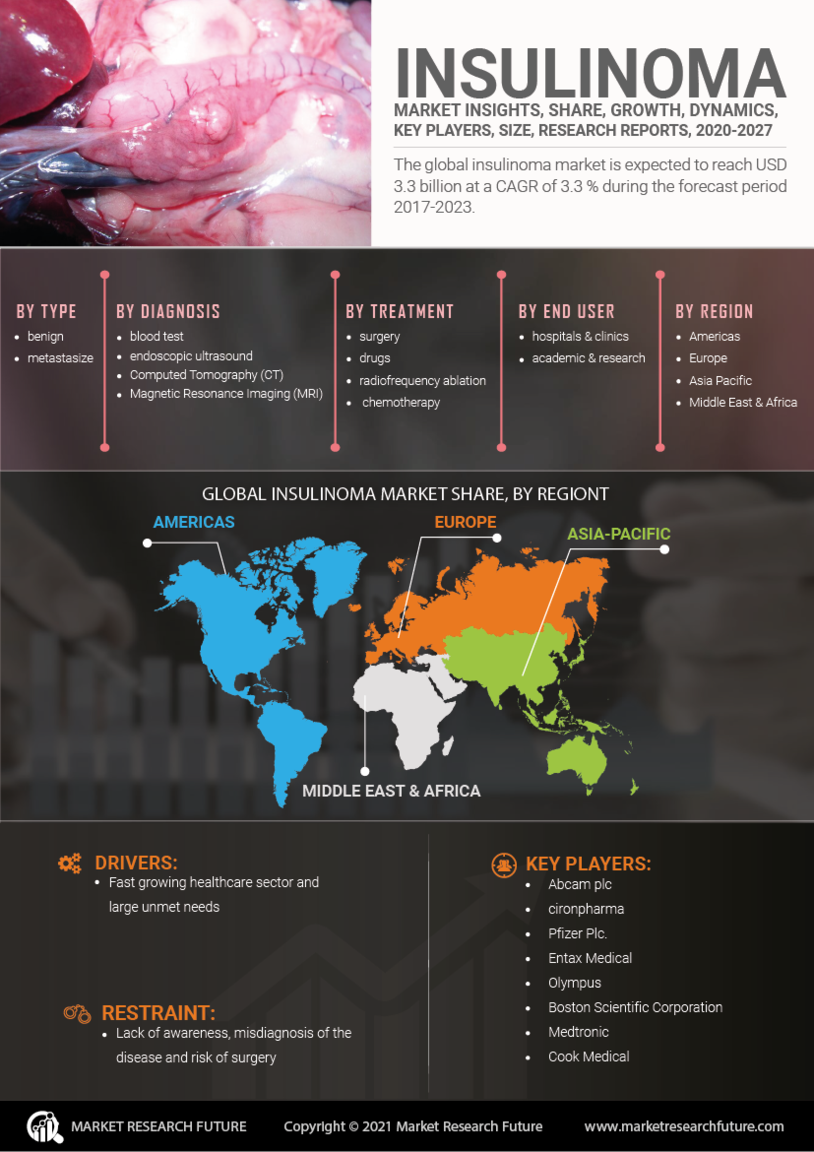

Rising Incidence of Insulinoma

The Insulinoma Market is experiencing growth due to the rising incidence of insulinoma cases. Recent data indicates that the prevalence of insulinoma is increasing, with estimates suggesting that it affects approximately 4 to 10 individuals per million annually. This rise in cases is likely attributed to improved diagnostic capabilities and heightened awareness among healthcare professionals. As more patients are diagnosed, the demand for effective treatment options and management strategies is expected to surge. Consequently, pharmaceutical companies and healthcare providers are focusing on developing innovative therapies and surgical interventions to address this growing patient population. This trend is anticipated to drive the Insulinoma Market forward, as stakeholders seek to meet the needs of an expanding demographic of insulinoma patients.

Increased Awareness and Education

The Insulinoma Market is benefiting from increased awareness and education regarding insulinoma among both healthcare professionals and the general public. Campaigns aimed at educating individuals about the symptoms and risks associated with insulinoma are gaining traction. This heightened awareness is likely to lead to earlier diagnosis and treatment, which is crucial for improving patient outcomes. Furthermore, healthcare providers are increasingly incorporating insulinoma into their training programs, ensuring that new practitioners are well-equipped to recognize and manage this condition. As awareness continues to grow, it is expected that more patients will seek medical attention, thereby driving demand within the Insulinoma Market.

Advancements in Treatment Modalities

The Insulinoma Market is significantly influenced by advancements in treatment modalities. Recent innovations in surgical techniques, such as laparoscopic surgery, have improved patient outcomes and reduced recovery times. Additionally, the development of targeted therapies and novel pharmacological agents is enhancing the treatment landscape for insulinoma. For instance, the introduction of somatostatin analogs has shown promise in managing symptoms and controlling insulin secretion. As these treatment options become more widely available, they are likely to attract attention from both healthcare providers and patients. The ongoing research and development efforts in this area suggest a robust pipeline of new therapies, which could further stimulate growth in the Insulinoma Market.

Technological Innovations in Diagnostics

The Insulinoma Market is poised for growth due to technological innovations in diagnostic methods. Advanced imaging techniques, such as MRI and CT scans, are becoming more sophisticated, allowing for earlier and more accurate detection of insulinomas. Additionally, the development of biomarker assays is enhancing the ability to identify insulinoma at earlier stages. These advancements not only facilitate timely intervention but also improve the overall management of the disease. As diagnostic technologies continue to evolve, they are likely to play a pivotal role in shaping the Insulinoma Market, as healthcare providers increasingly rely on these tools to guide treatment decisions.

Growing Investment in Research and Development

The Insulinoma Market is experiencing a surge in investment in research and development activities. Pharmaceutical companies and research institutions are allocating significant resources to explore new therapeutic options and improve existing treatments for insulinoma. This influx of funding is fostering innovation and collaboration among stakeholders, leading to the discovery of novel compounds and treatment strategies. Moreover, government initiatives aimed at supporting research in rare diseases are likely to further enhance the landscape for insulinoma research. As a result, the Insulinoma Market is expected to benefit from a robust pipeline of new therapies and improved management strategies, ultimately enhancing patient care.