- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

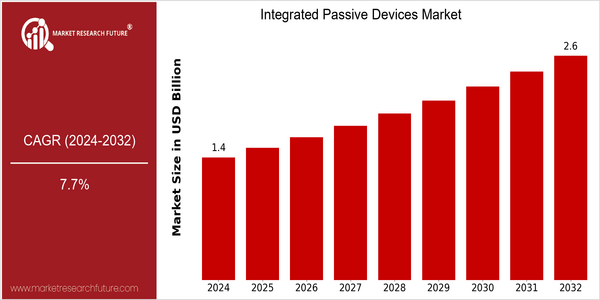

| Year | Value |

|---|---|

| 2024 | USD 1.4 Billion |

| 2032 | USD 2.56 Billion |

| CAGR (2024-2032) | 7.7 % |

Note – Market size depicts the revenue generated over the financial year

The INTEGRATED PASSIVE DEVICES (IPD) market is poised for considerable growth. In 2024, the market is expected to be worth $ 1.4 billion, and it is projected to reach $ 2.56 billion by 2032. This represents a CAGR of 7.7% for the period of forecast. The primary factor driving the market is the growing demand for miniaturized electrical components in the telecommunications, automotive, and consumer electronics industries. As the trend in the industry is towards smaller and more efficient products, the integration of passive components into a single chip is becoming more and more popular. This integration enhances performance while reducing cost and space. The major players in the IPD market, such as TEXAS INSTRUMENTS, INFINEON TECHNOLOGIES, and STMicroelectronics, are investing in R&D to develop new products and expand their existing product lines. Strategic alliances and acquisitions are also on the rise, as companies seek to acquire complementary technology and increase their market share. In recent years, the industry has launched products for high-frequency applications and energy-efficient designs. The market is still evolving, but these trends and developments will be critical in shaping the future of the IPD market.

Regional Market Size

Regional Deep Dive

The INTEGRATED PASSIVE DEVICES MARKET is set to grow significantly over the forecast period, driven by the increasing demand for smaller and more compact electronic components and the increasing use of advanced wireless communication technology such as the Internet of Things (IoT) and 5G. Each region has its own market dynamics, which are influenced by technological developments, regulations and economic conditions. North America leads in innovation and R&D investment, while Asia-Pacific is characterized by a high manufacturing capacity and a growing consumer electronics market. Europe is characterized by its regulatory and sustainable focus, while Latin America and the Middle East and Africa are adopting IPDs slowly, mainly due to the development of digitalization and the construction of telecommunications networks.

Europe

- The European Union's Green Deal is influencing the IPD market by encouraging manufacturers to develop eco-friendly electronic components, with companies like Infineon Technologies leading the charge in sustainable technology.

- With the growing importance of digitalization in the field of automation, and in particular of the development of self-driving vehicles, the demand for integrated passive devices will continue to increase. The collaboration between automobile manufacturers and IT companies, such as the one between BMW and Intel, will continue to grow.

Asia Pacific

- China remains a dominant player in the IPD market, with significant investments in semiconductor manufacturing and a focus on enhancing its domestic supply chain, supported by government initiatives like 'Made in China 2025.'

- The rapid growth of consumer electronics in countries like India and South Korea is propelling the demand for integrated passive devices, with major companies like Samsung and LG Electronics investing in advanced manufacturing technologies.

Latin America

- Brazil is emerging as a key market for integrated passive devices, driven by the growth of its electronics manufacturing sector and government incentives aimed at boosting local production.

- The region is witnessing a rise in demand for IPDs in telecommunications, particularly as countries like Mexico and Argentina invest in expanding their 5G networks, creating opportunities for integrated passive solutions.

North America

- The U.S. is witnessing a surge in demand for integrated passive devices due to the expansion of the automotive sector, particularly in electric vehicles, with companies like Tesla and General Motors investing heavily in advanced electronics.

- In recent years, the development of energy-saving regulations has forced manufacturers to adopt integrated passive solutions. Moreover, with the Department of Energy as the leading authority, efforts are being made to reduce energy consumption.

Middle East And Africa

- The Middle East is seeing increased investment in smart city projects, which is driving the demand for integrated passive devices in a number of applications, including smart grids and the Internet of Things. The UAE, for example, has its Vision 2021 initiative, which is pushing for the development of smart cities.

- In Africa, the growing mobile penetration and digital transformation initiatives are creating opportunities for integrated passive devices, with local startups and tech hubs emerging to support the development of innovative electronic solutions.

Did You Know?

“Integrated passive devices can reduce the size of electronic components by up to 50%, enabling more compact and efficient designs in modern electronics.” — Market Research Future

Segmental Market Size

In the overall market for passive devices, a vital role is played by a component known as an INTEGRATED PASSIVE DEVICE (IDD). IDDs are used to enhance the performance and miniaturization of electronic devices. This market is growing, driven by the growing demand for smaller and more efficient devices in the consumer, automotive and telecommunications industries. In particular, the need for higher functionality in smaller form factors and the need for energy-efficient solutions are driving this growth. The current phase of IDD implementation is one of mass production. Leading IDD suppliers include TEXAS INSTRUMENTS and MURATA. IDDs are used in the RF front ends of mobile phones and in automotive sensors to reduce the size and improve the performance of these devices. Growth is also being driven by the emergence of 5G and the IoT, which require more advanced, smaller-scale solutions. And the evolution of manufacturing processes, such as 3D-packaging and the use of advanced materials, is enabling the integration of more complex functions in smaller form factors.

Future Outlook

From 2024 to 2032, the ipd market is expected to grow from $1.4 billion to $2.5 billion, at a strong compound annual growth rate (CAGR) of 7.7 percent. This growth is driven by the increasing demand for miniaturization of electronic devices, which is driving the integration of passive components into single-chip solutions. In the field of consumer electronics, the automobile and telecommunications, the use of ipds will increase, as it will improve performance and reduce space and manufacturing costs. Further growth is expected as a result of technological developments, such as the development of new materials and production methods. The development of semiconductor technology, especially in the field of 5G and IoT, will also drive the need for more efficient and compact passive components. The government's support for the development of smart technology and sustainable manufacturing methods will also create a favorable environment for growth. In 2032, the penetration rate of ipds in various applications is expected to reach about 30 percent. This underlines the important role of ipds in the future of the design and manufacturing of electronic devices.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.3 Billion |

| Growth Rate | 7.70% (2024-2032) |

Integrated Passive Devices Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.