Regulatory Framework Enhancements

The evolving regulatory framework in Italy is influencing the pipe laying-vessel market. Recent legislative changes aimed at promoting environmental sustainability and safety standards are prompting companies to adapt their operations. Compliance with these regulations often requires the use of advanced pipe laying vessels that meet stringent environmental criteria. As a result, the market is witnessing a shift towards vessels that are not only efficient but also environmentally friendly. The Italian government is expected to continue refining its regulatory policies, which may further drive the demand for compliant vessels in the pipe laying-vessel market. This trend indicates a growing awareness of the need for sustainable practices within the sector.

Growing Demand for Renewable Energy

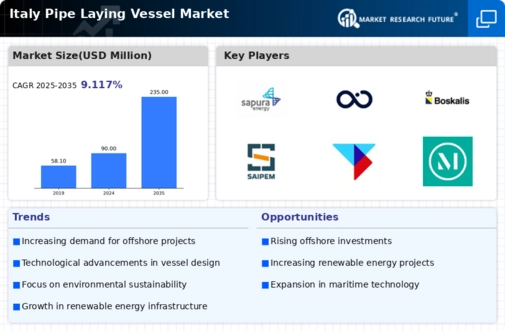

The increasing emphasis on renewable energy sources in Italy is driving the pipe laying-vessel market. As the country aims to meet its energy transition goals, investments in offshore wind and solar energy projects are surging. This shift necessitates the deployment of advanced pipe laying vessels to install underwater cables and pipelines efficiently. According to recent data, the Italian government has allocated approximately €10 billion for renewable energy initiatives, which is expected to create a robust demand for specialized vessels in the coming years. The pipe laying-vessel market is likely to benefit significantly from this trend, as companies seek to enhance their capabilities to support the growing renewable sector.

Infrastructure Development Initiatives

Italy's ongoing infrastructure development initiatives are poised to bolster the pipe laying-vessel market. The government has launched several projects aimed at modernizing transportation and energy infrastructure, including the construction of new pipelines for gas and water distribution. With an estimated investment of €30 billion earmarked for infrastructure upgrades, the demand for pipe laying vessels is anticipated to rise. These vessels play a crucial role in ensuring the timely and efficient installation of pipelines, which is essential for the successful execution of these projects. The pipe laying-vessel market stands to gain from this influx of infrastructure spending, as companies strive to meet the increasing demand for advanced laying technologies.

Increased Offshore Exploration Activities

The resurgence of offshore exploration activities in Italy is a significant driver for the pipe laying-vessel market. With the discovery of new oil and gas reserves in the Adriatic Sea, companies are investing heavily in exploration and production. This trend is likely to necessitate the use of specialized pipe laying vessels to facilitate the installation of subsea pipelines. Recent estimates suggest that offshore exploration investments could reach €5 billion over the next five years, creating a favorable environment for the pipe laying-vessel market. As operators seek to enhance their operational efficiency, the demand for technologically advanced vessels is expected to rise, further propelling market growth.

Technological Innovations in Vessel Design

Technological innovations in vessel design are transforming the pipe laying-vessel market. The introduction of advanced materials and automation technologies is enhancing the efficiency and safety of pipe laying operations. Italian companies are increasingly adopting these innovations to improve their competitive edge in the market. For instance, the integration of dynamic positioning systems and automated laying techniques is streamlining operations, reducing costs, and minimizing environmental impact. As the industry evolves, the demand for modernized vessels equipped with these technologies is likely to increase. The pipe laying-vessel market is expected to witness substantial growth as companies invest in upgrading their fleets to incorporate these cutting-edge designs.