Enhanced Telehealth Services

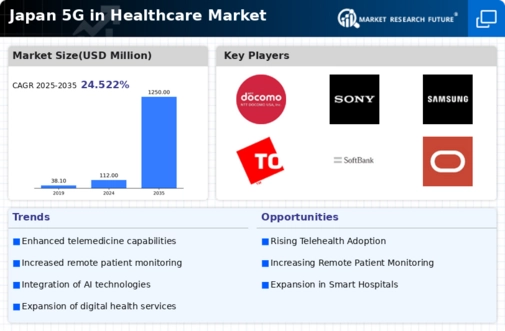

The 5g in-healthcare market is poised for growth due to the enhancement of telehealth services. As healthcare providers in Japan increasingly adopt telehealth solutions, the demand for high-speed, low-latency connections becomes critical. 5g technology enables high-definition video consultations and instant data transfer, which are essential for effective remote consultations. The telehealth market in Japan is expected to reach $1.5 billion by 2026, reflecting a growing acceptance of virtual healthcare services. This shift not only improves access to healthcare for patients in remote areas but also allows specialists to provide consultations without geographical limitations. The integration of 5g technology is likely to further streamline these services, making them more efficient and user-friendly.

Development of Smart Hospitals

The 5g in-healthcare market is significantly impacted by the development of smart hospitals in Japan. These facilities leverage advanced technologies, including IoT devices and real-time data analytics, to enhance operational efficiency and patient care. The implementation of 5g technology facilitates seamless connectivity among devices, enabling healthcare professionals to access critical information instantly. As of 2025, it is estimated that over 30% of hospitals in Japan will adopt smart technologies, driven by the need for improved patient outcomes and cost efficiency. The integration of 5g in these environments allows for better resource management, streamlined workflows, and enhanced patient experiences, ultimately transforming the healthcare landscape.

Integration of AI and Machine Learning

The 5g in-healthcare market is increasingly influenced by the integration of artificial intelligence (AI) and machine learning technologies. These advancements enable healthcare providers to analyze vast amounts of data in real-time, leading to improved diagnostic accuracy and personalized treatment plans. In Japan, the healthcare AI market is projected to grow to $2 billion by 2027, driven by the need for innovative solutions to enhance patient care. The high-speed connectivity provided by 5g allows for the rapid processing of data from various sources, including wearable devices and electronic health records. This integration not only enhances clinical decision-making but also supports predictive analytics, which can identify potential health issues before they escalate.

Increased Demand for Remote Patient Monitoring

The 5g in-healthcare market is experiencing a surge in demand for remote patient monitoring solutions. This trend is driven by the need for continuous health tracking, particularly among chronic disease patients. With 5g technology, healthcare providers can offer real-time monitoring, which enhances patient outcomes and reduces hospital visits. In Japan, the market for remote patient monitoring devices is projected to grow at a CAGR of 15% from 2025 to 2030. This growth is indicative of a broader shift towards proactive healthcare management, where patients can receive timely interventions based on real-time data. The integration of 5g technology facilitates seamless communication between devices and healthcare professionals, thereby improving the overall efficiency of healthcare delivery.

Regulatory Support for Digital Health Innovations

The 5g in-healthcare market is benefiting from increased regulatory support for digital health innovations in Japan. The government is actively promoting the adoption of digital health technologies to improve healthcare delivery and patient outcomes. Recent initiatives aim to streamline the approval process for digital health solutions, encouraging investment and innovation in the sector. This regulatory environment is expected to foster growth in the 5g in-healthcare market, as companies seek to develop and deploy new technologies. By 2026, it is anticipated that the digital health market in Japan will exceed $3 billion, reflecting the positive impact of supportive regulations. This trend indicates a commitment to enhancing healthcare accessibility and efficiency through technological advancements.