Growing Industrial Automation

The circuit breaker market in Italy is likely to benefit from the ongoing trend of industrial automation. As industries increasingly adopt automated processes, the need for reliable electrical protection systems becomes paramount. Circuit breakers play a critical role in safeguarding machinery and equipment from electrical faults. In 2025, the manufacturing sector in Italy is expected to grow by around 4%, which may lead to heightened demand for circuit breakers. This growth in industrial automation not only enhances operational efficiency but also necessitates the integration of advanced circuit protection solutions, thereby propelling the circuit breaker market forward.

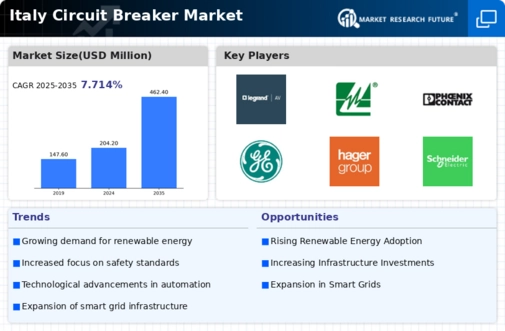

Rising Infrastructure Investments

The circuit breaker market in Italy is experiencing a notable boost due to increased investments in infrastructure. The Italian government has allocated substantial funds for the modernization of electrical grids and urban development projects. This trend is expected to enhance the demand for circuit breakers, as they are essential components in ensuring the safety and reliability of electrical systems. In 2025, the infrastructure investment is projected to reach approximately €30 billion, which could lead to a corresponding increase in the circuit breaker market. The focus on upgrading aging infrastructure and expanding urban areas necessitates the installation of advanced circuit protection devices, thereby driving growth in the circuit breaker market.

Increased Focus on Safety Standards

The circuit breaker market in Italy is influenced by a heightened emphasis on safety standards across various sectors. Regulatory bodies are implementing stricter safety regulations, compelling industries to adopt advanced circuit protection devices. This trend is particularly evident in the construction and manufacturing sectors, where compliance with safety standards is critical. In 2025, it is anticipated that the enforcement of these regulations will lead to a 15% increase in the adoption of circuit breakers. As companies strive to meet these standards, the circuit breaker market is likely to experience significant growth, driven by the demand for reliable and compliant electrical protection solutions.

Rising Demand for Energy Efficiency

The circuit breaker market in Italy is likely to see growth driven by the increasing demand for energy efficiency. As businesses and consumers become more conscious of energy consumption, there is a push for electrical systems that minimize waste. Circuit breakers equipped with energy-saving features are becoming more popular, as they help optimize energy use and reduce operational costs. In 2025, the energy efficiency market in Italy is projected to grow by 10%, which may correlate with a rise in the circuit breaker market. This trend reflects a broader commitment to sustainability and cost-effectiveness, positioning circuit breakers as vital components in energy-efficient electrical systems.

Expansion of Smart Grid Technologies

The circuit breaker market in Italy is poised for growth due to the expansion of smart grid technologies. The integration of digital solutions into electrical grids enhances monitoring and control capabilities, necessitating the use of advanced circuit breakers. These devices are essential for managing the complexities of smart grids, which require real-time data and automated responses to electrical faults. In 2025, investments in smart grid initiatives are projected to exceed €5 billion, indicating a robust market opportunity for circuit breakers. As utilities and energy providers embrace smart technologies, the demand for innovative circuit protection solutions is expected to rise, thereby benefiting the circuit breaker market.