Rising Healthcare Expenditure

The increase in healthcare expenditure in India is positively influencing the pedicle screw-systems market. With the government and private sectors investing more in healthcare infrastructure, hospitals are better equipped to offer advanced surgical solutions. The healthcare expenditure in India is anticipated to reach approximately 3.5% of GDP by 2025, which may lead to enhanced access to innovative medical technologies, including pedicle screw systems. This financial commitment is likely to facilitate the adoption of cutting-edge surgical tools, thereby propelling the growth of the pedicle screw-systems market.

Surge in Geriatric Population

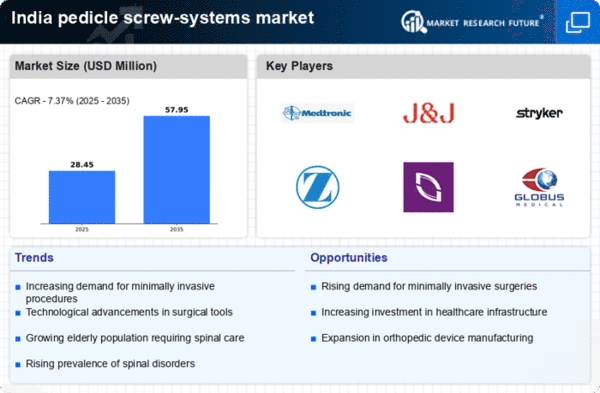

India's aging population is contributing significantly to the demand for spinal surgeries, thus impacting the pedicle screw-systems market. With an estimated 8% of the population aged 60 and above, the prevalence of spinal disorders is likely to increase. This demographic shift necessitates effective surgical solutions, including advanced pedicle screw systems. The market is projected to witness a growth rate of around 12% annually, driven by the need for surgical interventions in older adults. As healthcare providers focus on addressing the unique needs of this population, the demand for specialized pedicle screw systems is expected to grow.

Growing Awareness of Spinal Health

There is a noticeable increase in awareness regarding spinal health among the Indian population, which is driving the demand for effective treatment options. Educational campaigns and health initiatives are emphasizing the importance of spinal care, leading to more individuals seeking medical advice for spinal issues. This heightened awareness is likely to result in an increase in spinal surgeries, thereby boosting the pedicle screw-systems market. As patients become more informed about their treatment options, the demand for advanced pedicle screw systems is expected to rise, reflecting a shift towards proactive healthcare.

Technological Innovations in Surgical Tools

The continuous advancements in surgical technology are significantly impacting the pedicle screw-systems market. Innovations such as 3D printing and robotic-assisted surgeries are enhancing the precision and effectiveness of spinal surgeries. In India, the integration of these technologies is expected to grow, with the market for surgical instruments projected to expand at a CAGR of around 10% over the next few years. As hospitals adopt these cutting-edge tools, the demand for sophisticated pedicle screw systems is likely to increase, thereby shaping the future of spinal surgery.

Increasing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive surgical techniques is driving the pedicle screw-systems market. Surgeons and patients alike favor these procedures due to their reduced recovery times and lower complication rates. In India, the market for minimally invasive surgeries is projected to grow at a CAGR of approximately 15% over the next few years. This trend is likely to increase the adoption of advanced pedicle screw systems, which are designed to facilitate such procedures. As hospitals and surgical centers invest in state-of-the-art equipment, the demand for innovative pedicle screw-systems is expected to rise, thereby enhancing the overall market landscape.