Shift Towards Digital Transformation

In Japan, the automation as-a-service market is significantly influenced by the ongoing shift towards digital transformation. Enterprises are increasingly adopting digital tools to modernize their operations and improve customer experiences. This transformation is not merely a trend but a necessity for survival in a rapidly evolving market. Reports suggest that over 60% of Japanese companies are prioritizing digital initiatives, which include automation services. This shift is expected to drive the automation as-a-service market, as organizations seek to leverage technology to enhance their service offerings and operational capabilities. The focus on digital transformation is likely to create new opportunities for automation providers in the coming years.

Increased Focus on Customer Experience

Enhancing customer experience is a pivotal driver for the automation as-a-service market in Japan. Businesses are increasingly leveraging automation to provide personalized services and improve response times. The ability to automate customer interactions not only enhances satisfaction but also fosters loyalty. Recent surveys indicate that 70% of consumers prefer interacting with automated systems for routine inquiries. This preference is pushing companies to invest in automation solutions that can streamline customer service processes. As organizations prioritize customer experience, the automation as-a-service market is likely to expand, with a focus on developing innovative solutions that cater to evolving consumer expectations.

Rising Demand for Operational Efficiency

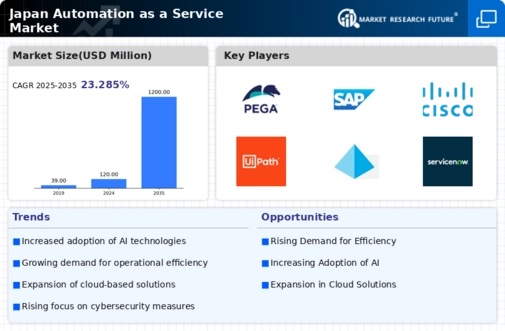

The demand for operational efficiency in the automation as-a-service market in Japan is surging. Organizations are increasingly recognizing the need to streamline processes and reduce manual intervention. This trend is driven by the desire to enhance productivity and minimize errors. According to recent data, companies that have adopted automation solutions report a 30% increase in operational efficiency. As businesses strive to remain competitive, the automation as-a-service market is positioned to grow, with projections indicating a potential market size of $1 billion by 2026. This demand for efficiency is likely to propel further investments in automation technologies, thereby shaping the future landscape of the industry.

Advancements in Technology and Infrastructure

Technological advancements and improvements in infrastructure are significantly influencing the automation as-a-service market in Japan. The proliferation of high-speed internet and cloud computing capabilities has made it easier for businesses to adopt automation solutions. Furthermore, innovations in artificial intelligence and machine learning are enhancing the capabilities of automation services, making them more accessible and effective. As organizations seek to leverage these technologies, the market is expected to witness substantial growth. Projections suggest that the automation as-a-service market could reach a valuation of $1.5 billion by 2027, driven by these technological advancements and the increasing reliance on automated solutions.

Growing Need for Compliance and Risk Management

The automation as-a-service market in Japan is also being propelled by the growing need for compliance and risk management. As regulatory requirements become more stringent, organizations are compelled to adopt automated solutions to ensure adherence to laws and standards. This is particularly relevant in sectors such as finance and healthcare, where compliance is critical. Data indicates that companies utilizing automation for compliance purposes have seen a reduction in compliance-related costs by approximately 25%. This trend underscores the importance of automation in mitigating risks and ensuring regulatory compliance. Consequently, it drives growth in the automation as-a-service market.