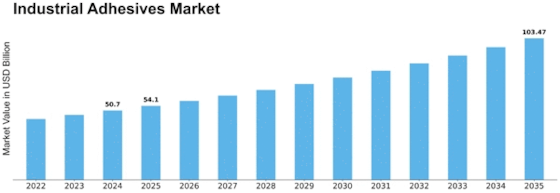

Industrial Adhesive Size

Industrial Adhesive Market Growth Projections and Opportunities

The industrial adhesives market is influenced by a variety of factors that collectively shape its dynamics and demand across diverse industrial sectors. The following key points outline the market factors contributing to the evolution and demand for industrial adhesives:

Diverse Industrial Applications: Industrial adhesives find widespread use across diverse industrial applications, including automotive, aerospace, construction, electronics, packaging, and medical devices. Their versatility makes them essential for bonding various materials in different manufacturing processes.

Growing Automotive Sector: The automotive industry is a major driver for the industrial adhesives market. Adhesives play a crucial role in automotive assembly, providing strong and durable bonds for components, reducing weight, and contributing to enhanced vehicle performance and fuel efficiency.

Advancements in Aerospace Manufacturing: The aerospace industry relies on industrial adhesives for bonding lightweight materials, such as composites and alloys, in aircraft construction. Adhesives contribute to reducing overall weight and enhancing structural integrity, critical factors in aerospace manufacturing.

Construction Industry Demand: In the construction sector, industrial adhesives are used for bonding materials like concrete, glass, and metals. Their application ranges from structural bonding to sealant and insulation bonding, contributing to the efficiency and durability of construction projects.

Electronics and Electrical Applications: The electronics and electrical industries utilize industrial adhesives for bonding delicate components, ensuring secure connections, and enhancing the performance of electronic devices. Miniaturization trends in electronics drive the demand for precision adhesives.

Packaging Industry Growth: The packaging industry relies on industrial adhesives for sealing and bonding packaging materials. Adhesives play a crucial role in ensuring the integrity of packages, contributing to the efficiency of packaging processes and the protection of goods during transportation.

Medical Device Assembly: Industrial adhesives are extensively used in the assembly of medical devices. They provide biocompatible and sterile bonding solutions for medical components, supporting the manufacture of devices ranging from implants to diagnostic equipment.

Shift towards Sustainable Adhesives: The market is witnessing a notable shift towards sustainable and eco-friendly adhesives. Manufacturers and end-users are increasingly opting for formulations with reduced environmental impact, low VOC emissions, and compliance with green certifications.

Technological Innovations in Adhesive Formulations: Ongoing technological innovations contribute to the development of advanced adhesive formulations. Innovations include the introduction of smart adhesives, self-healing adhesives, and adhesives with enhanced thermal and chemical resistance, expanding their range of applications.

Globalization of Supply Chains: The industrial adhesives market is influenced by the globalization of supply chains. Factors such as international trade, logistics, and geopolitical considerations impact the availability and pricing of raw materials, affecting the overall cost and supply of industrial adhesives.

Adoption of Robotics and Automation: The adoption of robotics and automation in manufacturing processes contributes to the demand for industrial adhesives. Adhesives facilitate automated bonding processes, improving efficiency, precision, and consistency in manufacturing operations.

Focus on Bonding Dissimilar Materials: As industries strive for lightweight and high-performance materials, the demand for adhesives capable of bonding dissimilar materials, such as metals and composites, is on the rise. Adhesives provide a reliable solution for joining materials with different physical properties.

Strategic Collaborations and Mergers: The industrial adhesives market is shaped by strategic collaborations, partnerships, and mergers among key players. These initiatives aim to enhance product portfolios, expand market reach, and leverage combined research and development capabilities.

End-User Industries Emphasizing Efficiency: End-user industries place a strong emphasis on efficiency, cost-effectiveness, and process optimization. Industrial adhesives offer advantages such as faster curing times, improved production speed, and reduced waste, aligning with the efficiency goals of manufacturing operations.

Leave a Comment