Growing Aging Population

Italy's demographic shift towards an aging population significantly influences the cardiac biomarkers market. With over 23% of the population aged 65 and older, the demand for effective cardiovascular diagnostics is on the rise. Older adults are at a higher risk for heart-related ailments, which drives the need for accurate and timely biomarker testing. The cardiac biomarkers market is poised to expand as healthcare providers focus on tailored solutions for this demographic. Furthermore, the Italian government is likely to allocate more resources towards healthcare initiatives aimed at improving the quality of life for the elderly, thereby enhancing the market for cardiac biomarkers.

Rising Awareness of Preventive Healthcare

There is a notable increase in public awareness regarding preventive healthcare in Italy, which is positively impacting the cardiac biomarkers market. As individuals become more informed about the importance of early detection and management of cardiovascular diseases, the demand for biomarker testing is likely to grow. Educational campaigns and health initiatives are encouraging people to undergo regular screenings, thereby driving the cardiac biomarkers market forward. This shift towards preventive measures is expected to result in a higher adoption rate of biomarker tests, as healthcare providers respond to the changing attitudes of patients towards their health.

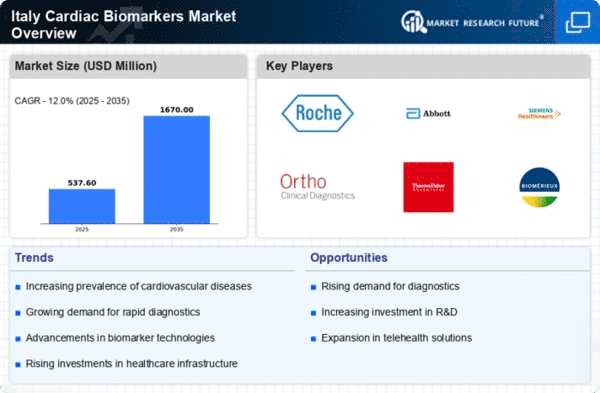

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Italy is a primary driver for the cardiac biomarkers market. According to recent health statistics, cardiovascular diseases account for approximately 35% of all deaths in the country. This alarming trend necessitates the development and utilization of advanced diagnostic tools, including cardiac biomarkers, to facilitate early detection and management of these conditions. As healthcare providers seek to improve patient outcomes, the demand for reliable and efficient biomarkers is expected to rise. The cardiac biomarkers market is likely to benefit from this growing need, as healthcare systems invest in innovative solutions to combat the rising burden of cardiovascular diseases.

Increased Investment in Healthcare Infrastructure

Italy's commitment to enhancing its healthcare infrastructure plays a crucial role in the growth of the cardiac biomarkers market. Recent government initiatives have led to increased funding for healthcare facilities, which in turn supports the adoption of advanced diagnostic technologies. The cardiac biomarkers market stands to gain from this investment, as hospitals and clinics upgrade their equipment and expand their testing capabilities. This trend is expected to facilitate the integration of innovative biomarker tests into routine clinical practice, ultimately improving patient care and outcomes in cardiovascular health.

Advancements in Biomarker Research and Development

Ongoing research and development in the field of cardiac biomarkers are propelling the market forward in Italy. Innovative studies are uncovering new biomarkers that can enhance diagnostic accuracy and provide insights into disease progression. The cardiac biomarkers market is benefiting from these advancements, as pharmaceutical companies and research institutions collaborate to bring novel tests to market. This focus on R&D is likely to lead to the introduction of more sensitive and specific biomarkers, which could revolutionize the way cardiovascular diseases are diagnosed and managed in clinical settings.