evolving to support sustainable packaging practices, which is expected to further stimulate market growth in the coming years. Countries like South Africa and the UAE are emerging as key players in this market, with local and international companies exploring opportunities to expand their footprint. The competitive landscape is still developing, with several players focusing on innovation and sustainability to capture market share. As the region's economy diversifies, the liquid packaging sector is poised for significant growth, driven by changing consumer preferences and regulatory support.