Aging Population

Japan's demographic shift towards an older population is a key driver for the electronic pill market. By 2025, it is estimated that over 30% of the population will be aged 65 and above. This demographic is more likely to require chronic disease management, which necessitates consistent medication adherence. Electronic pills can facilitate this by providing reminders and tracking capabilities, thereby improving compliance rates. The electronic pill market is likely to see increased adoption as healthcare systems adapt to the needs of an aging society, potentially leading to a market growth rate of 15% annually.

Rising Healthcare Costs

The escalating costs associated with healthcare in Japan are driving the demand for innovative solutions within the electronic pill market. As the population ages, the need for efficient medication management becomes increasingly critical. In 2025, healthcare expenditure in Japan is projected to reach approximately $500 billion, prompting healthcare providers to seek cost-effective alternatives. Electronic pills offer a potential solution by enhancing adherence and reducing hospital visits, which can lead to significant savings. The electronic pill market is thus positioned to benefit from this trend, as it aligns with the broader goal of optimizing healthcare resources while improving patient outcomes.

Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare technology are playing a pivotal role in the electronic pill market. In recent years, Japan has allocated substantial funding towards innovative health solutions, including electronic medication management systems. This support is expected to continue, with the government investing approximately $200 million in digital health technologies by 2026. Such initiatives not only foster innovation but also encourage collaboration between tech companies and healthcare providers. The electronic pill market is poised to benefit from this favorable environment, potentially leading to increased market growth and adoption rates.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care in Japan is reshaping the landscape of the electronic pill market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, which aligns with the functionalities offered by electronic pills. These devices not only ensure medication adherence but also empower patients by providing them with information about their treatment. As the healthcare system evolves, the electronic pill market is likely to experience growth driven by this focus on personalized care, with projections indicating a potential market expansion of 10% annually.

Technological Integration in Healthcare

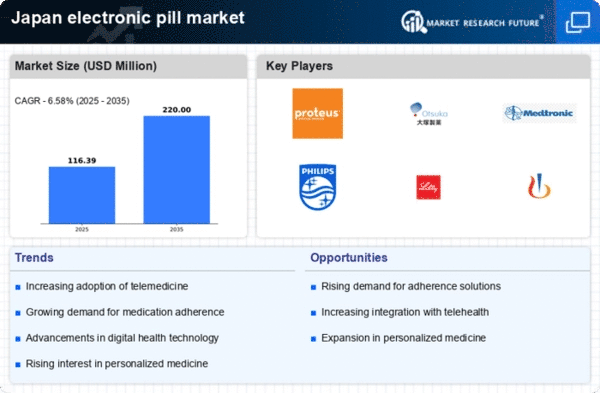

The integration of advanced technologies in healthcare is significantly influencing the electronic pill market. With the rise of telemedicine and digital health solutions, there is a growing expectation for medication delivery systems to incorporate smart technology. In Japan, the government has been promoting digital health initiatives, which could enhance the acceptance of electronic pills. The electronic pill market stands to gain from this trend, as healthcare providers and patients increasingly seek solutions that offer real-time data and connectivity, potentially increasing market penetration by 20% over the next five years.