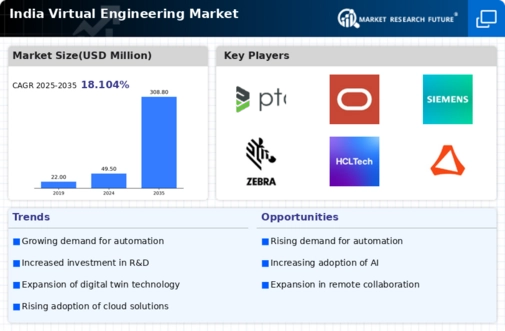

Rising Demand for Automation

The increasing demand for automation in various industries is a key driver for the India virtual engineering market. As companies seek to enhance efficiency and reduce operational costs, the integration of virtual engineering solutions becomes essential. Industries such as manufacturing, automotive, and aerospace are increasingly adopting automation technologies, which often rely on virtual engineering for design, testing, and optimization. According to recent data, the automation market in India is projected to grow at a CAGR of over 10% in the coming years, indicating a robust demand for virtual engineering services. This trend suggests that the india virtual engineering market will likely experience significant growth as businesses invest in automation to remain competitive.

Emergence of Advanced Technologies

The rapid emergence of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) is transforming the landscape of the India virtual engineering market. These technologies enable more sophisticated simulations and analyses, allowing engineers to create more accurate models and predictions. For instance, AI-driven design tools can optimize engineering processes, leading to faster product development cycles. The integration of IoT in virtual engineering allows for real-time data collection and analysis, enhancing decision-making processes. As these technologies continue to evolve, they are expected to drive innovation within the india virtual engineering market, creating new opportunities for growth and development.

Growing Focus on Skill Development

The increasing emphasis on skill development in India is a significant driver for the India virtual engineering market. With the rise of digital technologies, there is a pressing need for a skilled workforce capable of leveraging virtual engineering tools effectively. Government initiatives, such as the Skill India Mission, aim to equip individuals with the necessary skills to thrive in the digital economy. Educational institutions are also adapting their curricula to include virtual engineering concepts, ensuring that graduates are well-prepared for the job market. This focus on skill development is likely to enhance the talent pool available to the india virtual engineering market, fostering innovation and competitiveness.

Government Initiatives and Policies

The Indian government has been actively promoting the adoption of digital technologies across various sectors, which significantly impacts the India virtual engineering market. Initiatives such as the Digital India program aim to enhance the country's digital infrastructure, thereby facilitating the growth of virtual engineering solutions. The government has also introduced policies that encourage innovation and investment in technology, which could lead to increased funding for virtual engineering projects. For instance, the Make in India initiative aims to boost manufacturing capabilities, which may require advanced virtual engineering tools for design and simulation. As a result, the india virtual engineering market is likely to benefit from these supportive policies, fostering an environment conducive to growth and development.

Expansion of the Manufacturing Sector

The expansion of the manufacturing sector in India is a crucial driver for the India virtual engineering market. As the country aims to become a global manufacturing hub, there is an increasing need for advanced engineering solutions to streamline production processes. The government's initiatives, such as the Production Linked Incentive (PLI) scheme, are designed to boost manufacturing capabilities across various sectors, including electronics, textiles, and automotive. This growth in manufacturing is expected to drive demand for virtual engineering services, as companies seek to optimize their design and production processes. Consequently, the india virtual engineering market is poised for growth as manufacturers increasingly adopt virtual engineering tools to enhance efficiency and reduce costs.