Regulatory Support for Biotechnology

Regulatory support for biotechnology in India serves as a crucial driver for the protein engineering market. The government has implemented various policies aimed at promoting biotechnological innovations, including streamlined approval processes for biopharmaceuticals and genetically modified organisms. This supportive regulatory environment encourages investment and research in protein engineering, as companies can navigate the approval landscape more efficiently. Additionally, initiatives such as the Biotechnology Industry Research Assistance Council (BIRAC) provide funding and resources to startups and established firms alike, fostering a culture of innovation. The protein engineering market stands to gain from these regulatory frameworks, as they not only enhance the development of new products but also ensure safety and efficacy in their applications.

Growing Demand for Biopharmaceuticals

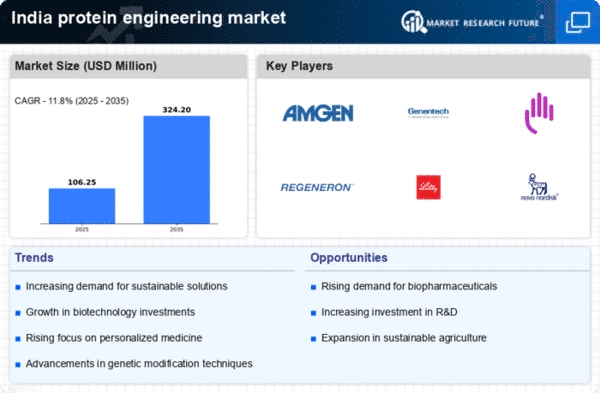

The increasing demand for biopharmaceuticals in India is a key driver for the protein engineering market. As healthcare needs evolve, there is a notable shift towards biologics, which are derived from living organisms. The biopharmaceutical sector is projected to reach a market size of approximately $30 billion by 2025, indicating a robust growth trajectory. This surge is largely attributed to the rising prevalence of chronic diseases and the need for innovative therapies. Consequently, the protein engineering market is poised to benefit from advancements in biopharmaceutical production, as engineered proteins play a crucial role in drug development and therapeutic applications. The focus on developing more effective and targeted treatments further propels the demand for protein engineering solutions, making it a pivotal area of growth within the industry.

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the protein engineering market in India. The government and private sectors are increasingly allocating funds to enhance R&D capabilities, particularly in biotechnology and life sciences. In recent years, R&D expenditure in the biotechnology sector has seen a rise, with estimates suggesting an increase of around 15% annually. This investment fosters innovation in protein engineering techniques, enabling the development of novel proteins with enhanced functionalities. Furthermore, collaborations between academic institutions and industry players are becoming more prevalent, facilitating knowledge transfer and accelerating the commercialization of engineered proteins. As a result, the protein engineering market is likely to experience substantial growth, driven by the continuous advancements in research and technology.

Rising Awareness of Health and Nutrition

Rising awareness of health and nutrition among the Indian population is driving the protein engineering market. As consumers become more health-conscious, there is an increasing demand for protein-rich foods and supplements. This trend is reflected in the growing market for plant-based proteins and functional foods, which are projected to expand significantly in the coming years. The protein engineering market is likely to benefit from this shift, as engineered proteins can be tailored to meet specific nutritional needs and preferences. Moreover, the emphasis on sustainable and ethical food sources aligns with the advancements in protein engineering, as companies seek to develop innovative solutions that cater to the evolving dietary habits of consumers. This heightened awareness is expected to propel the market forward, creating new opportunities for growth.

Technological Advancements in Protein Production

Technological advancements in protein production are emerging as a vital driver for the protein engineering market. Innovations such as synthetic biology, CRISPR gene editing, and high-throughput screening are revolutionizing the way proteins are engineered and produced. These technologies enable the creation of proteins with enhanced properties, such as improved stability and functionality, which are essential for various applications in pharmaceuticals and food industries. The protein engineering market is likely to see increased adoption of these advanced technologies, as they offer significant advantages in terms of efficiency and cost-effectiveness. Furthermore, the integration of automation and artificial intelligence in protein production processes is expected to streamline operations, reduce time-to-market, and enhance product quality, thereby fostering growth within the industry.