Growing Geriatric Population

India's aging population is contributing to a heightened focus on eye health, thereby impacting the pupillometer market. With approximately 8% of the population aged 60 and above, age-related eye conditions such as cataracts and glaucoma are becoming more prevalent. This demographic shift necessitates the use of advanced diagnostic tools like pupillometers to monitor and manage these conditions effectively. Healthcare providers are increasingly investing in such technologies to cater to the needs of the elderly, which is likely to drive market growth. The pupillometer market could see an annual growth rate of around 12% as the demand for eye care solutions for the elderly rises.

Awareness Campaigns on Eye Health

Awareness campaigns focused on eye health are playing a crucial role in driving the pupillometer market in India. Organizations and healthcare providers are increasingly promoting the importance of regular eye check-ups and the role of advanced diagnostic tools in early detection of eye diseases. These campaigns are likely to enhance public knowledge about the benefits of using pupillometers for accurate assessments of pupil responses. As awareness grows, more individuals are expected to seek eye care services, thereby increasing the demand for pupillometers. The market could see a potential growth of around 10% as these awareness initiatives gain traction across various demographics.

Integration of Telemedicine in Eye Care

The integration of telemedicine into healthcare services in India is emerging as a significant driver for the pupillometer market. As remote consultations become more prevalent, the need for accurate and portable diagnostic tools is increasing. Pupillometers that can be used in telemedicine settings allow healthcare professionals to assess patients' eye health remotely, thus expanding access to care. This trend is particularly relevant in rural areas where access to specialized eye care is limited. The market for pupillometers is expected to grow as telemedicine continues to evolve, with projections indicating a potential increase in market size by 20% over the next five years.

Increasing Demand for Eye Care Solutions

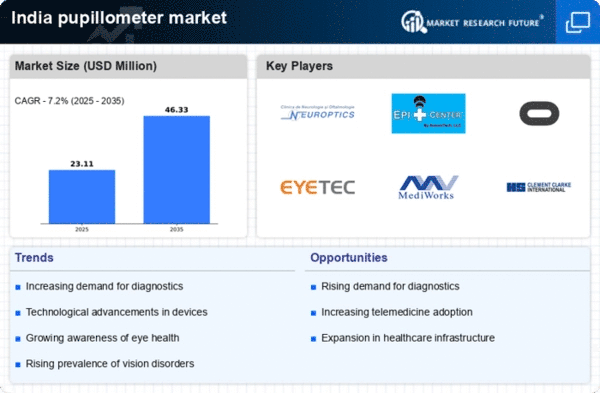

The rising prevalence of eye disorders in India is driving the demand for advanced diagnostic tools, including pupillometers. With an estimated 62 million people suffering from refractive errors, the need for precise measurement of pupil responses is becoming critical. The pupillometer market is likely to benefit from this increasing demand, as healthcare providers seek to enhance their diagnostic capabilities. Furthermore, the Indian government's initiatives to improve eye care services are expected to bolster the market. Investments in eye care facilities and the introduction of new technologies are anticipated to create a favorable environment for the pupillometer market, potentially leading to a growth rate of around 15% annually over the next few years.

Rising Investment in Healthcare Technology

The Indian government's focus on enhancing healthcare infrastructure is fostering growth in the pupillometer market. Increased investment in healthcare technology, including diagnostic equipment, is evident as part of initiatives like the National Health Mission. This commitment to improving healthcare services is likely to lead to the adoption of advanced diagnostic tools, including pupillometers, in hospitals and clinics across the country. The market is expected to expand as healthcare facilities upgrade their equipment to meet modern standards. Projections suggest that the pupillometer market could experience a growth rate of approximately 18% in the coming years due to these investments.