Rising Medical Tourism

India's emergence as a hub for medical tourism is a significant driver for the surgical blades market. The country attracts a large number of international patients seeking affordable and high-quality surgical procedures. The medical tourism sector in India is estimated to be worth $9 B, with a projected growth rate of 30% annually. This influx of patients necessitates the availability of advanced surgical instruments, including blades, to cater to diverse surgical needs. As hospitals and clinics enhance their services to accommodate foreign patients, the demand for surgical blades is likely to increase. Furthermore, the emphasis on quality and safety in surgical procedures will drive healthcare providers to invest in superior surgical blades, thereby positively impacting the market.

Surge in Surgical Procedures

The rising number of surgical procedures in India significantly impacts the surgical blades market. As the population ages and the prevalence of chronic diseases increases, the demand for surgical interventions is expected to grow. Data suggests that the number of surgeries performed annually in India has been increasing at a rate of approximately 10% per year. This trend indicates a growing need for surgical blades, as they are fundamental to various surgical techniques. Additionally, the increasing awareness of health issues and the availability of advanced surgical options contribute to this surge. As more patients opt for surgical solutions, the surgical blades market is likely to experience substantial growth, driven by the need for high-quality and precise instruments.

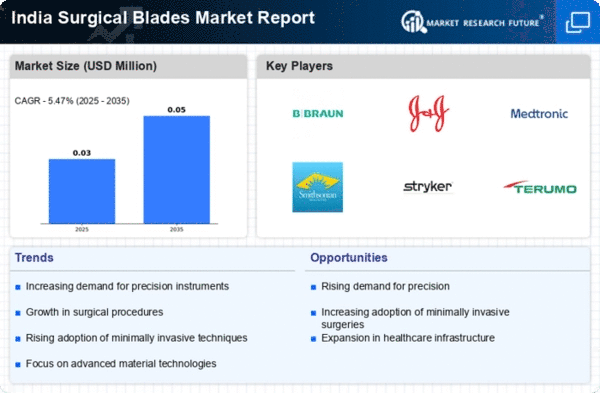

Growing Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a pivotal driver for the surgical blades market. With increasing investments in hospitals and surgical centers, the demand for surgical instruments, including blades, is on the rise. The Indian government has been actively promoting healthcare initiatives, leading to the establishment of new medical facilities. According to recent data, the healthcare sector is projected to reach a value of $372 B by 2022, indicating a robust growth trajectory. This growth is likely to enhance the availability of surgical blades, as more healthcare facilities require these essential tools for various surgical procedures. Furthermore, the increasing number of surgeries performed annually is expected to further boost the surgical blades market, as healthcare providers seek reliable and efficient instruments to meet patient needs.

Increased Focus on Training and Education

The growing emphasis on training and education for healthcare professionals is a crucial driver for the surgical blades market. As surgical techniques evolve, the need for skilled surgeons who are proficient in using advanced surgical instruments becomes paramount. Medical institutions in India are increasingly incorporating comprehensive training programs that focus on the use of surgical blades and other instruments. This focus on education not only enhances the skills of healthcare providers but also promotes the adoption of high-quality surgical blades. As more professionals become adept at utilizing these tools, the demand for reliable and efficient surgical blades is likely to rise. This trend suggests a positive outlook for the surgical blades market, as the quality of surgical care improves through enhanced training and education.

Technological Innovations in Surgical Instruments

Technological advancements in surgical instruments are transforming the surgical blades market in India. Innovations such as the development of single-use and safety blades are gaining traction among healthcare providers. These advancements not only enhance the safety of surgical procedures but also reduce the risk of infections. The surgical blades market is witnessing a shift towards more sophisticated designs that improve precision and ease of use. As hospitals and surgical centers adopt these new technologies, the demand for traditional blades may decline, while the market for innovative surgical blades is likely to expand. This trend indicates a potential shift in consumer preferences, with healthcare professionals increasingly favoring advanced surgical instruments that offer enhanced performance and safety.