Growth in Aerospace and Defense Sectors

The aerospace and defense sectors in Japan are witnessing robust growth, which is positively impacting the laser cladding market. The need for lightweight, high-strength materials in aircraft and defense equipment is driving the adoption of laser cladding technology. This process allows for the precise application of coatings that improve the performance and longevity of critical components. As the Japanese government invests in defense capabilities, the demand for advanced manufacturing techniques, including laser cladding, is expected to rise. The laser cladding market could see an increase in revenue, with estimates suggesting a potential market value of $200 million by 2026.

Rising Demand for High-Performance Materials

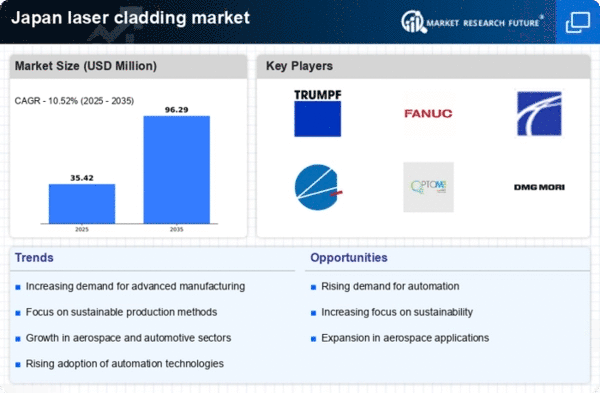

The laser cladding market in Japan is experiencing a notable increase in demand for high-performance materials across various industries. This trend is driven by the need for enhanced durability and resistance to wear and corrosion in components used in sectors such as aerospace, automotive, and energy. As manufacturers seek to improve the lifespan of their products, the adoption of laser cladding technology becomes more prevalent. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the increasing reliance on advanced materials. The ability of laser cladding to apply coatings that significantly enhance material properties positions it as a critical technology in the laser cladding market.

Government Support for Advanced Manufacturing

In Japan, government initiatives aimed at promoting advanced manufacturing technologies are significantly influencing the laser cladding market. Policies that encourage research and development, as well as financial incentives for adopting innovative manufacturing processes, are fostering a conducive environment for the growth of the laser cladding market. The Japanese government has allocated substantial funding to support the integration of laser technologies in manufacturing, which is expected to enhance productivity and competitiveness. This support is likely to result in a market expansion, with projections indicating a potential increase in market size by 15% over the next five years.

Emergence of Eco-Friendly Manufacturing Practices

The laser cladding market in Japan is also being shaped by the emergence of eco-friendly manufacturing practices. As industries strive to reduce their environmental footprint, laser cladding offers a sustainable alternative to traditional coating methods. This technology minimizes waste and energy consumption, aligning with the growing emphasis on sustainability in manufacturing. Companies are increasingly adopting laser cladding to meet regulatory requirements and consumer expectations for environmentally responsible practices. The laser cladding market is expected to see a surge in demand as businesses prioritize eco-friendly solutions, with projections indicating a market growth of 12% over the next few years.

Increasing Focus on Customization and Precision Engineering

Customization and precision engineering are becoming increasingly important in the Japanese manufacturing landscape, thereby influencing the laser cladding market. Industries are seeking tailored solutions that meet specific performance criteria, which laser cladding technology can provide through its ability to create complex geometries and coatings. This trend is particularly evident in sectors such as automotive and medical devices, where precision is paramount. The laser cladding market is likely to benefit from this shift, as manufacturers invest in technologies that allow for greater customization, potentially leading to a market growth rate of 10% annually.