Consumer Demand for Authenticity

The blockchain supply-chain market in Japan is significantly influenced by the rising consumer demand for product authenticity. As consumers become more aware of the origins and quality of products, businesses are compelled to adopt technologies that can provide verifiable information. Blockchain technology enables companies to create immutable records of product journeys, ensuring transparency and trust. Recent surveys indicate that over 70% of Japanese consumers are willing to pay a premium for products with verified authenticity. This shift in consumer behavior is likely to drive companies to invest in blockchain solutions, thereby expanding the market. The focus on authenticity not only enhances brand loyalty but also positions the blockchain supply-chain market as a vital component in meeting consumer expectations.

Regulatory Support and Compliance

The blockchain supply-chain market in Japan is experiencing a surge in regulatory support, which appears to be a crucial driver for its growth. The Japanese government has been actively promoting blockchain technology to enhance transparency and efficiency in supply chains. Recent initiatives indicate that compliance with regulations can lead to increased adoption of blockchain solutions among businesses. For instance, the Ministry of Economy, Trade and Industry (METI) has outlined frameworks that encourage the integration of blockchain in various sectors. This regulatory backing not only fosters innovation but also instills confidence among stakeholders, potentially leading to a market growth rate of around 25% by 2027. As companies align with these regulations, the blockchain supply-chain market is likely to expand significantly.

Collaboration Among Industry Players

Collaboration among industry players is emerging as a significant driver for the blockchain supply-chain market in Japan. Companies are recognizing the value of partnerships to leverage blockchain technology effectively. Collaborative efforts between manufacturers, suppliers, and technology providers are fostering innovation and accelerating the development of blockchain solutions. Recent initiatives, such as consortiums formed by major corporations, indicate a collective approach to addressing supply chain challenges. This trend suggests that as more organizations come together to share knowledge and resources, the blockchain supply-chain market may experience accelerated growth. The synergy created through collaboration is likely to enhance the overall effectiveness of blockchain applications, positioning the market for substantial advancements.

Technological Advancements in Blockchain

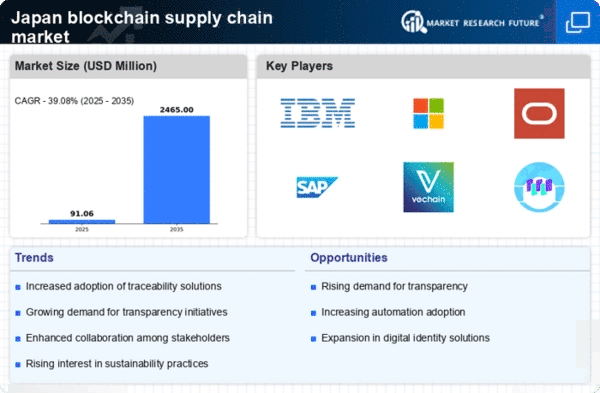

Technological advancements are playing a pivotal role in shaping the blockchain supply-chain market in Japan. Innovations such as smart contracts and improved consensus algorithms are enhancing the functionality and scalability of blockchain solutions. These advancements enable businesses to automate processes, reduce transaction times, and improve data security. As technology evolves, the potential applications of blockchain in supply chains are expanding, attracting more investments. Reports suggest that the market could witness a compound annual growth rate (CAGR) of 30% over the next five years, driven by these technological improvements. Consequently, the blockchain supply-chain market is likely to become increasingly sophisticated, offering more robust solutions to meet the demands of modern supply chains.

Rising Demand for Supply Chain Efficiency

In Japan, the demand for enhanced supply chain efficiency is driving the blockchain supply-chain market forward. Companies are increasingly seeking solutions that can streamline operations, reduce costs, and improve overall productivity. The integration of blockchain technology offers a decentralized approach that can minimize delays and errors in supply chain processes. According to recent data, businesses that have adopted blockchain solutions report a reduction in operational costs by approximately 15%. This trend suggests that as more organizations recognize the potential of blockchain to optimize their supply chains, the market is poised for substantial growth. The emphasis on efficiency is likely to propel the blockchain supply-chain market to new heights in the coming years.