Collaborative Research Initiatives

Collaborative research initiatives among academic institutions, government agencies, and private enterprises are fostering innovation in the quantum computing market in Japan. These partnerships are essential for sharing knowledge, resources, and expertise, which can accelerate the development of quantum technologies. Notably, Japan's universities are increasingly engaging in joint research projects with tech companies, focusing on areas such as quantum algorithms and quantum cryptography. Such collaborations not only enhance the research output but also create a skilled workforce adept in quantum technologies. The establishment of research consortia is likely to lead to breakthroughs that could redefine the landscape of the quantum computing market, making it more competitive and robust.

Rising Interest in Quantum Cybersecurity

As cybersecurity threats become more sophisticated, the quantum computing market in Japan is witnessing a surge in interest related to quantum cybersecurity solutions. Quantum key distribution (QKD) is emerging as a promising technology to secure communications against potential quantum attacks. Japanese companies are actively exploring QKD to protect sensitive data, particularly in sectors like finance and government. The market for quantum cybersecurity solutions is expected to grow significantly, with estimates suggesting it could reach $200 million by 2026. This growing focus on cybersecurity is likely to drive investments in the quantum computing market, as organizations seek to safeguard their digital assets in an increasingly complex threat landscape.

Technological Advancements in Quantum Hardware

The rapid evolution of quantum hardware technologies is a pivotal driver for the quantum computing market in Japan. Innovations in qubit design, error correction, and quantum gate operations are enhancing computational capabilities. For instance, companies in Japan are investing heavily in superconducting qubits and trapped ions, which are expected to improve performance metrics significantly. The Japanese government has allocated approximately $1 billion to support research and development in quantum technologies, indicating a strong commitment to advancing this field. As these technologies mature, they are likely to attract further investments, thereby expanding the quantum computing market. The integration of quantum hardware into existing systems may also lead to new applications across various sectors, including finance, pharmaceuticals, and logistics, thereby driving market growth.

Increased Demand for Quantum Solutions in Industry

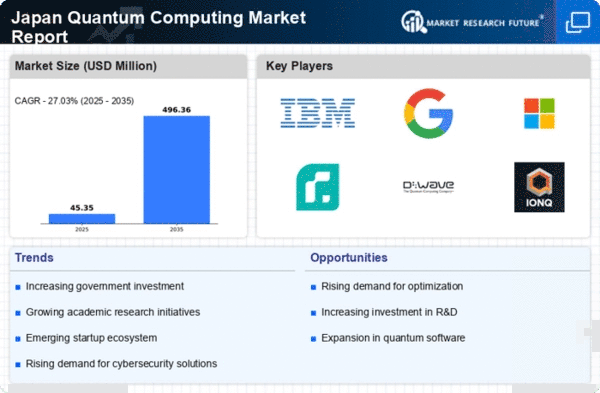

The growing need for advanced computational solutions across various industries is propelling the quantum computing market in Japan. Industries such as finance, healthcare, and logistics are increasingly recognizing the potential of quantum computing to solve complex problems that classical computers struggle with. For example, financial institutions are exploring quantum algorithms for portfolio optimization and risk analysis, which could lead to more efficient operations. The market for quantum computing solutions in Japan is projected to reach approximately $500 million by 2027, reflecting a compound annual growth rate (CAGR) of around 25%. This surge in demand is likely to stimulate further innovation and investment in the quantum computing market, as companies seek to leverage these technologies for competitive advantage.

Government Support for Quantum Research and Development

The Japanese government is playing a crucial role in shaping the quantum computing market through its support for research and development initiatives. With a strategic focus on becoming a leader in quantum technologies, the government has launched various funding programs aimed at fostering innovation. For instance, the establishment of the Quantum Technology Innovation Program has allocated substantial financial resources to support startups and research institutions. This initiative is expected to enhance collaboration between academia and industry, thereby accelerating the commercialization of quantum technologies. The government's proactive stance is likely to create a conducive environment for the growth of the quantum computing market, attracting both domestic and international investments.