Growing Geriatric Population

India's aging population is a significant factor contributing to the growth of the spinal cord-stimulator market. As the demographic landscape shifts, the number of elderly individuals is expected to rise dramatically, leading to an increase in age-related health issues, including chronic pain and neurological disorders. By 2030, it is estimated that the elderly population in India will reach 300 million, creating a substantial demand for effective pain management solutions. Spinal cord stimulators are increasingly recognized for their potential to improve the quality of life for older adults suffering from chronic pain. This demographic trend is likely to drive market expansion as healthcare systems adapt to meet the needs of this growing population.

Rising Healthcare Expenditure

Increased healthcare expenditure in India is a crucial driver for the spinal cord-stimulator market. As disposable incomes rise and health awareness improves, individuals are more willing to invest in advanced medical treatments. The Indian healthcare sector is projected to grow at a CAGR of 12% over the next five years, with a significant portion of this growth attributed to the demand for innovative pain management solutions. Spinal cord stimulators, being a less invasive option compared to traditional surgeries, are becoming increasingly attractive to patients and healthcare providers alike. This trend indicates a shift towards prioritizing quality of life and effective pain management, further propelling the market forward.

Rising Incidence of Chronic Pain

The increasing prevalence of chronic pain conditions in India is a primary driver for the spinal cord-stimulator market. Conditions such as neuropathic pain, back pain, and fibromyalgia are becoming more common, affecting millions of individuals. According to recent health surveys, approximately 20% of the Indian population suffers from chronic pain, which necessitates effective pain management solutions. Spinal cord stimulators offer a promising alternative to traditional pain relief methods, such as medications and surgeries. As awareness of these devices grows, more patients and healthcare providers are likely to consider spinal cord stimulators as viable treatment options. This trend is expected to propel the market forward, as the demand for innovative pain management solutions continues to rise.

Advancements in Medical Technology

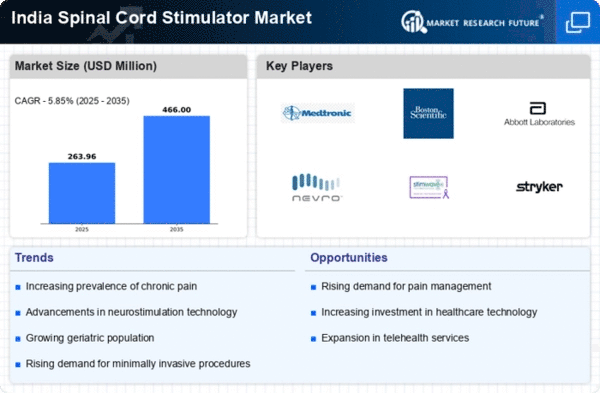

Technological innovations in the field of spinal cord stimulation are significantly influencing the market dynamics. The introduction of advanced devices with features such as wireless connectivity, rechargeable batteries, and improved programming capabilities enhances the efficacy and user experience of spinal cord stimulators. These advancements not only improve patient outcomes but also increase the adoption rates among healthcare professionals. The spinal cord-stimulator market is witnessing a shift towards more sophisticated systems that can be tailored to individual patient needs. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of around 15% over the next few years, driven by these technological enhancements.

Increased Investment in Healthcare Infrastructure

The Indian government is making substantial investments in healthcare infrastructure, which is likely to benefit the spinal cord-stimulator market. Initiatives aimed at enhancing healthcare access and quality are being implemented, including the establishment of specialized pain management clinics and rehabilitation centers. These facilities are expected to incorporate advanced technologies, including spinal cord stimulators, into their treatment protocols. Furthermore, public and private partnerships are fostering innovation and research in medical devices, which may lead to the development of more effective spinal cord stimulation therapies. As healthcare infrastructure improves, the market is poised for growth, with increased availability of spinal cord stimulators across various regions.