Renewable Energy Targets

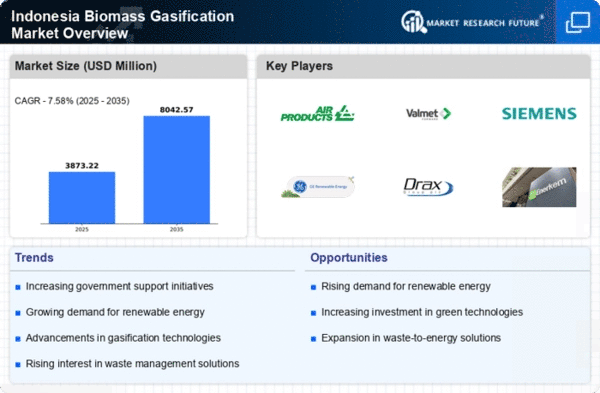

The Indonesian government has established ambitious renewable energy targets, aiming for 23% of the national energy mix to come from renewable sources by 2025. This commitment is likely to drive the biomass gasification market, as biomass is a key component of renewable energy. The government’s focus on reducing reliance on fossil fuels and enhancing energy security may further stimulate investments in biomass gasification technologies. As a result, the biomass gasification market could experience significant growth, with projections indicating a potential increase in market size by over 15% annually. This regulatory environment creates a favorable landscape for stakeholders in the biomass gasification market, encouraging innovation and development.

Waste Management Solutions

Indonesia faces considerable challenges in waste management, with millions of tons of waste generated annually. Biomass gasification presents a viable solution to this issue, converting organic waste into energy while reducing landfill dependency. The biomass gasification market could benefit from this dual advantage, as municipalities and private sectors seek sustainable waste management practices. The potential to generate energy from waste not only addresses environmental concerns but also aligns with the government's objectives for cleaner energy. As cities increasingly adopt biomass gasification technologies, the market may see a surge in demand, potentially increasing by 20% in the next few years.

Investment in Clean Technology

There is a growing trend of investment in clean technology within Indonesia, driven by both public and private sectors. The biomass gasification market stands to gain from this influx of capital, as investors seek sustainable and innovative energy solutions. The government has initiated various funding programs and incentives to promote clean energy projects, which could enhance the attractiveness of biomass gasification technologies. With an estimated investment of $1 billion earmarked for renewable energy projects, the biomass gasification market may witness a significant uptick in development and deployment of new technologies, fostering a competitive landscape.

Public Awareness and Education

Increasing public awareness regarding environmental issues and the benefits of renewable energy is influencing the biomass gasification market in Indonesia. Educational campaigns and community engagement initiatives are fostering a better understanding of biomass gasification technologies and their potential to mitigate climate change. As citizens become more informed, there is a growing demand for cleaner energy solutions, which could drive market growth. The biomass gasification market may see a rise in adoption rates as communities advocate for sustainable practices, potentially leading to a market expansion of around 12% in the coming years. This shift in public perception is crucial for the long-term viability of biomass gasification.

Energy Independence Initiatives

Indonesia's pursuit of energy independence is a critical driver for the biomass gasification market. The country aims to reduce its dependence on imported fossil fuels, which can be volatile and costly. By investing in biomass gasification, Indonesia can utilize its abundant agricultural residues and organic waste to produce energy locally. This strategy not only enhances energy security but also promotes rural development through job creation in biomass supply chains. The potential for biomass gasification to contribute to energy independence may lead to a projected market growth of approximately 18% over the next five years, as stakeholders recognize the strategic importance of local energy production.