Regulatory Support for AI Adoption

The Japan Generative Ai In Bfsi Market benefits from a regulatory environment that increasingly supports the adoption of artificial intelligence technologies. The Financial Services Agency (FSA) of Japan has been proactive in establishing guidelines that encourage financial institutions to integrate AI into their operations. This regulatory backing not only fosters innovation but also ensures that AI applications comply with existing financial regulations. As a result, financial institutions are more likely to invest in generative AI solutions, which can enhance customer service and operational efficiency. The FSA's initiatives, such as the 'FinTech Innovation Hub', provide a platform for collaboration between regulators and financial firms, further stimulating growth in the Japan Generative Ai In Bfsi Market.

Focus on Enhanced Cybersecurity Measures

In the Japan Generative Ai In Bfsi Market, there is an increasing emphasis on enhancing cybersecurity measures, particularly as financial institutions adopt generative AI technologies. The integration of AI into financial services presents unique cybersecurity challenges, necessitating robust protective measures. Financial institutions are investing in AI-driven cybersecurity solutions that can proactively identify and mitigate potential threats. Recent statistics indicate that cyberattacks on financial institutions in Japan have risen by 30% over the past year, underscoring the urgency for improved security protocols. By prioritizing cybersecurity, financial institutions not only protect their assets but also build customer trust, which is essential for the sustained growth of the Japan Generative Ai In Bfsi Market.

Advancements in Data Analytics Capabilities

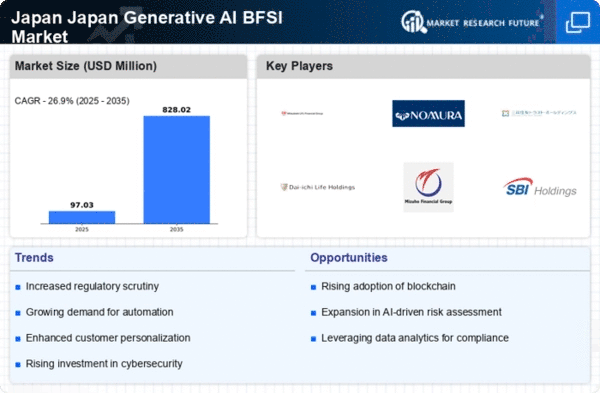

The Japan Generative Ai In Bfsi Market is witnessing significant advancements in data analytics capabilities, which are crucial for the effective implementation of generative AI solutions. Financial institutions are increasingly adopting sophisticated analytics tools that enable them to process and interpret large datasets efficiently. This capability is essential for risk assessment, fraud detection, and customer segmentation. According to recent reports, the market for data analytics in Japan's financial sector is projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years. As these analytics capabilities improve, they empower financial institutions to harness generative AI technologies more effectively, leading to enhanced decision-making and operational efficiency.

Increased Investment in FinTech Innovations

The Japan Generative Ai In Bfsi Market is experiencing a surge in investment directed towards FinTech innovations, particularly those involving generative AI technologies. Venture capital funding for FinTech startups in Japan has reached unprecedented levels, with investments exceeding 200 billion yen in the past year alone. This influx of capital is facilitating the development of cutting-edge AI solutions that can transform various aspects of the financial services sector, from customer service chatbots to automated trading systems. As financial institutions recognize the potential of these innovations, they are more inclined to collaborate with startups and technology firms, further propelling the growth of the Japan Generative Ai In Bfsi Market.

Growing Demand for Personalized Banking Solutions

In the Japan Generative Ai In Bfsi Market, there is a marked increase in consumer demand for personalized banking solutions. As customers seek tailored financial products and services, generative AI technologies are being leveraged to analyze vast amounts of data and deliver customized offerings. For instance, banks are utilizing AI algorithms to assess individual customer profiles and preferences, enabling them to provide personalized investment advice and loan options. This trend is supported by data indicating that over 60% of Japanese consumers express a preference for personalized financial services. Consequently, financial institutions are investing heavily in generative AI to meet these evolving customer expectations, thereby driving growth in the market.