Advancements in Treatment Modalities

Innovations in treatment modalities are significantly influencing the sacroiliitis treatment market. The introduction of novel therapies, including targeted biologics and advanced imaging techniques, has transformed the management of sacroiliitis. For instance, the development of Janus kinase inhibitors has shown promising results in clinical trials, potentially offering new avenues for patients who do not respond to traditional therapies. Additionally, the integration of personalized medicine approaches allows for tailored treatment plans based on individual patient profiles. This shift towards more effective and individualized care is likely to enhance patient outcomes and satisfaction, thereby driving market growth. As healthcare providers in Italy increasingly adopt these advanced treatment options, the sacroiliitis treatment market is expected to expand, reflecting the ongoing evolution of therapeutic strategies.

Rising Awareness and Education Initiatives

The growing awareness of sacroiliitis and related conditions among the general public and healthcare professionals is a significant driver for the sacroiliitis treatment market. Educational campaigns aimed at both patients and providers are increasingly prevalent in Italy, promoting early diagnosis and effective management of sacroiliitis. These initiatives are likely to lead to a higher rate of diagnosis, as individuals become more informed about the symptoms and potential treatments available. Furthermore, healthcare professionals are receiving enhanced training on the latest treatment protocols, which may improve patient outcomes. As awareness continues to rise, the demand for effective treatment options is expected to increase, thereby positively impacting the sacroiliitis treatment market.

Aging Population and Associated Health Issues

Italy's aging population is a critical factor influencing the sacroiliitis treatment market. As the demographic shifts towards an older age group, the prevalence of musculoskeletal disorders, including sacroiliitis, is likely to rise. Statistics indicate that approximately 23% of the Italian population is over 65 years old, a demographic that is more susceptible to chronic inflammatory conditions. This trend suggests a growing need for effective treatment solutions tailored to the elderly. Additionally, the healthcare system may need to adapt to accommodate the unique challenges faced by older patients, such as comorbidities and polypharmacy. Consequently, the sacroiliitis treatment market is expected to expand as healthcare providers seek to address the specific needs of this demographic.

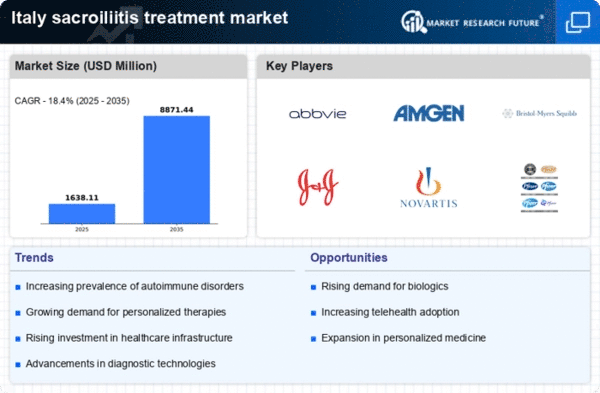

Increasing Prevalence of Autoimmune Disorders

The rising incidence of autoimmune disorders in Italy is a crucial driver for the sacroiliitis treatment market. Conditions such as ankylosing spondylitis and psoriatic arthritis, which often lead to sacroiliitis, are becoming more common. Recent studies indicate that autoimmune diseases affect approximately 5% of the Italian population, contributing to a growing need for effective treatment options. This trend is likely to propel the demand for therapies targeting sacroiliitis, as healthcare providers seek to address the underlying causes of these conditions. Furthermore, the increasing awareness of autoimmune disorders among both patients and healthcare professionals is expected to enhance the market landscape, as more individuals seek timely diagnosis and treatment for their symptoms. Consequently, the sacroiliitis treatment market is poised for growth as the healthcare system adapts to these changing demographics.

Growing Investment in Healthcare Infrastructure

The Italian government's commitment to enhancing healthcare infrastructure plays a pivotal role in the sacroiliitis treatment market. Increased funding for healthcare facilities and research initiatives is likely to improve access to advanced diagnostic tools and treatment options for patients suffering from sacroiliitis. Recent reports indicate that healthcare spending in Italy is projected to rise by 3% annually, which may facilitate the development of specialized clinics and treatment centers focused on autoimmune disorders. This investment not only enhances the quality of care but also encourages the adoption of innovative therapies, thereby stimulating market growth. As healthcare infrastructure continues to evolve, the sacroiliitis treatment market is expected to benefit from improved patient access and enhanced treatment capabilities.