Focus on Network Security

The heightened focus on network security in Japan is a crucial driver for the deep packet-inspection market. With the increasing frequency of cyber threats, organizations are compelled to adopt comprehensive security measures. Deep packet inspection plays a vital role in identifying and mitigating potential threats by analyzing data packets in real-time. This proactive approach to security is essential for safeguarding sensitive information and maintaining customer trust. In 2025, it is estimated that the cybersecurity market in Japan will exceed $20 billion, with a significant portion allocated to advanced security solutions, including deep packet inspection. As businesses prioritize security investments, the demand for deep packet-inspection technologies is expected to rise, further propelling market growth.

Increased Network Traffic

The surge in network traffic in Japan is a pivotal driver for the deep packet-inspection market. As more users engage in data-intensive activities, such as streaming and online gaming, the demand for effective traffic management solutions escalates. In 2025, it is estimated that data traffic in Japan will reach approximately 50 exabytes per month, necessitating advanced technologies to monitor and analyze this influx. Deep packet inspection enables organizations to optimize bandwidth usage and enhance user experience by identifying and prioritizing critical applications. This capability is particularly vital for service providers aiming to maintain competitive advantages in a saturated market. Consequently, the deep packet-inspection market is poised for growth as businesses seek to implement robust solutions to manage the increasing complexity of network traffic.

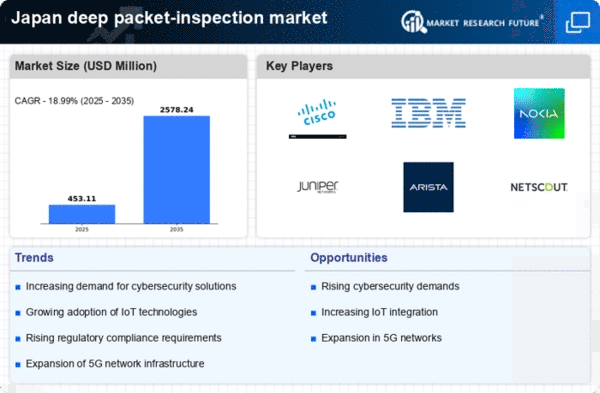

Emergence of 5G Technology

The rollout of 5G technology in Japan is significantly influencing the deep packet-inspection market. With 5G networks promising higher speeds and lower latency, the volume of data transmitted is expected to increase exponentially. This technological advancement presents both opportunities and challenges for network operators. The deep packet-inspection market is likely to benefit from the need for enhanced security measures and traffic management solutions that can handle the increased data flow. As organizations transition to 5G, they will require sophisticated tools to ensure network integrity and performance. The anticipated growth in 5G adoption could lead to a market expansion, with projections indicating a potential increase in revenue for deep packet-inspection solutions by over 30% by 2027.

Growing Demand for Data Analytics

The rising demand for data analytics in Japan is driving the deep packet-inspection market. Organizations are increasingly recognizing the value of data-driven insights for decision-making and operational efficiency. Deep packet inspection provides granular visibility into network traffic, enabling businesses to analyze user behavior and application performance. This capability is essential for optimizing resources and enhancing service delivery. In 2025, the analytics segment within the deep packet-inspection market is projected to account for approximately 40% of total market revenue, reflecting the growing emphasis on data utilization. As companies strive to leverage data for competitive advantage, the integration of deep packet-inspection solutions will likely become a standard practice in network management.

Regulatory Pressures on Data Management

Regulatory pressures regarding data management and privacy are increasingly shaping the deep packet-inspection market in Japan. As laws and regulations evolve, organizations must ensure compliance with stringent data protection standards. Deep packet inspection provides the necessary tools to monitor data flows and ensure adherence to regulatory requirements. This capability is particularly relevant in sectors such as finance and healthcare, where data integrity is paramount. In 2025, it is anticipated that compliance-related expenditures will constitute a significant portion of IT budgets, driving investments in deep packet-inspection solutions. As companies navigate the complexities of regulatory landscapes, the demand for effective data management tools will likely bolster the deep packet-inspection market.