Italy Payment Service Market Overview

As per MRFR analysis, the Italy Payment Service Market Size was estimated at 347.93 (USD Million) in 2023.The Italy Payment Service Market is expected to grow from 510.4(USD Million) in 2024 to 4,367 (USD Million) by 2035. The Italy Payment Service Market CAGR (growth rate) is expected to be around 21.549% during the forecast period (2025 - 2035).

Key Italy Payment Service Market Trends Highlighted

The Italy Payment Service Market is currently experiencing significant trends driven by increased digitalization and consumer behavior shifts. One key market driver is the rise in contactless payments, which gained momentum during the pandemic, prompting both consumers and merchants to adopt more convenient ways to transact. The Italian government supports this shift through initiatives aimed at promoting cashless transactions, ultimately enhancing the overall efficiency of the payment ecosystem.

Additionally, collaborations between fintech companies and traditional banking institutions are becoming more common, allowing for innovative solutions that cater to the needs of a tech-savvy population.There are clear opportunities in the Italy Payment Service Market, especially when it comes to making payments safer and using new technologies like blockchain. As competition gets tougher, companies in this market are looking for ways to work together to offer better services and reach more customers.

The rise in interest in mobile wallets and buy-now-pay-later services shows that people are changing the way they want to pay. People in Italy, especially younger people, are increasingly interested in flexible payment options. This is a sign of a shift toward more personalized financial services. There has also been a recent trend toward more focus on sustainability in the payment industry.

Italian consumers are becoming more aware of their environmental impact, driving demand for eco-friendly payment solutions. This trend is being recognized by businesses, which are keen to address the changing preferences of consumers. Overall, the Italy Payment Service Market is witnessing a blend of technological innovation and changing consumer expectations, presenting a dynamic landscape for both established players and newcomers.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Italy Payment Service Market Drivers

Increasing Digital Payment Adoption

The Italy Payment Service Market Industry is witnessing a significant shift towards digital payment methods, with a notable increase in the adoption of contactless payments and mobile wallet solutions. As of recent statistics, approximately 56% of the Italian population has embraced digital payment options, a figure that highlights a growing consumer preference for convenience and efficiency in transactions.

Major companies like Sella and Nexi have been pivotal in promoting digital payment solutions through innovative platforms and services.Moreover, the Italian government's support for cashless transactions, notably through initiatives aimed at incentivizing the use of electronic payments, is encouraging consumers and businesses alike to adopt these modern solutions.

The European Central Bank has been advocating for digital transactions, resulting in a gradual decline of cash transactions, which were reported to constitute only around 34% of the total number of payments in Italy by 2020.This growing trend is expected to propel the Italy Payment Service Market further, aligning with forecasts of accelerated growth in the coming years.

Supportive Regulatory Environment

A conducive regulatory framework plays a vital role in the growth of the Italy Payment Service Market Industry. The Italian government, through the Ministry of Economic Development, has implemented several policies aimed at enhancing financial technology (fintech) innovation and increasing competition in the payments sector. For instance, the introduction of the Digital Payment Strategy aligns with the European Union’s objectives to build a holistic digital economy by 2025.This strategy not only fosters innovation but also aims at fostering financial inclusion for all segments of the population.

In addition, the European Payment Services Directive 2 (PSD2) has facilitated a more open banking environment that encourages third-party service providers to offer tailored payment solutions, thus driving overall market growth. As a result of these regulations, the number of licensed payment institutions in Italy has significantly increased over the last few years, with the Bank of Italy reporting approximately 500 licensed payment service providers, highlighting the rising competitiveness in the industry.

Rise in E-Commerce Activities

E-commerce is experiencing unprecedented growth in Italy, which is a key driver for the Italy Payment Service Market Industry. Recent data indicates that the e-commerce market has expanded by over 30% compared to previous years, with Italians increasingly purchasing goods and services online due to the convenience and variety offered. Established e-commerce platforms like Amazon and local players such as eBay Italy have significantly contributed to this trend, providing consumers with seamless shopping experiences.

Additionally, the COVID-19 pandemic accelerated this transition, as ongoing restrictions encouraged consumers to shift towards online shopping solutions. The shift has compelled many traditional retail businesses to implement robust online payment systems, consequently boosting the demand for payment services. Consequently, it is projected that as e-commerce continues to thrive, the Italy Payment Service Market will experience ancillary growth, with increasing transaction volumes creating more opportunities for payment service providers.

Italy Payment Service Market Segment Insights

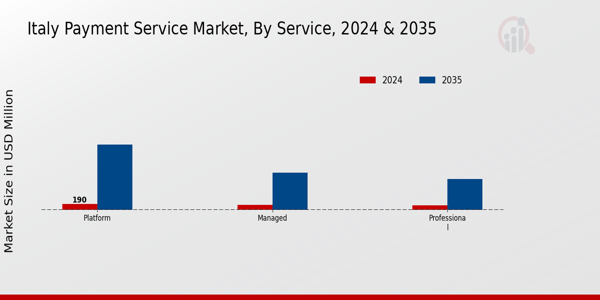

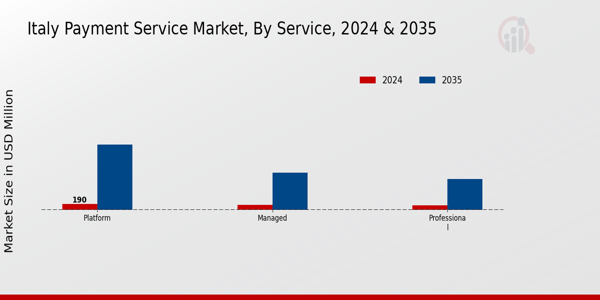

Payment Service Market Service Insights

The Italy Payment Service Market, specifically the Service segment, is experiencing robust growth driven by factors such as increasing consumer adoption of digital payments and the proliferation of e-commerce platforms. This segment capitalizes on the growing demand for seamless payment experiences, as consumers seek convenience and security in monetary transactions. In Italy, where there is a strong push towards cashless transactions, the dynamics of the market are evolving, with service providers implementing innovative solutions to cater to consumer needs.

Within this context, the Professional segment plays a crucial role by offering tailored services that enhance payment functionalities, ensuring businesses can meet specific requirements while optimizing their operations. The Managed aspect focuses on providing comprehensive solutions, including transaction processing and fraud detection services, which are essential for building trust and efficiency within the payment ecosystem.

Additionally, the Platform category continues to gain traction as it offers integrated payment solutions that connect various stakeholders, ranging from merchants to service providers, thus streamlining the payment process.The integration of advanced technology, such as artificial intelligence and machine learning, is enhancing the capabilities of these services, allowing for better analysis of consumer behavior and predictive recommendations. This continual evolution in the Service segment indicates a strong future trajectory for the Italy Payment Service Market as it adapts to changing consumer preferences and technological advancements.

The emphasis on regulatory compliance, especially in alignment with European Union regulations, underscores the importance of establishing secure and reliable payment ecosystems that protect both businesses and consumers.Furthermore, with initiatives promoting financial literacy and digital inclusion, Italy is paving the way for a more accessible payment infrastructure, providing opportunities for various stakeholders. Overall, the Service segment is pivotal in shaping the future landscape of the Italy Payment Service Market, representing not just a response to current market demands but also a proactive measure to remain competitive in a rapidly changing environment.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Payment Service Market Vertical Insights

The Vertical segment of the Italy Payment Service Market encompasses various industries, including BFSI, Retail, Healthcare, Media and Entertainment, and Hospitality, each playing a pivotal role in enhancing payment solutions. The BFSI sector remains substantial due to the increasing demand for secure and efficient transaction processing, reflecting the broader trends in fintech innovation and regulatory compliance. The Retail sector is similarly dynamic, propelled by the rise of e-commerce and digital payment solutions, making shopping more accessible for consumers.In Healthcare, the emphasis on patient convenience and secure transactions is paramount as digital health solutions grow.

Meanwhile, the Media and Entertainment industry is transforming with subscription models and digital content purchases requiring agile payment frameworks. Customer experience in the Hospitality sector is significantly advanced through automated payment systems, ensuring streamlined operations and improved guest satisfaction. Overall, the Italy Payment Service Market segmentation shows strong potential across these sectors, driven by technological advancements and changing consumer preferences, indicating a robust and evolving landscape for payment services.

Italy Payment Service Market Key Players and Competitive Insights

The Italy Payment Service Market is characterized by a diverse and rapidly evolving landscape that is fueled by the increasing adoption of digital payment solutions and technologies. As consumers increasingly lean towards e-commerce and mobile payments, various players have emerged to cater to this demand, leading to heightened competition and innovation in the sector. The market is marked by traditional banking institutions, fintech companies, and large global players, all vying for market share while addressing the growing consumer preference for seamless and secure transaction experiences.

Additionally, the impact of regulatory landscapes, technological advancements, and shifting consumer behaviors has created unique opportunities as well as challenges for firms operating within this market. As the competition intensifies, companies are focusing on enhancing their service offerings, optimizing user experiences, and leveraging data for better decision-making to stay ahead in the market in Italy.Poste Italiane stands out in the Italy Payment Service Market due to its extensive network and established presence as a trusted financial services provider.

With a robust distribution system that includes a vast number of postal offices across the country, Poste Italiane effectively reaches a wide array of customers, facilitating easy access to payment services.

The company capitalizes on its long-standing reputation and customer loyalty, which have been instrumental in driving its success in providing payment services. The strengths of Poste Italiane lie in its comprehensive range of offerings, including money transfers, bill payments, and prepaid cards, all of which are tailored to meet the needs of consumers while ensuring security and compliance with local regulations.

This advantageous infrastructure and service portfolio enable Poste Italiane to maintain a competitive edge in Italy’s payment service landscape.Adyen, operating within the Italy Payment Service Market, brings a global perspective to payment processing while ensuring tailored solutions that resonate with local businesses.

Adyen stands out for its unified commerce approach, offering a range of services that encompass payment processing across online, mobile, and point-of-sale channels. This versatility allows merchants to seamlessly integrate and manage transactions, simplifying their operations and enhancing customer experiences. Adyen's strength lies in its advanced technology stack, enabling real-time data insights and analytics that empower businesses to make informed decisions regarding payment strategies. The company's commitment to innovation is reflected in its continuous product development and partnerships with various local merchants and platforms.

Furthermore, Adyen has shown strategic interest in the Italian market through mergers and acquisitions aimed at expanding its service capabilities, thereby enhancing its presence and competitiveness in Italy's dynamic payment sector.

Key Companies in the Italy Payment Service Market Include:

- Poste Italiane

- Adyen

- Nexi

- Intesa Sanpaolo

- Klarna

- Revolut

- Bancomat

- PayPal

- Worldline

- SIA

- Square

- Amazon Payments

- UniCredit

- SumUp

- Stripe

Italy Payment Service Industry Developments

Recent developments in the Italy Payment Service Market have shown significant growth and shifts in player dynamics. Poste Italiane has been focusing on digital transformation, enhancing its payment solutions. In August 2023, Nexi announced the acquisition of a key tech firm to bolster its digital payment capabilities, following a trend in the sector toward consolidation and technological advancement. Intesa Sanpaolo has also been expanding its payment services portfolio, targeting e-commerce solutions, while Klarna and Revolut are increasingly popular among younger consumers for their alternative finance solutions.

The market has witnessed a steady rise in transaction volumes driven by heightened digital adoption, especially after the COVID-19 pandemic. PayPal continues to compete fiercely with local players, while Worldline is advancing its position through strategic partnerships within the country.

Bancomat, a domestic payment network, plays a crucial role in the usage of debit cards. The Italian payment sector is also adapting to regulatory changes aimed at enhancing consumer protection and promoting competition. Notably, the overall market valuation of digital payment services in Italy has been positively impacted by these developments, reflecting a shift towards more integrated and user-friendly financial services.

Italy Payment Service Market Segmentation Insights

Payment Service Market Service Outlook

-

- Professional

- Managed

- Platform

Payment Service Market Vertical Outlook

-

- BFSI

- Retail

- Healthcare

- Media & Entertainment

- Hospitality

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

347.93(USD Million) |

| MARKET SIZE 2024 |

510.4(USD Million) |

| MARKET SIZE 2035 |

4367.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

21.549% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Poste Italiane, Adyen, Nexi, Intesa Sanpaolo, Klarna, Revolut, Bancomat, PayPal, Worldline, SIA, Square, Amazon Payments, UniCredit, SumUp, Stripe |

| SEGMENTS COVERED |

Service, Vertical |

| KEY MARKET OPPORTUNITIES |

Digital wallet adoption surge, E-commerce payment integration growth, Contactless payment technology expansion, SME payment solutions development, Cryptocurrency payment acceptance rise |

| KEY MARKET DYNAMICS |

digital payment adoption, mobile wallet growth, regulatory framework changes, security concerns, consumer preference shifts |

| COUNTRIES COVERED |

Italy |

Frequently Asked Questions (FAQ):

The expected market size of the Italy Payment Service Market in 2024 is valued at 510.4 million USD.

By 2035, the Italy Payment Service Market is expected to be valued at 4367.0 million USD.

The projected CAGR for the Italy Payment Service Market from 2025 to 2035 is 21.549%.

In 2024, the Platform segment had the highest valuation, valued at 190.0 million USD.

By 2035, the Managed segment is expected to reach a value of 1220.495 million USD.

Some of the major players in the Italy Payment Service Market include Poste Italiane, Adyen, Nexi, and PayPal.

The Professional segment is expected to be valued at approximately 1017.079 million USD by 2035.

The Italy Payment Service Market presents opportunities driven by technological advancements and increased consumer demand for digital payments.

Challenges in the Italy Payment Service Market include regulatory compliance and competition from emerging fintech companies.

The competitive landscape has evolved with increased participation from both established players like Nexi and new entrants like Klarna and Revolut.