Growth of E-commerce Platforms

the auto parts market in Japan is shifting due to the growth of e-commerce platforms.. Consumers are increasingly turning to online channels for purchasing auto parts, driven by convenience and a wider selection of products. This trend is likely to reshape the distribution landscape, as traditional retailers adapt to the digital marketplace. E-commerce sales in the auto parts sector are projected to increase by 7% annually, indicating a robust opportunity for businesses to reach a broader audience. Furthermore, the rise of online reviews and ratings is influencing consumer purchasing decisions, making it essential for companies to establish a strong online presence. This shift towards e-commerce is expected to play a pivotal role in the future of the auto parts market.

Increased Focus on Safety Features

the auto parts market in Japan is increasingly focused on safety features, driven by consumer demand.. As awareness of road safety rises, manufacturers are prioritizing the development of advanced safety components, such as collision avoidance systems and adaptive braking technologies. This trend is likely to lead to a surge in demand for specific auto parts that contribute to overall vehicle safety. In 2025, the market for safety-related auto parts is expected to grow by approximately 5%, reflecting the importance of safety in consumer purchasing decisions. Consequently, companies that invest in innovative safety technologies may find themselves well-positioned to capitalize on this growing segment of the auto parts market.

Government Regulations and Standards

the auto parts market in Japan is influenced by strict government regulations aimed at improving vehicle safety and sustainability.. The Japanese government has implemented various policies to reduce emissions and promote fuel efficiency, compelling manufacturers to innovate and comply with these regulations. For instance, the introduction of stricter emissions standards is likely to drive demand for advanced catalytic converters and other emission control components. As a result, companies that adapt to these regulations may gain a competitive edge in the market. The ongoing regulatory landscape suggests that compliance will be a critical driver for growth in the auto parts market, potentially leading to a market expansion of around 4% in the coming years.

Rising Demand for Vehicle Customization

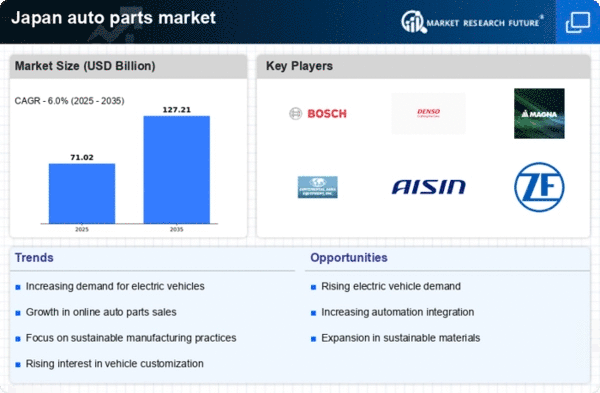

the auto parts market in Japan is seeing increased demand for vehicle customization, reflecting changing consumer preferences.. Japanese consumers increasingly seek personalized vehicles that reflect their individual styles and needs. This trend is fostering a robust aftermarket for auto parts, as consumers are willing to invest in modifications and enhancements. The customization market is projected to grow at a rate of 6% annually, indicating a strong potential for businesses that cater to this demand. This trend not only boosts sales for aftermarket parts but also encourages innovation among manufacturers to create unique offerings. Consequently, the auto parts market is likely to benefit from this evolving consumer behavior.

Technological Advancements in Manufacturing

the auto parts market in Japan is transforming due to advancements in manufacturing technology.. Automation and robotics are increasingly integrated into production lines, enhancing efficiency and precision. This shift is likely to reduce production costs and improve product quality, which is crucial in a competitive landscape. Moreover, the adoption of advanced materials, such as lightweight composites, is becoming prevalent, contributing to fuel efficiency and performance. As a result, manufacturers are expected to invest heavily in research and development, potentially increasing their market share. In 2025, the market is projected to grow by approximately 5% annually, driven by these innovations in manufacturing technology.