Growing Livestock Population

The expanding livestock population in India serves as a substantial driver for the veterinary clostridium-vaccine market. With the increasing demand for meat, dairy, and other animal products, the livestock sector is experiencing rapid growth. As of 2025, the livestock population is estimated to exceed 600 million, creating a larger market for veterinary vaccines. This growth necessitates enhanced disease management strategies, including vaccination against clostridial infections. The veterinary clostridium-vaccine market is likely to benefit from this trend, as farmers recognize the importance of vaccination in maintaining herd health and productivity.

Government Initiatives and Support

Government initiatives aimed at improving animal health and productivity are significantly influencing the veterinary clostridium-vaccine market. Various state and central government programs in India promote vaccination campaigns and provide subsidies for vaccine procurement. These initiatives are designed to enhance livestock health, thereby increasing productivity and reducing mortality rates. For instance, the Indian government has allocated approximately $200 million for animal health programs, which includes funding for vaccination against clostridial diseases. Such support not only boosts the veterinary clostridium-vaccine market but also encourages farmers to adopt vaccination as a standard practice.

Advancements in Vaccine Development

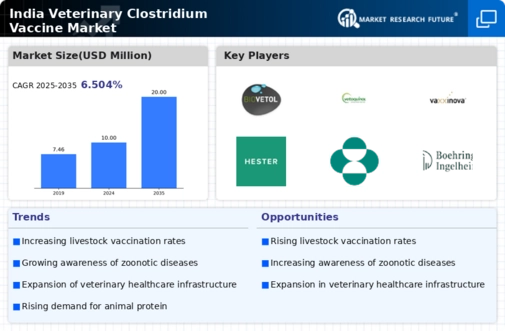

Innovations in vaccine development are playing a pivotal role in shaping the veterinary clostridium-vaccine market. Recent advancements in biotechnology have led to the creation of more effective and safer vaccines for clostridial diseases. These new formulations are designed to provide longer-lasting immunity and reduce the number of doses required. As a result, veterinarians and farmers are more likely to adopt these modern vaccines, thereby increasing market penetration. The veterinary clostridium-vaccine market is expected to witness a compound annual growth rate (CAGR) of around 8% as these advancements gain traction among livestock producers.

Rising Export Demand for Animal Products

The increasing demand for Indian animal products in international markets is driving the veterinary clostridium-vaccine market. As India aims to enhance its export capabilities, ensuring the health and quality of livestock becomes paramount. Countries importing Indian meat and dairy products often require stringent health certifications, which include vaccination against prevalent diseases. This trend is likely to propel the veterinary clostridium-vaccine market, as producers invest in vaccination programs to meet export standards. The potential for increased revenue from exports could lead to a market growth rate of approximately 10% annually in the coming years.

Increasing Incidence of Clostridial Diseases

The rising incidence of clostridial diseases among livestock in India is a critical driver for the veterinary clostridium-vaccine market. Clostridial infections, such as enterotoxemia and tetanus, have been reported with increasing frequency, leading to significant economic losses for farmers. The veterinary clostridium-vaccine market is expected to grow as farmers seek preventive measures to protect their herds. According to recent data, the economic impact of these diseases can reach up to $1 billion annually in livestock losses. Consequently, the demand for effective vaccines is likely to surge, prompting manufacturers to innovate and expand their product offerings in the veterinary clostridium-vaccine market.